)

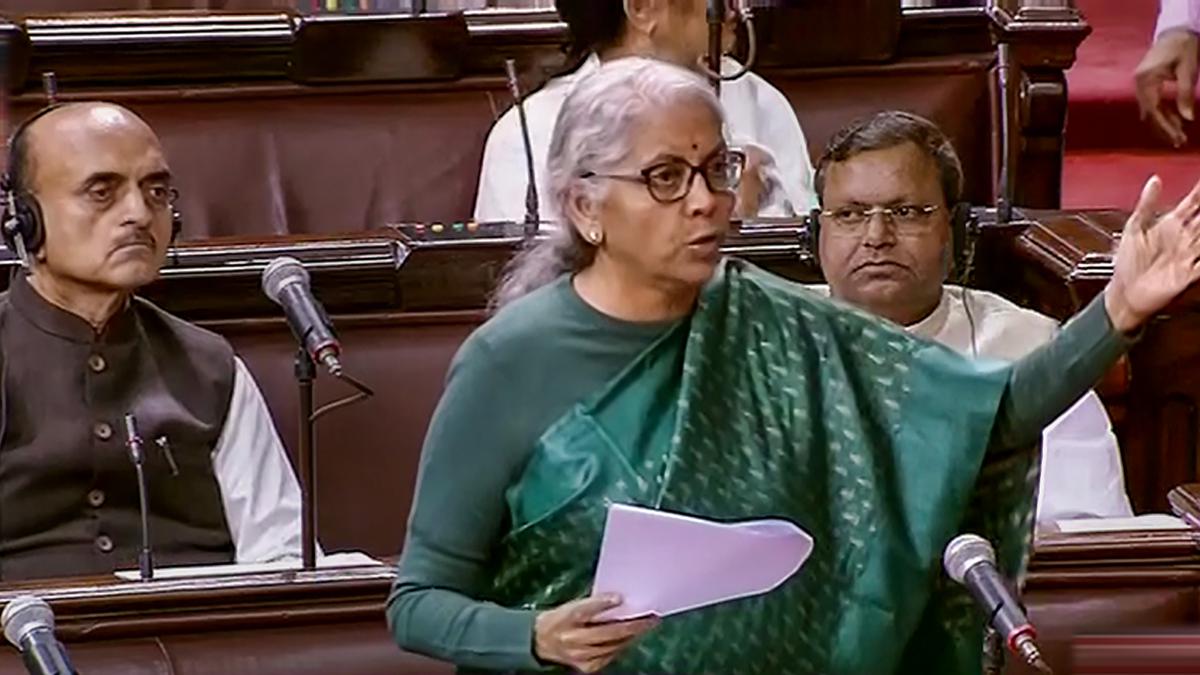

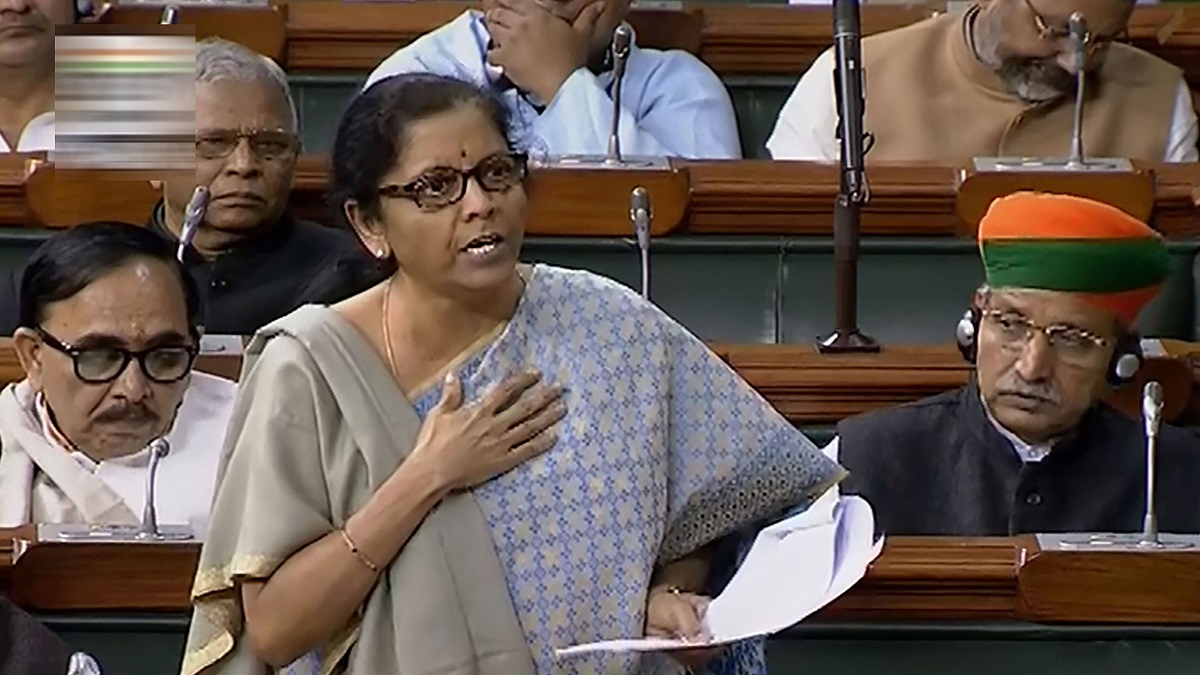

Nirmala Sitharaman announces corporate tax cut; other key highlights of announcements

FirstpostThe government on Friday slashed the income tax rate for companies by almost 10 percentage points to 25.17 percent and offered a lower rate to 17.01 percent for new manufacturing firms to boost economic growth rate from a six-year low by incentivising investments to help create jobs In a surprise move, the government on Friday slashed the income tax rate for companies by almost 10 percentage points to 25.17 percent. It also offered a lower rate to 17.01 percent for new manufacturing firms to boost economic growth rate from a six-year low by incentivising investments to help create jobs. “To attract fresh investment in manufacturing and boost Make In India, new provision has been inserted in the I-T Act, which allows any new domestic company incorporated on or after 1 October, 2019, making fresh investment in manufacturing, and starts operations before 31 March, 2023, an option to pay income tax at 15 percent,” she said. Here are the highlights of the announcements made by Finance Minister Nirmala Sitharaman: Corporate tax rate has been slashed to 22 percent for domestic companies not availing any incentives/exemptions; earlier rate 30 percent Effective tax rate for such companies now stands at 25.17 percent including cess and surcharge; earlier it was 34.94 percent Also, such companies shall not be required to pay Minimum Alternate Tax New domestic companies incorporated on or after 1 October, 2019, making fresh investment in manufacturing can pay income-tax at a rate of 15 percent; the earlier rate was 25 percent However, lower tax is applicable if the companies do not avail any exemption/incentive, and commence production by 31 March, 2023 Their effective tax rate will be 17.01 percent inclusive of surcharge and cess; earlier the rate was 29.12 percent These companies, too, will not be required to pay MAT For cos which continues to avail exemptions/incentives, the MAT has been reduced from 18.5 percent to 15 percent Enhanced super-rich tax on capital gains on the sale of a share in hands has been removed Enhanced surcharge will also not apply to capital gains on the sale of a security in the hands of foreign portfolio investors Enhanced surcharge introduced in Budget shall not apply on capital gain arising on sale of equity shares in a Co liable for Securities Transaction Tax No tax on buyback of shares if companies have made an announcement regarding it before 5 July 2019 Scope of corporate social responsibility activities has been expanded Lower tax rates are effective from 1 April, 2019 Changes in Income Tax Act, 1961 and Finance Act, 2019 made through an ordinance.

History of this topic

Analysis shows Trump tax plan would make rich people richer — and working people poorer

Raw Story

Budget 2024: How the new tax regime announced by Sitharaman will impact taxpayers?

India TV News

Old vs proposed income tax slabs under new regime. What has changed?

Hindustan Times

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

’Middle class bearing more weight than corporates’: Congress slams Centre over taxation policy ahead of Budget 2024

Live Mint

Ahead of budget, U.S.-India forum urges Nirmala Sitharaman for stable and predictable tax environment

The Hindu

No changes in income tax rates, slabs, announces Nirmala Sitharaman

Hindustan Times

Budget 2023: How Nirmala Sitharaman attempted to simplify tax experience

Live Mint

Budget 2023: 5 major announcements on personal income tax

Hindustan Times

Targeted relief measures during pandemic saved country from recession: FM

The Hindu

Budget 2022: No change in income tax slabs announced

India Today)

Union Budget 2022: From widening tax base to growth-related announcements, what we want from FM Sitharaman

Firstpost

Tax increase for corporations looks more likely as US election nears

Live Mint)

PM Modi to Launch 'Transparent Taxation

News 18

Govt's endeavour has been to further simplify Direct Tax laws: Sitharaman

India TV News

Govt to consider extension in deadline for availing 15% corporate tax rate benefit: FM Nirmala Sitharaman

Live Mint)

Nirmala Sitharaman says Centre has no more announcements to make; rules out any cut in income tax rates

Firstpost

Budget 2020: No boosters in Nirmala Sitharaman's tightrope walk

India Today

Budget 2020: Personal Income Tax Rates Slashed

Live Law

Union Budget 2020: Govt proposes cut in tax on cooperative societies to 22 percent

India TV News

Budget 2020 Highlights: Nirmala Sitharaman announces tax cuts and an LIC stake sale!

New Indian Express

Corporate tax cut to mostly benefit less than 1% of companies: Economic Survey

Live Mint)

Various tax exemptions for salaried class has outlived utility; time for Nirmala Sitharaman to enhance them

Firstpost)

Ahead of Budget 2020, Narendra Modi, Amit Shah meet economists, experts at NITI Aayog; discuss steps to revive growth

Firstpost

Budget 2020 Expectations: Govt Likely To Reduce Personal Income Tax Rates To Spur Economic Growth

ABP News

Govt working on measures to boost economy, I-T rate cuts under consideration: Nirmala Sitharaman

India Today

Software, mining, books printing industry not qualify for 15% corporate tax cut: Nirmala Sitharman

Live Mint![Lok Sabha Passes Bill To Slash Corporate Tax Rates [Read Bill]](https://www.livelaw.in/h-upload/2019/01/08lok-sabha.jpg)

Lok Sabha Passes Bill To Slash Corporate Tax Rates [Read Bill]

Live Law

Direct tax collection up 5 per cent till November: Sitharaman

India TV News

In a first, govt seeks suggestions on income tax rates, other duties

Live Mint

Budget 2020: Finance Ministry seeks suggestions for rationalising income tax, other duties

India TV News)

Govt unlikely to go for personal income tax cut amid fiscal stress, lower tax realisation

Firstpost

Number of income tax payers jumps 13.8% to 84.5 million

Live Mint

‘Corporate tax cut is the single biggest reform in the last two decades’

Live Mint

Under Modi, India is ‘red carpet society’: Sitharaman

The Hindu

Government considering demands to reduce personal income tax rates, says NITI Aayog

India TV News)

Govt should provide more stimulus; lower personal income tax to boost slowing growth rate of economy: Adi Godrej

Firstpost)

Companies opting for new lower corporate tax rate can't claim MAT credit, other deductions: CBDT

Firstpost

Govt plans rejig in personal tax slabs to boost spending

Hindustan Times

Six ways to slice the corporate tax cut

Live Mint)

Corporate tax cut makes India an investment destination; to attract foreign firms to set up units: Nirmala Sitharaman

Firstpost

After Sitharaman’s tax bonanza come the big challenges

Live Mint

Corporate tax cut credit positive, raises fiscal risks: Moody’s

Live Mint)

Industry, stock market experts term Sitharaman's corporate tax cut 'revolutionary', say will make Indian firms globally competitive

Firstpost

Corp tax cut credit positive,but raises fiscal risks: Moody's

The Quint

Opinion | Aaj Ki Baat September 20 episode: A bold and historic move by Finance Minister Sitharaman

India TV News

Corporate tax rate cut is chemotherapy for cancer that was being treated with Crocin: Niranjan Hiranandani

India Today

Corporate tax cut can translate into maximum of 5 per cent product price reduction, say industry veterans

India Today

A deep cut: On corporate tax cuts

The Hindu

Corporate tax reliefs to spur growth, create jobs: India Inc

The QuintDiscover Related

)

)