EU edges closer to $60-per-barrel Russian oil price cap

Associated PressBRUSSELS — The European Union was edging closer to setting a $60-per-barrel price cap on Russian oil — a highly anticipated and complex political and economic maneuver designed to keep Russia’s supplies flowing into global markets while clamping down on President Vladimir Putin’s ability to fund his war in Ukraine. The $60 figure would mean a cap near the current price of Russia’s crude, which fell this week below $60 per barrel, and is meant to prevent a sudden loss of Russian oil to the world following the new Western sanctions. On the flipside, the official said failure to put it in place would be “a win for Russia.” Oil is the Kremlin’s main pillar of financial revenue and has kept the Russian economy afloat so far despite export bans, sanctions and the freezing of central bank assets that began with the February invasion. “The reality is that it is unlikely to be binding given where oil prices are now.” Critics of the price cap measure, including former Treasury Secretary Steve Mnuchin, have called the plan “ridiculous.” Mnuchin told CNBC during a panel in November at the Milken Institute’s Middle East and Africa Summit that the price cap was “not only not feasible, I think it’s the most ridiculous idea I’ve ever heard.” Rachel Ziemba, an adjunct senior fellow at the Center for a New American Security, said that while a worst-case scenario envisions Russia cutting off the global supply of its oil, “the Saudis and Emiratis would boost production.” “Russia has made is clear the countries that abide by the cap won’t receive their oil and that could result in cuts to natural gas exports as well,” she said.

History of this topic

Two US treasury officials visiting India to urge Modi govt to maintain implementation of Russian oil price cap

India TV News

US to tell event in India that price cap on Russian oil working

Hindustan Times

US sanctions UAE shipping firm for transporting Russian crude oil above USD60 per barrel price cap

India TV NewsU.S. imposes more Russian oil price cap sanctions and issues new compliance rules for shippers

Associated Press

How Russia games oil sanctions for big profits

Live MintA price cap on Russian oil aims to starve Putin of cash. But it’s largely been untested. Until now

Associated Press

Opinion: Putin is using high oil prices to test support for Ukraine. Congress’ dysfunction plays right into his hands

LA Times

G7 said to shelve regular Russian oil cap reviews as prices soar

The HinduUS says price caps on Russia’s oil are cutting revenue nearly in half and weakening its economy

Associated Press

India and China snap up Russian oil in April above ’price cap’

Live Mint

India and China Snapping up Majority of Russian Oil Above Western Price Cap

The Hindu

India and China snap up Russian oil in April above ‘price cap’

Al Jazeera

US says Russia not benefiting from +$60/bbl oil to India

Live Mint

Russia’s economy holds up, but growing challenges test Putin

Associated Press

‘We don’t and won't': Russia's unequivocal message to West on oil price cap

Hindustan Times

Spill over of macroeconomic tightening of major economies, debt overhang need to be addressed: Janet Yellen

Live Mint

Russia announces cut to oil output over Western price caps

Associated Press

Russia to Slash Crude Oil Output in Retaliation for Western Price Cap

News 18

'US won't impose sanctions on India for purchasing Russian oil despite oil price cap': Top Energy official

India TV News

How will EU ban and West’s price cap on Russian diesel work?

Associated Press

EU countries agree on new price cap for Russian oil

NL Times

G-7, Europe reach deal for price cap on Russian diesel

Associated Press

Europe reaches deal for price cap on Russian diesel

The IndependentVladimir Putin’s plans to freeze Europe melt away with warm weather, as his economy withstands bracing winds

ABC

Report: Oil price cap takes small slice of Russia’s revenue

Associated Press

G7 Seeks Two Price Caps for Russian Oil Products

News 18

Russia bans sales of oil to countries imposing price cap

Live Mint)

Russia bans oil exports for countries using price cap: Why Moscow made move, who will be affected?

FirstpostVladimir Putin bans Russian oil exports to countries that imposed price cap over Ukraine war

ABC

Russia bans oil sales to nations, firms complying with price cap

Al Jazeera

EU countries agree gas price cap to battle energy crisis

Al JazeeraThe great gamble on the Russian oil price cap

The Hindu

Russia appreciates India's decision to not back G7's price cap on oil

India TV NewsExplained | What does a price cap for Russian oil mean?

The Hindu

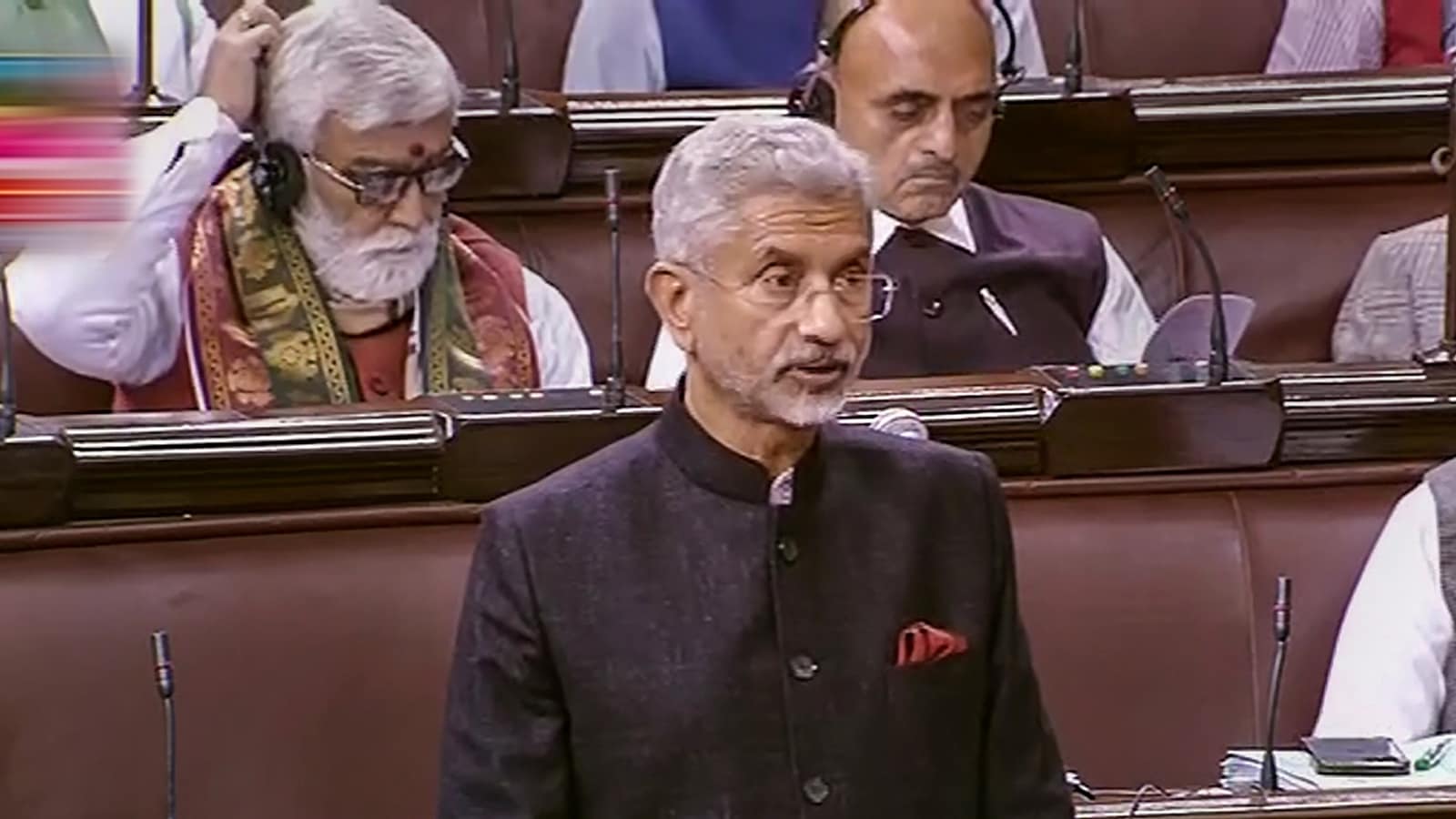

'We don't ask our companies...': Jaishankar on India's purchases of Russian oil

Hindustan Times

Russian oil price cap, EU ban aim to limit Kremlin war chest

Associated Press

Russian oil price cap, EU ban aim to limit Kremlin war chest

Associated Press

G7 price cap on Russian oil kicks in, Russia will only sell at market price

The Hindu

Cap on Russian oil prices begins, in pressure campaign on Moscow over Ukraine

LA Times

Russian oil price cap: Five things you need to know

Al JazeeraFighting between Russian and Ukrainian forces running at a 'reduced tempo', US intelligence chief says

ABC

OPEC+ agrees to keep output levels unchanged

The Hindu

No OPEC+ oil shakeup as Russian price cap stirs uncertainty

Associated Press

Russia will not sell oil subject to Western cap: Putin's aide

Hindustan Times

Russia rejects $60-a-barrel cap on its oil, warns of cutoffs

Associated PressRussian oil revenues could weather EU ban, G7 price cap

The HinduG7’s $60 Russian oil price cap impact on India and global markets

The Hindu

G7's price cap on Russia oil 'to benefit low, medium-income nations': US

Hindustan Times

G-7 joins EU on $60-per-barrel price cap on Russian oil

The Hindu

G7 group agrees $60 per barrel price cap for Russian oil

Hindustan TimesDiscover Related

)

)