Stick to fiscal deficit as the norm for fiscal prudence

The HinduGovernment expenditures exceeding revenue by a high margin can lead to a difficult situation. In the 1980s, rising fiscal deficit accompanied by rising government debt led to a difficult balance of payments situation and a high ratio of interest payment to revenue receipts. With these levels of fiscal deficit in two consecutive years, the Centre’s debt-GDP ratio is estimated at 54% in 2025-26, assuming a nominal GDP growth of 10.5% in these two years. In this context, the Twelfth Finance Commission had observed, “The transferable savings of the household sector of 10 per cent of GDP combined with an acceptable level of current account deficit of 1.5 per cent would be adequate to provide for a government fiscal deficit of 6 per cent, an absorption by the private corporate sector of 4 per cent, and by non-departmental public enterprises of 1.5 per cent of GDP.” The recent tendency is for household financial savings to come down. In India’s context, if the debt-GDP ratio remains relatively high compared to the norms given in the FRLs of the Centre and States, the ratio of interest payment to revenue receipts would also remain high, pre-empting government’s revenue receipts while leaving progressively lower shares for financing non-interest expenditures.

History of this topic

India’s fiscal deficit will be 4.8 pc in FY25, below budget estimate of 4.9 pc: CareEdge Ratings

Live Mint

Economists ask Finance Minister to focus on growth rather than fiscal consolidation

New Indian Express

Budget 2024: Modi govt reduces fiscal deficit target to 4.9 per cent of GDP for FY25

India TV News

A look at key macro numbers ahead of Budget: GDP, fiscal deficit, inflation

Hindustan Times

Govt may revise fiscal deficit target to 5% of GDP in Budget

Hindustan Times

Budget 2024: It’s tax buoyancy that shrank the deficit

Live Mint

Union Budget fiscal deficit for 2024-25 at 5.1% compared to 5.8% in FY24

The Hindu)

Budget 2024: 5 key changes we can expect this year

Firstpost

Govt meets 6.4% fiscal deficit target for FY23

Hindustan TimesIndia likely to have stable debt-to-GDP ratio going forward, says IMF official

Deccan Chronicle

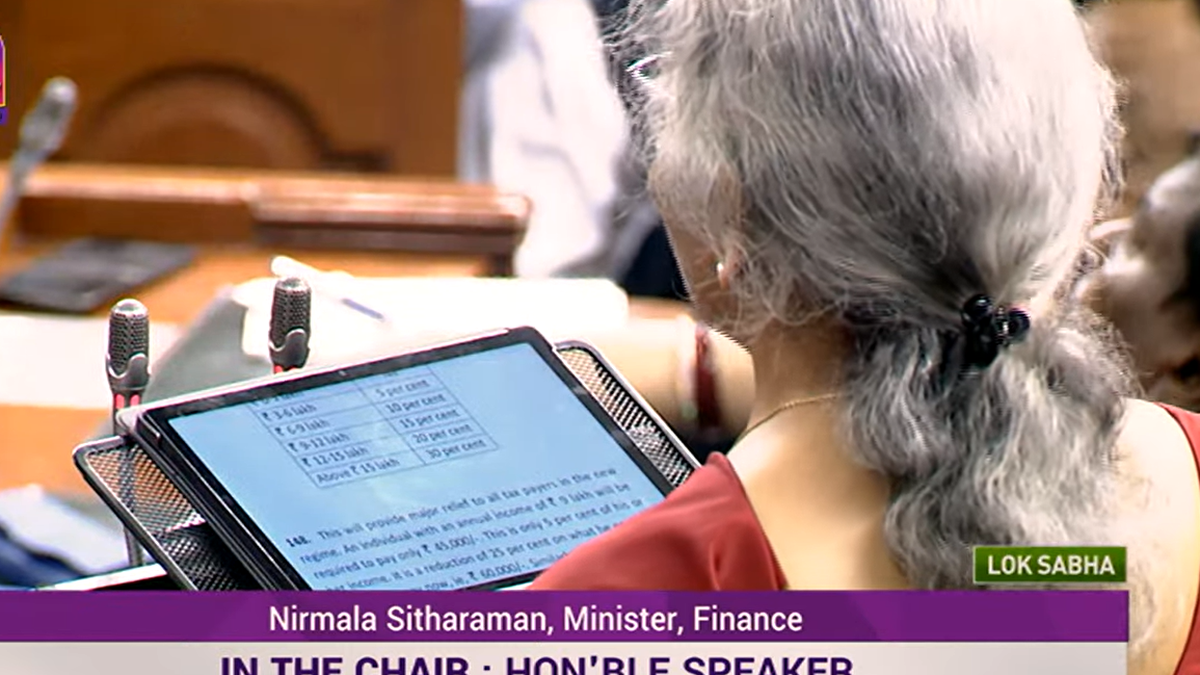

Budget 2023 | Fiscal deficit to be brought down to below 4.5% by 2025-26: FM Nirmala Sitharaman

The Hindu

Budget 2023: Know What Is Fiscal Deficit And How It Impacts Economy

ABP News

US starts fiscal year with record $31 trillion in debt

Associated PressFiscal deficit touches 32.6% of annual target till August this fiscal: official data

The Hindu

Fiscal Deficit Touches 32.6% of Annual Target Till August This Fiscal: Official Data

News 18

Fiscal deficit touches 20.5% of annual target in April-July: official data

The Hindu

Economy Might See Slowing Growth But Still Better Than Other Emerging Economies: FinMin

News 18

India seen boosting budget spending on infrastructure

Deccan Chronicle

India’s debt to GDP ratio is now at a 14-year high

Live MintIndia's fiscal deficit in 2020-21 lower than expected

The Hindu

US debt projected to balloon to more than double GDP by 2051

Al Jazeera)

Slower Consolidation to Constrain India's Fiscal Strength Over Medium Term: Moody's

News 18

Budget 2021: ’Raise limit for senior citizens interest income to ₹1 lakh’

Live Mint

Government debt-to GDP ratio to be at 80% by FY30: Report

Deccan Chronicle)

Govt Should Have Clear Exit Strategy, Milestones Needed for Fiscal Consolidation: RBI

News 18)

Fiscal Deficit Touches 83.2% of Budget Estimates at End-June due to Poor Tax Collection amid Lockdown

News 18Discover Related

)