1 year, 10 months ago

IRS urges special refund recipients to delay filing taxes

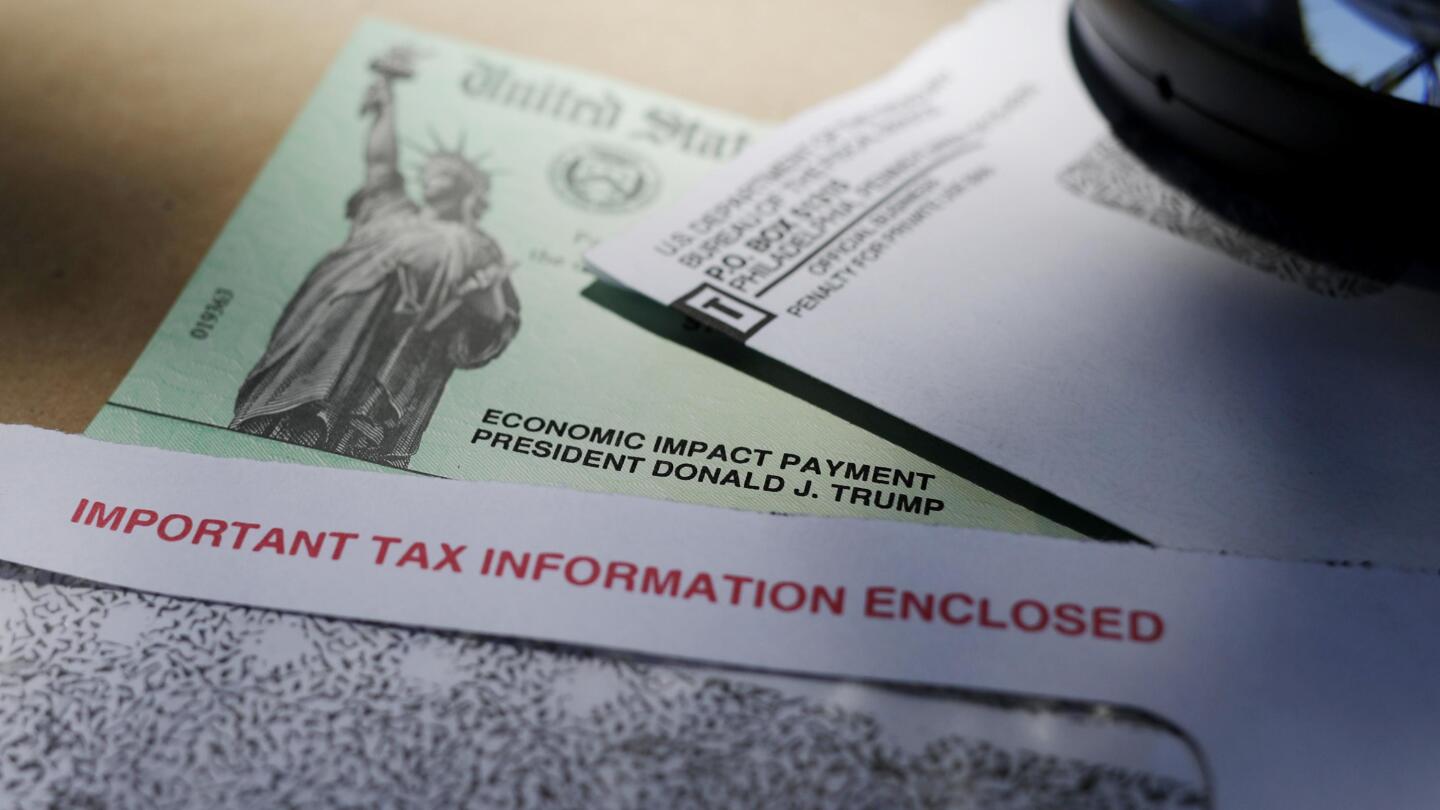

Associated PressNEW YORK — The Internal Revenue Service is recommending that taxpayers hold off on filing their tax returns for 2022 if they received a special tax refund or payment from their state last year. “We are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers,” the IRS said in its statement. If you got a tax refund from your state in 2022, the IRS is recommending you hold off on filing your tax return until the agency gives further instructions. In some states, people would get taxed if they received a tax refund in 2022 only if they itemize their deductions, said Keith Hall, president and CEO of the National Association for the Self-Employed.

States

State

Irs

Refund

Tax Return

Special Tax

taxes

states

taxpayers

urges

state

filing

recommending

recipients

special

tax

return

delay

irs

refunds

received

refund

History of this topic

Discover Related

1 day, 8 hours ago

4 days, 16 hours ago

Trending News

5 days, 3 hours ago

3 months, 3 weeks ago

5 months, 2 weeks ago

6 months, 3 weeks ago

8 months, 1 week ago

8 months, 1 week ago

8 months, 2 weeks ago

8 months, 4 weeks ago

9 months, 1 week ago

9 months, 2 weeks ago

10 months, 2 weeks ago

11 months, 2 weeks ago

1 year, 1 month ago

1 year, 2 months ago

1 year, 2 months ago

1 year, 2 months ago

1 year, 3 months ago

1 year, 3 months ago

1 year, 3 months ago

1 year, 4 months ago

1 year, 4 months ago

)

1 year, 4 months ago

1 year, 4 months ago

1 year, 5 months ago

1 year, 5 months ago

1 year, 5 months ago

1 year, 7 months ago

1 year, 8 months ago

1 year, 9 months ago

1 year, 9 months ago

1 year, 10 months ago

1 year, 10 months ago

1 year, 11 months ago

1 year, 11 months ago

2 years ago

)

2 years, 1 month ago

2 years, 2 months ago

2 years, 2 months ago

2 years, 3 months ago

2 years, 4 months ago

2 years, 4 months ago

2 years, 4 months ago

2 years, 4 months ago

2 years, 4 months ago