Government clarifies on FPI, experts say benefits limited

India TV NewsSoon after Finance Minister Nirmala Sitharaman announced to roll back higher surcharge on foreign and domestic portfolio investors, the Income Tax department on Saturday clarified that the tax payable at normal rate on the business income from the transfer of derivatives to a person other than Foreign Portfolio Investments will be liable for the enhanced surcharge. "The derivatives are not treated as capital asset and the income arising from the transfer of the derivatives is treated as business income and liable for normal rate of tax," an official statement said. In its official statement on Saturday, the tax department said that the enhanced surcharge shall be withdrawn on tax payable at special rate by both domestic as well as foreign investors on long-term and short-term capital gains from the transfer of equity share in a company or unit of an equity-oriented fund/business trust which are liable for securities transaction tax and also on tax payable at special rate under section 115AD by the FPI on the capital gains arising from the transfer of derivatives. "However, the tax payable at normal rate on the business income arising from the transfer of derivatives to a person other than FPI shall be liable for the enhanced surcharge," the statement said.

History of this topic

Watch: Budget 2024 | What’s in it for markets and investors?

The Hindu

FM Sitharaman Denies Rumors of Sweeping Tax Changes

Deccan Chronicle

Govt raises PF threshold limit to Rs 5 lakh for earning tax-free interest

India TV News)

Govt Raises Provident Fund Threshold Limit to Rs 5 Lakh for Earning Tax-free Interest

News 18

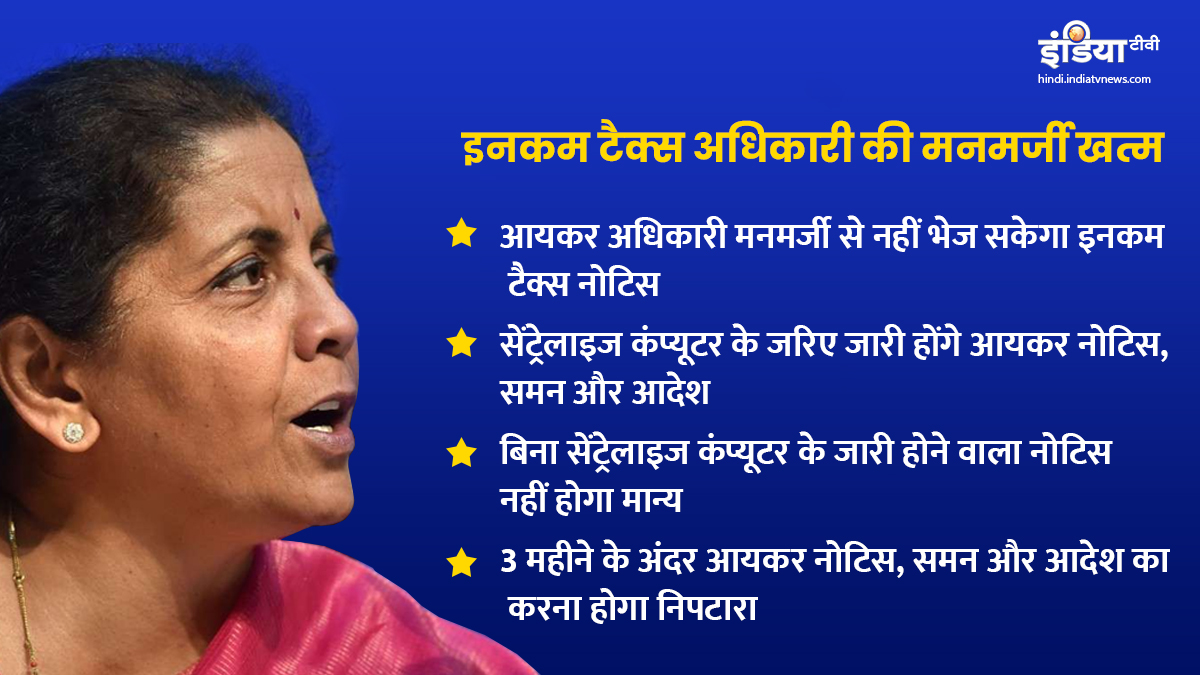

7 key takeaways from Nirmala Sitharaman's just announced new taxation laws

India TV News

FPI surcharge rollback has not created differential regime between FPIs, domestic investors: CBDT

India TV News

Cabinet may relax FDI in retail, okay ordinance to roll back FPI surcharge

India TV News

From FPIs surcharge to good news for Auto sector: Top business headlines at this hour

India TV News

Higher surcharge on gains from equity withdrawn for foreign, domestic investors

Live Mint

Big relief for markets as Nirmala Sitharaman rolls back tax surcharge on FPIs

India TV News

Govt considers exempting foreign investors from super-rich tax: Report

Live Mint

Super-rich tax: All eyes on Nirmala Sitharaman ahead of crucial FPI meet

New Indian Express)

Why super-rich sulking over super-hike in tax rates is bunkum; someone ought to foot the bill anyway

Firstpost

FM Nirmala Sitharaman shrugs off pleas by FPIs on super-rich tax

Live Mint

FM Nirmala Sitharaman shrugs off pleas by FPIs on super-rich tax

Live Mint

Budget impact: FIIs sell nearly Rs 3,000 cr in 6 sessions

India TV News

$42 billion wiped off Indian stocks as doubts on tax linger

Live Mint

No targeting of FPIs; higher tax on all super-rich including Indian residents: Finance Minister

India TV News

No targeting of FPIs, higher tax on all super-rich, says government

Live Mint

Government to soon issue clarification on applicability of surcharge on FPIs: CBDT chief P C Mody

India TV News

Sitharaman should give tax benefits to common man, remove MAT in Budget: Experts

India TV NewsDiscover Related

)

)