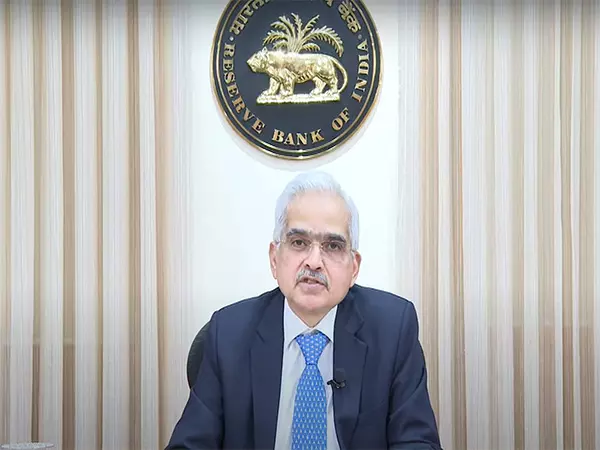

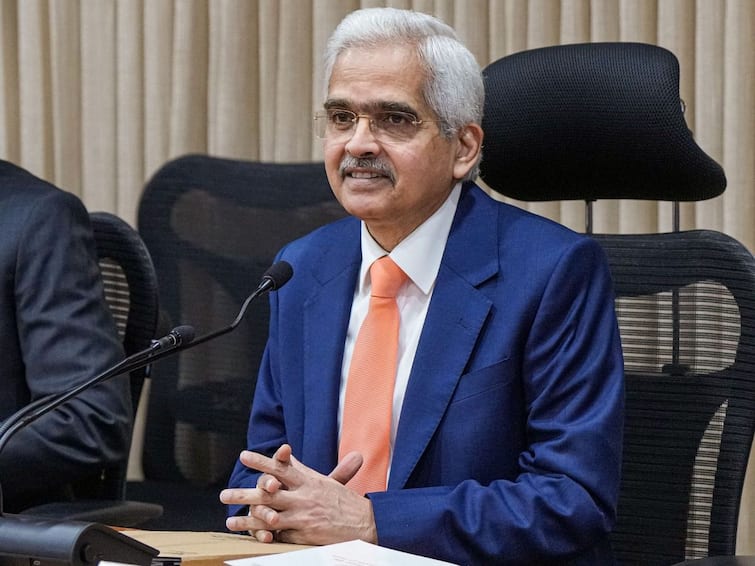

Why RBI made a surprise pitstop in rate hike cycle

India TodayJust a few days after major central banks around the globe hiked interest rates to rein in rising inflation, the Reserve Bank of India sprang a surprise and decided to keep the key repo rate unchanged. All six members of RBI's Monetary Policy Committee voted to keep the repo rate unchanged at 6.50 per cent, breaking the cycle of six consecutive hikes since May 2022 and surprising analysts who had predicted another rate hike. REASON BEHIND RBI'S MOVE Explaining the reason behind the MPC's policy decision, Shaktikanta Das said even as the global economic outlook faces considerable headwinds and headline inflation remains above the targets of central banks, banking and non-banking financial service sectors in India remain healthy. "We remain positive on equity markets and expect interest rate sensitive sectors like real estate, auto, banks, financials along with engineering/capital goods to lead the rally in the near-to-medium term," Arora said, based on RBI's policy decision and commentary on economic growth and stability. Achala Jethmalani, Economist, RBL Bank said the RBI's policy decision appears to be a "hawkish pause" as the MPC turns data dependent and waits for prior rate hikes to play out into the deposit and lending rates.

History of this topic

RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm

Live Mint

RBI’s monetary policy panel divided over timing of rate action

Live Mint

SBI Research anticipates RBI repo rate cut in February policy meet

Live Mint

RBI MPC meeting: Repo rate unchanged. What are other key takeaways? 10 points

Hindustan Times

RBI cuts GDP growth projection to 6.6%, repo rate unchanged at 6.5%

Deccan Chronicle)

RBI monetary policy: Repo rate to remain unchanged at 6.5%, says Shaktikanta Das

Firstpost

RBI keeps repo rate at 6.5% for 11th time in a row

Hindustan Times

RBI to Announce Interest Rate Decision Amid High Inflation

Deccan Chronicle

RBI keeps interest rate unchanged at 6.5%, lowers GDP projection to 6.6%, cuts CRR to 4%

New Indian Express

RBI keeps repo rate unchanged for 11th time in a row at 6.5 per cent

India TV News

RBI MPC Meeting: Nomura Predicts Surprise 25 Basis Point Rate Cut By Central Bank

ABP News

RBI MPC Meeting: When and where to watch Governor Shaktikanta Das’ policy announcement

Live Mint

No change expected in repo rate at next week's RBI monetary policy committee meet, cut ‘very likely’ in Feb: Report

Hindustan Times

RBI to keep repo rate unchanged at meeting next week, chances of rate cut in Feb increased: Report

Live Mint

October inflation wipes off rate cut hopes in Dec policy

Deccan Chronicle

RBI keeps Repo rate unchanged at 6.5% for ninth consecutive time

Deccan Chronicle

RBI Governor warns against hasty rate cut

Deccan Chronicle

Markets hold on to early gains after RBI monetary policy decision

The Hindu

RBI keeps repo rate unchanged at 6.5%: Top announcements by Shaktikanta Das

Hindustan Times

Markets hold on to early gains after RBI monetary policy decision

New Indian Express

RBI maintains status quo for 8th time in a row; repo rate unchanged at 6.5%

New Indian Express

RBI MPC maintains repo rate at 6.5 per cent for the 7th consecutive time

India TV News

RBI MPC minutes: Why did central bank keep policy rate unchanged? Shaktikanta Das explains

Hindustan Times

RBI keeps repo rate unchanged at 6.5%

Deccan Chronicle

‘Monetary policy actively disinflationary’: RBI keeps repo rate unchanged at 6.5%

Hindustan Times

RBI Watching Inflation Like a Hawk, But Keeps Rates in Check For Festive Cheer

News 18

RBI’s Monetary Policy Committee keeps policy rate unchanged; real GDP growth for FY24 projected at 6.5%

The Hindu

RBI Policy meet: Key things to watch out for

Live MintRBI monetary policy review meeting commences, another pause in repo rate likely

Deccan Chronicle

RBI Monetary Policy: Central bank likely to hold rates, maintain hawkish stance

India Today)

RBI maintains pause for third time in a row, keeps repo rate unchanged at 6.5%

Firstpost

RBI monetary policy: Shaktikanta Das-led MPC keeps repo rate steady at 6.50%

Live Mint

RBI policy: Stock market experts suggest ‘buy on dips’ strategy in these sectors

Live Mint

RBI rate, stance to stay on pause: Poll

Live Mint

RBI Holds Interest Rate Hike Again; Home Buyers Set To Get Relief

News 18

MPC meet: RBI to maintain policy repo rate at 6.5%, say experts

Hindustan Times

RBI Likely To Maintain Pause On Interest Rate As Inflation Moves Southwards: Experts

News 18

RBI To Hold Rates In 2023, Cut Expected In Early 2024: Report

News 18

RBI May Reduce Policy Rate In Fourth Quarter Of 2024: Oxford Economics

News 18

MPC members caution against over-tightening

Live Mint

Cumulative impact of monetary policy actions still unfolding: RBI Guv in MPC meeting

ABP News

RBI to keep interest rates unchanged through year-end: Poll

Hindustan TimesDC Edit | Sweet relief for borrowers

Deccan Chronicle

Don’t hit pause in the battle to contain inflation

Hindustan Times

Pause, not pivot, says RBI governor as repo rate stays unchanged at 6.5%

The Hindu

A pragmatic move by RBI

Hindustan Times

RBI Monetary Policy: It's Just A Pause, Not A Pivot, Says Governor Shaktikanta Das

ABP NewsRBI keeps repo rate unchanged at 6.5 per cent

Deccan ChronicleInflation may force RBI to hike rate once again

Deccan ChronicleDiscover Related

)