Lesson from Silicon Valley Bank’s failure, Zerodha CEO Nithin Kamath explains

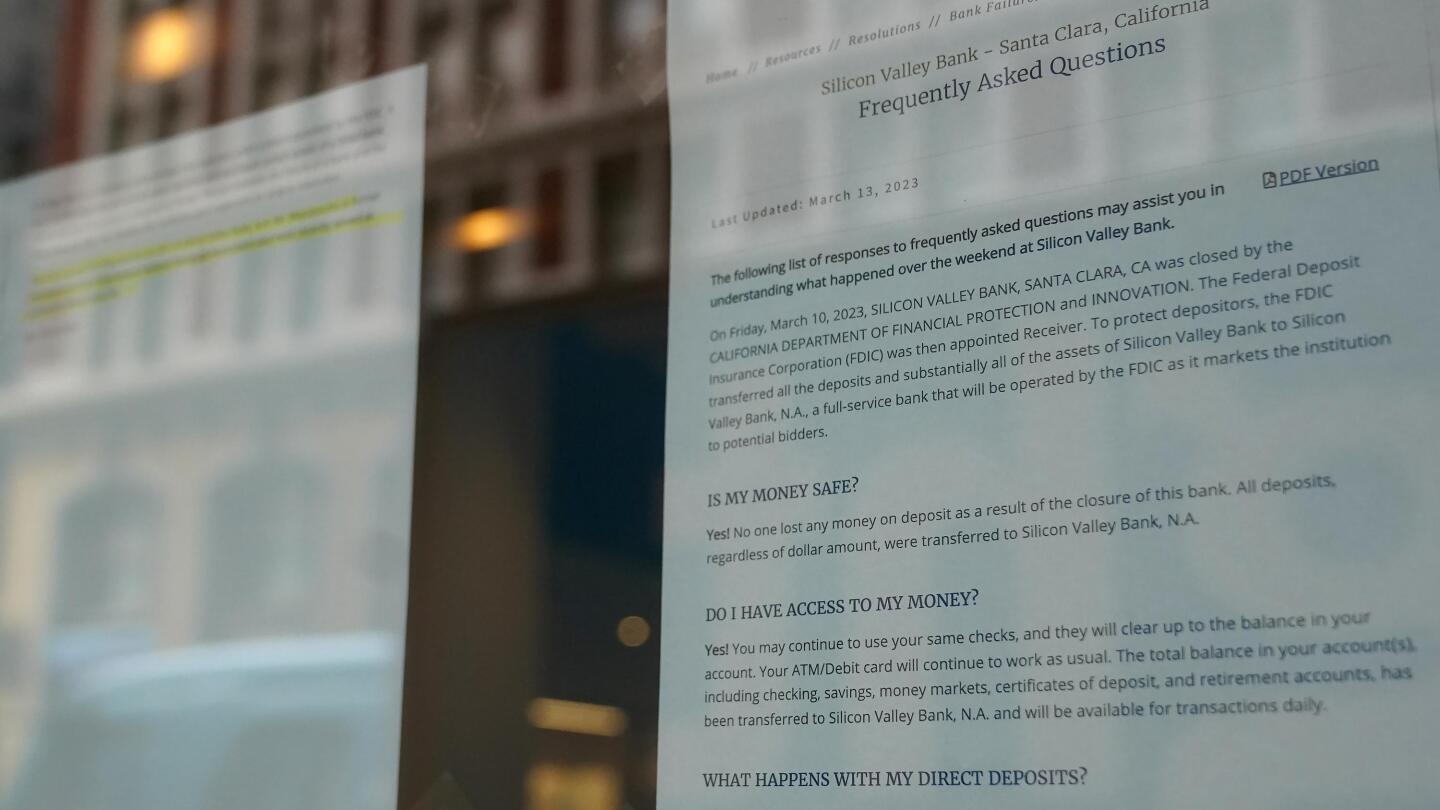

Live MintZerodha founder and investor Nithin Kamath said the lesson for the fallout of Silicon Valley Bank or the most recent collapse of a mid-sized Yes Bank in the Indian context is to have funds, especially working capital, distributed across a bunch of banks. Take a look at his tweet: The collapse of the Silicon Valley Bank has rocked the markets, raising concerns that other banks could be facing similar problems. "The contagion risk remains for small banks with highly rate-sensitive clients but the US authorities now step in to avoid contagion," Swissquote Bank's senior analyst, Ipek Ozkardeskaya, said. Some 89 per cent of SVB's $175 billion in deposits were uninsured as of the end of 2022, according to Federal Deposit Insurance Corp. All depositors, including those whose funds exceed the maximum government-insured level, will be made whole, as per a joint statement by US Treasury Secretary Janet Yellen, Fed Chair Jerome Powell and FDIC Chair Martin Gruenberg on Sunday evening.

History of this topic

How to protect YOUR cash from banking Armageddon: Shark Tank star Kevin O'Leary warns THOUSANDS more 'radioactive' regional banks could fail like SVB - you'll be amazed how simple it is to be safe

Daily Mail

Bank execs blame panicked depositors for Silicon Valley, Signature failures, but senators blame them

Associated Press

Heads of failed banks refuse to accept blame, defend their pay and bonuses

LA Times

US authorities investigate Goldman Sachs over Silicon Valley Bank collapse

Live Mint

Fed faults Silicon Valley Bank execs, itself in bank failure

Associated PressSilicon Valley Bank: US Fed calls for tougher bank rules after SVB collapse

Live Mint)

How the failure of Silicon Valley Bank might have affected the entire financial system

Firstpost

Profits at big US banks show few signs of industry distress

The Independent

Profits at big US banks show few signs of industry distress

Associated Press

Data | The Collapse of Silicon Valley Bank and Signature Bank Amid Rising Interest Rates and Asset Losses

The Hindu

Collapsed Silicon Valley Bank sold to US rival First Citizens

The Independent

First Citizens acquires bankrupt Silicon Valley Bank: 5 key things to know

Live Mint

Good News for SBV customers! First Citizens to acquire troubled Silicon Valley Bank

India TV News

SVB Crisis: Failing Banks, Living Your Life, and Finding Your Calling

The QuintSilicon Valley Bank's parent company cut off from bank's records

Firstpost

Explained | Will the SVB collapse impact Indian start-ups?

The Hindu

The global banking turmoil explained; what’s happening at SVB, Credit Suisse

Live Mint

What caused the collapse of Silicon Valley Bank, and is there a danger of ‘contagion’? | In Focus podcast

The Hindu

Explained | What’s next for Silicon Valley Bank?

The Hindu

Silicon Valley Bank’s Toronto branch seized by Canada’s banking regulator amid collapse

Hindustan Times

Silicon Valley Bank Collapse: Amid Global Reset, Can Indian Markets Bounce Back?

The Quint

Silicon Valley’s Favorite Bank Was Its Single Point of Failure

Bloomberg

Justice Dept, SEC probing collapse of Silicon Valley Bank

Associated Press

Silicon Valley Bank Was Not Your Bank

Slate

Massive job cuts in India due to Silicon Valley Bank collapse? Experts say…

Hindustan Times

HSBC puts £2 billion into SVB UK after buying it for £1, promises 'more cash'

Hindustan Times

From Moody’s downgraded outlook to oil prices, top 10 updates of SVB collapse

Live Mint

Silicon Valley Bank crisis: Fed faces flak for ‘missing’ warning signs| 5 points

Hindustan Times

Timeline: How US gov’t scrambled as Silicon Valley Bank collapsed

Al Jazeera

Silicon Valley Bank’s demise disrupts the disruptors in tech

Associated Press

Banking stocks steady in aftermath of Silicon Valley Bank collapse

The Independent

SVB Crisis: Check The List Of Companies Impacted By US Bank Collapse

ABP News

Will take up SVB-linked startups woes with FinMin, says Rajeev Chandrasekhar

Live Mint)

SVB resolution reassuring, will bring relief to startups: IT minister Ashwini Vaishnaw

Firstpost)

Silicon Valley Bank Collapse: How can you protect your money if your bank fails?

Firstpost

SVB resolution reassuring, will bring relief to startups: Minister Ashwini Vaishnaw

Deccan ChronicleSVB collapse fallout: Moody’s downgrades six US banks

Hindustan TimesSilicon Valley Bank collapse: This firm is looking to buy part of bank's loans

Hindustan TimesSilicon Valley Bank parent, CEO and CFO are sued by shareholders. Here's why

Hindustan TimesSilicon Valley Bank crisis: Did bank regulators, investors ignore warning signs?

Hindustan TimesSVB’s demise: Why didn’t US bank regulators see it coming?

Live MintSVB collapse: Rupee declines; Asian markets sink. 10 points

Hindustan Times)

Regret and blame in Silicon Valley after overnight collapse of SVB

FirstpostSilicon Valley Bank collapse: Here's what it means for climate tech

Hindustan Times

Silicon Valley Bank execs, parent company sued after collapse

Al Jazeera

Why did Silicon Valley Bank fail and is a financial crisis next?

Al Jazeera

Markets panic as Silicon Valley Bank fallout keeps spreading

The Telegraph

UK bank stocks sink deep into the red in aftermath of SVB collapse

The Independent

On Silicon valley bank crisis, Joe Biden's message to US taxpayers is...

Hindustan Times

President Joe Biden says U.S. banking system ‘safe’, but urges new regulations

The HinduDiscover Related