FPIs take out ₹25,586 crore from equities in May on poll jitters, attractive valuations in China

The HinduForeign investors pulled out a massive ₹25,586 crore from Indian equities in May due to uncertainty surrounding the outcome of general election and outperformance of Chinese markets. This was way higher than a net outflow of over ₹8,700 crore in April on concerns over a tweak in India's tax treaty with Mauritius and a sustained rise in U.S. bond yields. The relatively high valuations and weak earnings, particularly in the financial and IT sectors where FPIs have a high allocation, along with political uncertainties such as ambiguity around the outcome of elections, global risk-off sentiment, and the appeal of Chinese markets, have led to FPI selling, Vipul Bhowar, Director of Listed Investments at Waterfield Advisors, said. "These factors suggest that monthly FPI inflows could exceed a sustained ₹30,000 crore if the current government remains in power," Kislay Upadhyay, smallcase manager & Founder of FidelFolio, said.

History of this topic

FPIs make a comeback, lap up Indian stocks worth ₹14,435 crore in December after two months of selling

Live Mint

FPIs pump ₹22,766 crore in Indian equities; Will the inflows continue in December? Experts weigh in

Live Mint

FPIs Reverse Sentiment, Infuse Rs 24,454 Crore In Equities In December So Far

ABP News

FPIs stage a comeback in December, infuse ₹24,454 crore into Indian equities; Is the sell-off over?

Live Mint

FPIs return as buyers in December, purchase equities worth ₹14,000 crore in Indian stock market

Live Mint

FPI selling spree slowed in November; will inflows pick up in the coming months?

Live Mint

FPIs return to Indian stock market after 36-day selling streak; is the trend sustainable?

Live Mint

FPIs Continue Dumping Indian Equities In Nov, Outflows Hit Rs 26,533 Crore

ABP News

FPI Selling Spree: Oil & Gas, Financials, Auto sectors lead outflows in November so far

Live Mint

FPIs offload ₹22,420 crore from Indian equities in November: 5 key factors behind sell-off

Live Mint

Why are foreign investors exiting India? 3 reasons behind stock market selloff

India Today

US-based funds pulling out money from India at fastest pace since Jan 2022: Report

Live Mint

FPIs Dump Indian Equities Worth Nearly Rs 20,000 Crore In Nov So Far, See What Happened

ABP News

FPIs offload ₹19,994 crore from Indian equities on US market uptrend: What should retail investors do?

Live Mint

FPI Sell-off: Financials, Oil & Gas, Auto sectors lead October FPI exodus amid shift to cheaper markets

Live Mint

FPIs extend selling streak to 27th straight session; outflows reach ₹1.21 lakh crore

Live Mint

FPIs' Outflows Exacerbate Market Volatility: Impact on Nifty

The Hindu

FPIs Turn Net Sellers as Indian Stock Market Grabs Attention

Live Mint

Record FPI Outflows in October: Strong Domestic Support Fuels Market Resilience

Hindustan Times

FPIs pull out ₹55,700 crore from Indian equities in 7 days; DII buying stems severe market crash

Live Mint

FPIs inject ₹27,856 crore in equities in September so far on U.S. rate cut expectations

The Hindu

FPIs inflow in equities drops to ₹7,320 crore in August on higher valuations

The Hindu

Indian Debt Market Remains A Favourite For FPIs As Inflow Crosses Rs 1 Lakh Crore In 2024

ABP News

FPIs Turn Net Sellers; Withdraw Rs 13,400 Crore From Equities In August

News 18

Foreign investors pumped ₹33,600 crore in Indian equity in July amid continued policy reforms and good earnings season

Hindustan Times

FPIs return to Indian equities with ₹24,454 cr inflow in Dec first week

Live Mint

FPIs invest ₹30,772 crore in equities so far in July

The Hindu

Foreign investors infuse ₹7,390 crore in second week of July, net July investment at ₹15,352 crore

Hindustan Times

Foreign portfolio investors invest ₹26,565 crore in Indian equities in June

The Hindu

FPIs back to buying Indian equities? Data from last week indicates so

Live Mint

Foreign investors invested USD 1.4 billion in last five sessions post-NDA government formation

New Indian Express

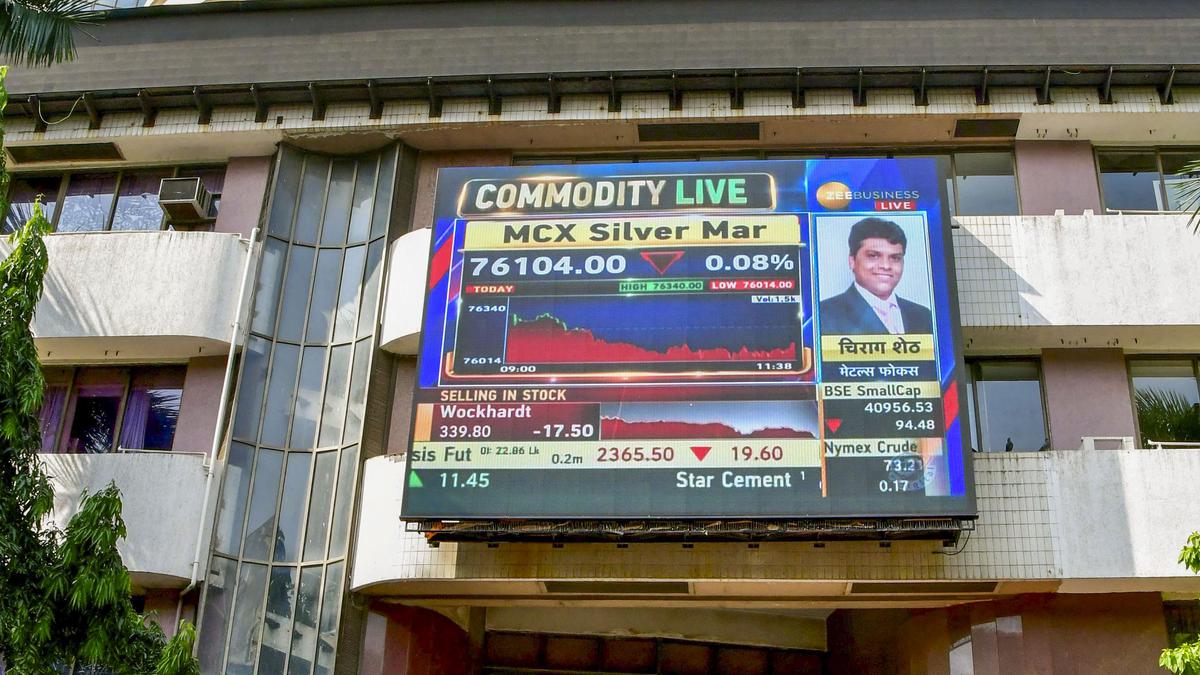

Indian stock markets volatile due to heavy selling by foreign investors as Chinese stocks become attractive

Hindustan Times

FPIs Dump Indian Equities Worth Rs 25,586 Crore In May, Remain Bullish On Debt Market

ABP News

India receives highest FDI from Singapore in 2023-24; Mauritius second biggest investor: Government data

The Hindu

FPIs halt selling: Sign of favourable Lok Sabha poll result calming investors?

Hindustan Times

FPIs take out ₹22,000 crore from equities in May amid poll jitters, Chinese markets’ outperformance

The Hindu

FPIs withdraw Rs 28,200 crore from Indian equities on poll jitters, attractive Chinese market valuations

New Indian Express

FPIs withdraw ₹8,600 cr from equities in April on Mauritius tax treaty, US bond yields rise

Hindustan Times

FPIs offload ₹20,000 crore in Indian equities in 4 sessions amid rising Iran-Israel tensions, hawkish Fed

Live Mint

FPIs offload Rs 16K crore equities in three sessions as tensions in Middle East surge

New Indian Express

FPIs Withdraw Rs 325 Crore From Indian Equities So Far In April

News 18

Foreign investors turn net buyers in Indian stock market for second month

New Indian Express

FPIs continue buying streak in March, pump ₹40,710 crore in Indian equities; Will the inflows continue?

Live Mint

FPIs reverse trend; infuse Rs 1,500 crore into Indian equities in February

India TV News

FPIs Infuse Rs 18,500 Cr In Debt Market In Feb

News 18

FPIs' Investment Value Rises 13% To USD 738 Bn In Dec Quarter

News 18FPIs infuse over ₹15,000 crore in debt market in February

The Hindu

FPIs Withdraw Rs 24,700 Crore From Indian Equities In January So Far On Rising US Bond Yields

ABP News

FPI equity assets at 22-month high, overcoming October setback

Live MintDiscover Related

_1653629830547_1734242852120.jpg)

)