Hindenburg shorts India’s Adani citing debt, accounting concerns

Al JazeeraConcerns raised by the US-based short seller sent shares of Adani Group’s listed firms tumbling, eroding $11bn. Hindenburg Research said it held short positions in India’s Adani Group, accusing the conglomerate of improper use of offshore tax havens and flagging concerns about high debt that eroded $11bn in investor wealth on Wednesday. It also said key listed Adani companies had “substantial debt” which has put the entire group on a “precarious financial footing”, and asserted that shares in seven Adani listed companies have an 85 percent downside on a fundamental basis due to what it called “sky-high valuations”. Adani Group’s chief financial officer, Jugeshinder Singh, said in a statement the company was shocked by the report, calling it a “malicious combination of selective misinformation and stale, baseless and discredited allegations”. Refinitiv data shows debt at Adani Group’s seven key listed Adani companies exceeds equity, with debt at Adani Green Energy Ltd exceeding equity by more than 2,000 percent.

History of this topic

Shares of 6 Adani Group companies, out of 11 listed, decline in mid-session deals

Hindustan Times

Adani Group Shares Rally: Adani Ports Leads Gains As Sensex, Nifty Surge

ABP News

Japanese Banks sticking with Adani as Jefferies, Barclays review ties

Live Mint

Adani Green, Adani Energy Solutions: Why these Adani Group stocks are surging today

India Today

Adani Group says it lost nearly $55 billion since US indictment: Report

Hindustan Times

Enough cash, no concerns on debt servicing, says Adani Group

Live Mint

Adani Group says companies have sufficient liquidity, assures investors about servicing debt obligations

Live Mint

Adani bonds slide to year low as investors and lenders weigh bribery allegations

Live Mint

Adani touts financial muscle, says can grow without external debt

The Hindu

Friday’s relief rally after Adani shock leaves investors richer by ₹7.27 trillion

Live Mint

Adani Group stocks, bonds fall for a second day after founder's US indictment

Deccan Chronicle

Adani may see wider impact from US setback

Live Mint

Adani Group shares trade lower for second consecutive day amid US bribery allegations

India TV News

Adani Group stocks extend slide amid bribery charges. Details here

India Today

Fact Check: Adani Group DIDN'T get Rs 120 lakh crore loan from Indian banks. Data goof-up creates confusion

India Today

US indictment of Adani Group honchos: What are the implications?

New Indian Express

Déjà vu moment for Adani Group after Hindenburg allegations

Deccan Chronicle

Live tracking Adani Stocks: Six Adani stocks recover on Friday

The Hindu

Adani Group: U.S. Department of Justice allegations baseless

The Hindu

Allegations and scandals against the Adani Group: A timeline

The Hindu

LIC loses nearly ₹12,000 crore in seven Adani shares in a day on Gautam Adani’s civil indictment news. Here’s how

Live Mint

Adani Group Responds To Bribery Charges, Cancels $600 Million Bond Offering

ABP News

Adani Group Shares Crash 20 Per Cent Amid US SEC Bribery And Fraud Allegations

ABP News

India’s Adani Group sees $22 billion in value wiped off after US indictments

Live Mint

Adani Group stocks go into a tailspin, crash up to 20% after US indicts Chairman and 7 others on bribery charges

Live Mint

Adani Group stocks nosedive after US indictment over alleged bribery, investor fraud

New Indian Express

Adani Group shares in free fall today. What should investors do?

India Today

Adani Group issues statement on bribery charges, abandons $600 million bond deal

India Today

Adani Group stocks see worst day since Hindenburg crisis, lose Rs 2 lakh crore

India TodayIndia's Adani Group unit raises 19.5 billion rupees via bond issue, say bankers

The Hindu

Hindenburg Report: Adani Group Denies Allegations, Watch Big Updates Of The Hour Only On ABP News

ABP News

Adani Group Denies Hindenburg Allegations, Claims All Accusations are False | ABP News

ABP News

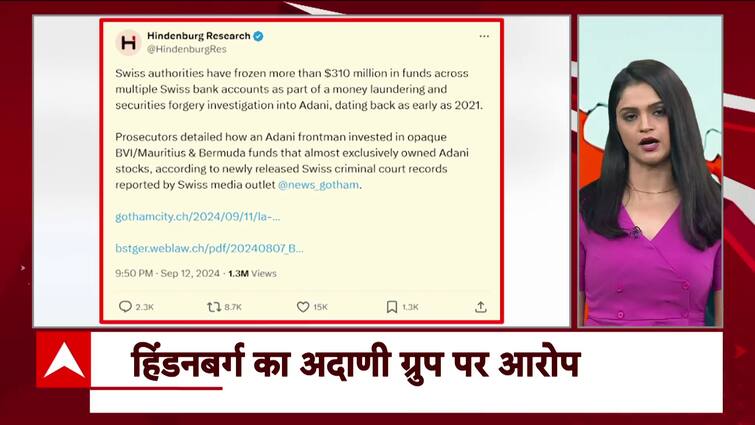

'No Swiss court proceedings, no account frozen': Adani Group rejects another claim made by US-based short seller Hindenburg

Op India

Adani Group shares drop after Hindenburg's fresh allegations

India Today

Domestic Banks, NBFCs now hold 36% exposure of Adani Group's total debt

India Today

Adani Group stocks plunge up to 17% following Hindenburg's latest claims

India Today

Adani Group rocked by Hindenburg allegations against SEBI

Al Jazeera

‘Something big soon India’: After Adani Group, Hindenburg Research hints at new report

Hindustan TimesAdani Enterprises eyes first-ever public debt issue in coming weeks: sources

The Hindu

Adani Energy Solutions may launch $600 million share sale this week: Report

Hindustan Times

Hindenburg shared Adani report with client two months before publishing it: Sebi

India TV News

Hindenburg claims it hardly made money by shorting Adani stocks and bonds: ‘Reality is…’

Hindustan Times

Adani Group case: Hindenburg Research gets show cause notice from SEBI, US firm terms it 'nonsense'

India TV News

New twist in clash between US short seller Hindenburg and India’s Adani

Al Jazeera

Adani stocks crash up to 18%, wipe out recent gains amid volatility

India Today

Adani Enterprises gets board nod to raise Rs 16,600 crore via QIP

Business Standard

India's Adani Energy Solutions to raise up to $1.5 billion

The Hindu

Adani Enterprises stock recovers $30 billion lost after Hindenburg report

Hindustan Times

Adani Group stocks today: All 10 Adani group companies trade lower. Here's why

Hindustan Times

Adani Group stocks down 13%, ₹90,000 cr wiped off in market-cap. Top loser is…

Hindustan TimesDiscover Related