Securities transaction tax on futures, options contracts: What's the controversy and why govt hiked tax?

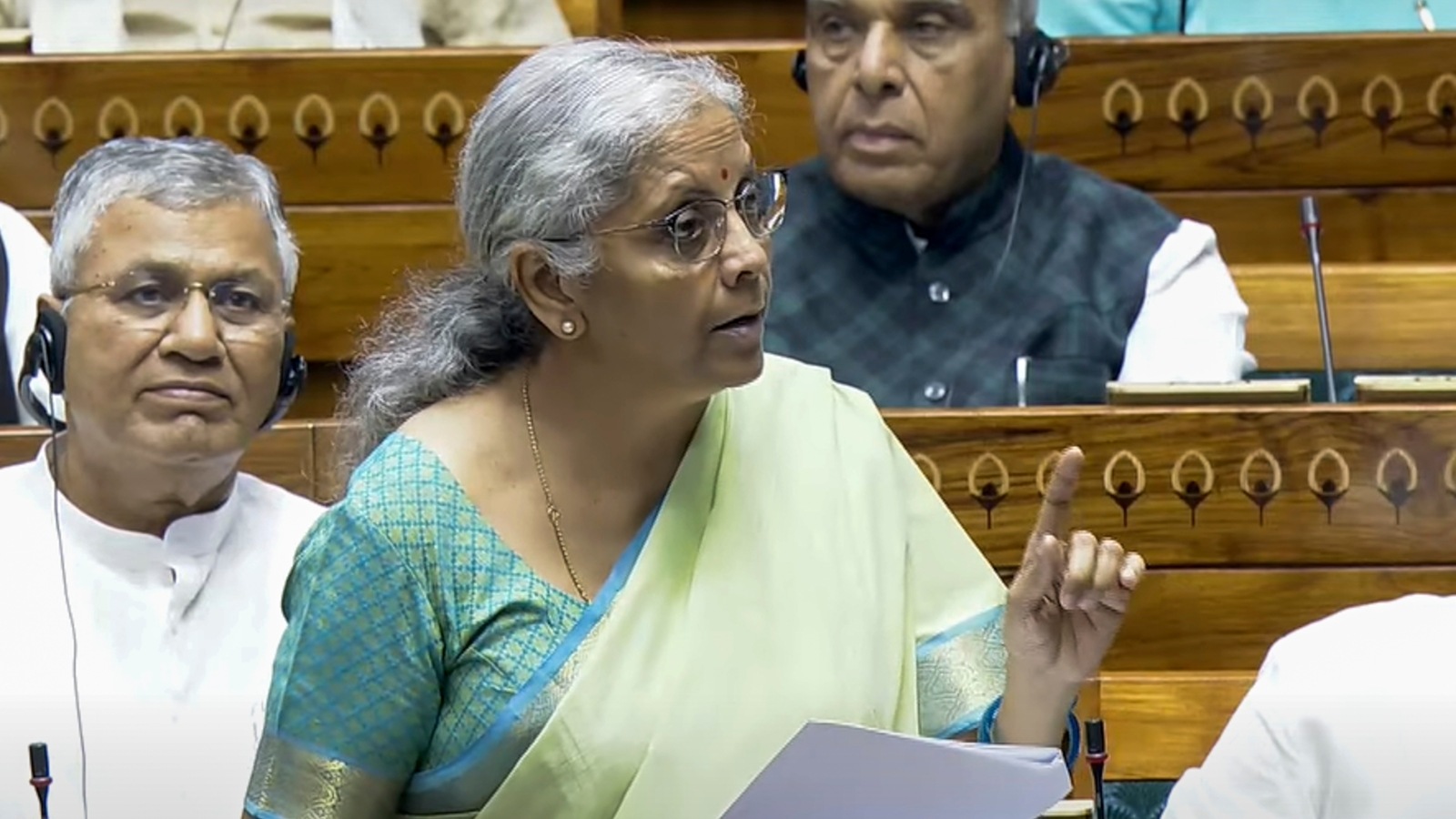

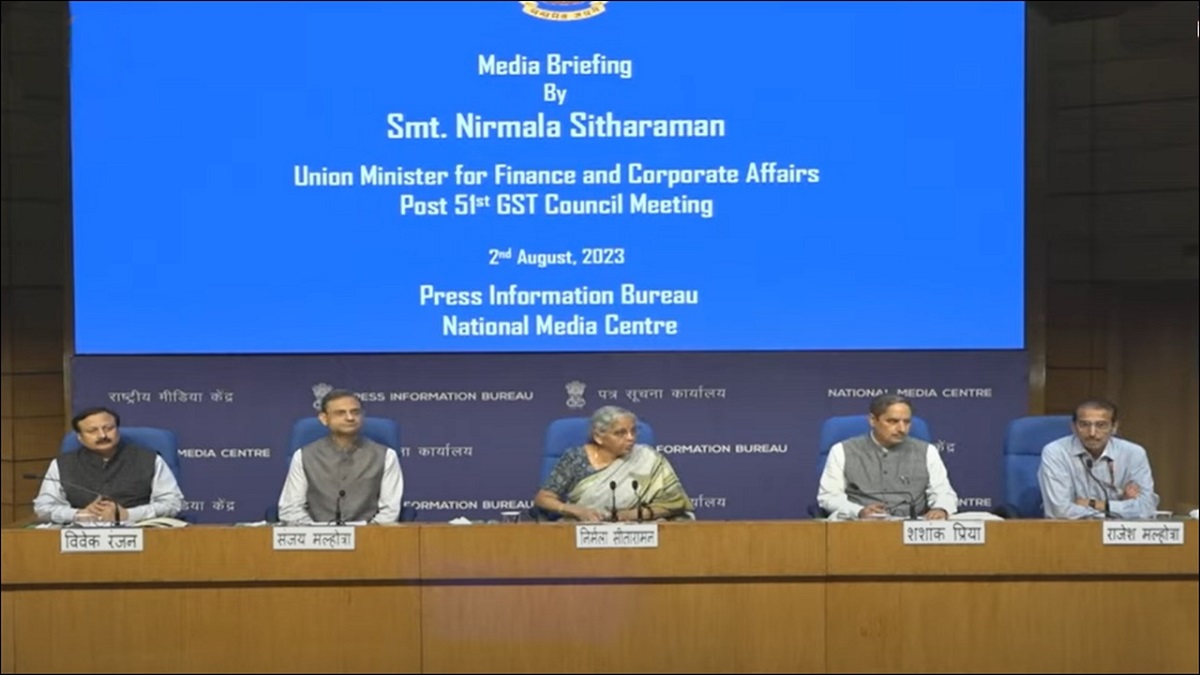

India TV NewsIn the Finance Bill 2023, passed by Lok Sabha on March 24, the government suggested raising the securities transaction tax on futures and options contracts. The Securities Transaction Tax on options is proposed to be increased to 0.0625 per cent from 0.05 per cent and on futures contracts to 0.0125 from 0.01 per cent. Sachin Gupta, CEO, Share India Securities said, “The introduction of higher STT will impact the sentiments of traders and investors who want to make a full-time career in the stock market. The securities transaction tax on selling options has been raised from 0.05% to 0.062%, not from 0.017% to 0.021% as stated in the recent amendment to Finance Bill 2023 that was approved by the Lok Sabha, the finance ministry said shortly after the bill's passage in Parliament.

Discover Related

)