Bitcoin tops $60,000 as investors bet on ETF approval

CNNNew York CNN Business — Bitcoin prices continued their October surge on Friday, topping $60,000 on hopes that the Securities and Exchange Commission will soon approve a bitcoin futures exchange-traded fund. Cryptocurrency investors were excited by a tweet from the verified account of the SEC’s Office of Investor Education and Advocacy late Thursday that said, “before investing in a fund that holds Bitcoin futures contracts, make sure you carefully weigh the potential risks and benefits.” That appeared to be a tacit admission that the SEC would soon give the regulatory green light to “a fund that holds Bitcoin futures contracts.” Numerous investing firms, including ProShares, Invesco, VanEck and Galaxy Digital, have filed with the SEC for bitcoin futures ETFs. “It seems clear that regulators will approve some version of a crypto ETF soon,” said Chris Kline, chief operating officer and co-founder of Bitcoin IRA., adding that “the SEC is starting to understand how these assets are stored, secured, and reconciled so that it makes sense in traditional finance.” Brokerages like Coinbase and Robinhood allow for bitcoin transactions, and there are also several ETFs already that invest in companies tied to cryptocurrencies and blockchain technology. The JPMorgan Chase CEO said on the Axios HBO show earlier this month that bitcoin was “a little bit of fool’s gold” with “no intrinsic value.” Dimon also warned on the Axios show that “regulators are going to regulate the hell out of it.” And if that wasn’t enough, Dimon called bitcoin “worthless” during a virtual appearance at the Institute of International Finance Meeting on Monday.

History of this topic

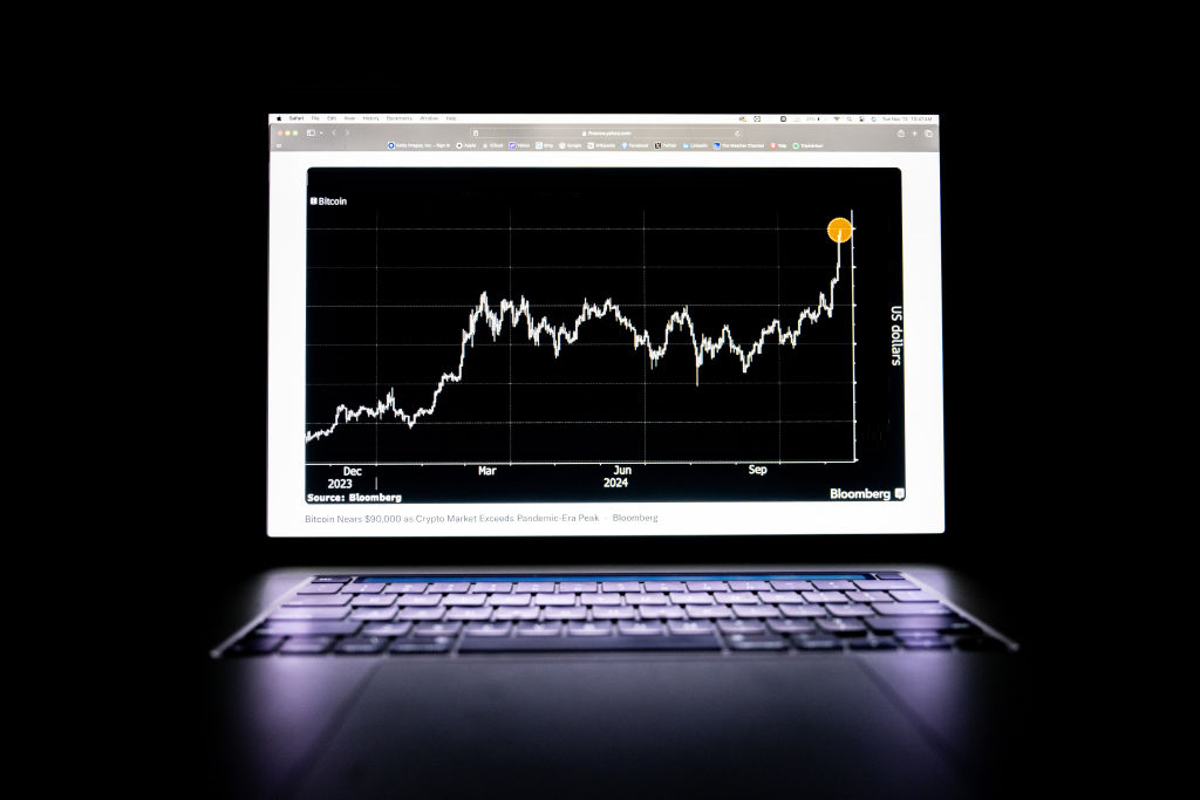

Timeline to $100,000 and beyond: Bitcoin's wild ride

Hindustan Times

Bitcoin hits $100,000, lifted by hopes of a crypto-friendly Washington

Live Mint

Bitcoin prices come within kissing distance of $100,000. Should you invest now or just sit on the fence?

Live Mint

Bitcoin reaches record high of $95,000. 5 things to know

India Today

US ETFs net inflows near $1 trillion in biggest annual rush fueled by Trump’s poll victory

Live Mint

Bitcoin price nears $90,000. What's behind the rally and will it continue?

India Today

Bitcoin rallies past $81,000. What's driving the surge?

India Today

Bitcoin Soars to $71,000: A Crypto Renaissance on the Horizon?

ABP News

Ether gets ETF approval from US regulator; experts predict volatility ahead

Live Mint

Bitcoin tumbles 10% off its peak in less than a week to trade at $65,300. Check details here

Live Mint

Hot New Bitcoin Funds Are Still Waiting for Buy-In from Financial Advisers

Live Mint

Bitcoin’s price is surging. What happens next?

Hindustan Times

Bitcoin briefly hits all-time high, less than two years after FTX scandal clobbered crypto

The HinduBitcoin briefly hits an all-time high, less than two years after FTX scandal clobbered crypto

Associated Press

Bitcoin surges to $66,000, market cap crosses $2.5 trillion

Live Mint

Bitcoin price hits fresh 2024 high amid record inflows

The Independent

Bitcoin Reclaims $57,000 After 2 Years On Heavy Institutional Buying

News 18

Bitcoin Crosses $46,000 As Excitement Around BTC Halving Catches Steam

ABP News

Bitcoin surges past $46,000, close to month-highs on ETF inflows, halving plans

Live MintSEC’s approval of Bitcoin ETFs sends muddled message

The Hindu

Here’s How the New Bitcoin ETFs Will Work

Live Mint

Bitcoin ETFs begin trading in U.S. ending decade-long tussle with SEC

The Hindu

Bitcoin price surges 5% to $49,000, daily trading volume reaches $52 billion

Live MintNew funds will make investing in bitcoin easier. Here’s what you need to know

Associated Press

Spot Bitcoin ETF: A paradigm shift in the world of cryptos?

Live Mint

Crypto market swells by billions after ‘historic’ bitcoin moment

The Independent

Bitcoin holds firm after regulators approve ETFs

The HinduRegulators approve new bitcoin funds in move that could spur more investment in the digital currency

Associated Press

Regulators are set to decide whether to OK a new bitcoin fund. Here's what investors need to know

The Independent

SEC approves bitcoin ETFs for some investment firms

CNNSEC chair denies a bitcoin ETF has been approved, says account on X was hacked

Associated Press

Bitcoin traded just below $47,000 mark as ETF frenzy continues: Report

Business Standard

Mint Explainer: What’s behind the surge in bitcoin prices

Live Mint)

Cryptocurrencies rally, Bitcoin surges past $45,000 for the first time since April 2022

FirstpostBitcoin climbs above $45,000 for first time since April 2022

The Hindu

Bitcoin Spot ETFs Expected To See US SEC Approval Soon Coinbase BlackRock All You Need To Know

ABP NewsBitcoin has surpassed $41,000 for the first time since April 2022. What’s behind the price surge?

Associated Press

Bitcoin has surpassed $41,000 for the first time since April 2022. What’s behind the price surge?

LA TimesIn spot bitcoin exchange-traded fund race, pioneers stick to the sidelines

The HinduBitcoin prices have doubled this year and potentially new ways to invest may drive prices higher

Associated Press

Bitcoin reaches 2-month high, surges above $30,000 in volatile week: Report

Live MintBitcoin price jumped after false news about spot ETF approval

The Hindu

Bitcoin Spot ETF Valkyrie US SEC Application Accept BTC Exchange Traded Fund

ABP News

US SEC Accepts BlackRock's Application For Spot Bitcoin ETFs: Here's What It Means

ABP News)

Value of Bitcoin skyrockets again as US ETF launch enhances investor exposure

Firstpost

Bitcoin ETF finally begins trading

CNN

Bitcoin investing could get boost from exchange-traded fund

Associated Press)

Bitcoin in red on October 17, but remains above $60,000 on US ETF fund approval nod

FirstpostBitcoin tops $60,000, nears record high, on growing U.S. ETF hopes

The HinduDiscover Related

)

)