Why falling inflation masks some nasty surprises

The IndependentWell, we’re finally out of double figures. The headline Consumer Prices Index rate of inflation for April came in at 8.7 per cent against 10.1 per cent in March. It’s a steep fall, but a lot less steep than most had hoped or expected; a Reuters poll of economists predicted 8.2 per cent, while the Bank of England’s more conservative forecast was 8.4 per cent. Food prices are picking up the slack, remaining stubbornly high; the official figure came in at 19.1 per cent, barely changed on the previous month’s 19.2 per cent despite the fuss supermarkets have been making about cutting the price of some essentials. Jeremy Hunt said: “The IMF said yesterday we’ve acted decisively to tackle inflation but, although it is positive that it is now in single digits, food prices are still rising too fast… we must stick resolutely to the plan to get inflation down.” That plan is now going to involve more pain because numbers like this are creating pain for the Treasury.

History of this topic

Where inflation accelerated in November – and where it eased

The Independent

Inflation rises AGAIN to its highest level since March: Price rises hit 2.6 per cent driven by spikes in the cost of petrol and fags to increase pressure on Chancellor Rachel Reeves

Daily Mail

Inflation heated up last month as consumer prices rose 2.7%, underscoring the slog ahead

CNN

Inflation behaving more like a magician who tricks you again and again

New Indian Express

Why has inflation slowed and what does it mean for households?

The Independent

Federal Reserve’s favored inflation gauge shows price pressures easing as rate cuts near

LA Times

Inflation rises to 2.2% for first time this year in blow to interest rate cut next month

The Independent

U.S. inflation slowed again in July, clearing the way for the Fed to begin cutting rates

LA TimesWhy headline inflation numbers are masking the confronting financial reality facing many households

ABC

‘Taylor Swift effect’ stops inflation dropping below 2% as calls grow for rate cut

The IndependentFederal Reserve’s preferred inflation gauge shows price pressures easing further

Associated PressFederal Reserve sees some progress on inflation but envisions just one rate cut this year

Associated Press

An inflation gauge closely tracked by the Federal Reserve rises at slowest pace this year

LA TimesInflation pressures lingering from pandemic are keeping Fed rate cuts on pause

Associated Press

Inflation unexpectedly rises to 3.5% - plunging Dow Jones down 450 points and all but ruling out a summer cut to interest rates

Daily Mail

What does the steep fall in inflation mean for UK households?

The IndependentEuropean inflation eases to 2.6% as energy prices fall and food inflation slows

Associated Press

What kept prices rising faster than expected in January? Stubborn inflation causes Dow to dive 700 points - here are the items that rose (and fell) the most over the past year

Daily Mail

Federal Reserve’s favored inflation gauge tumbles in November as prices continue to ease

LA Times

What rising inflation means for you: CPI increases to a six-month high - what happens next?

Daily Mail

Inflation shock as Jeremy Hunt expects prices to go back up again

The Independent

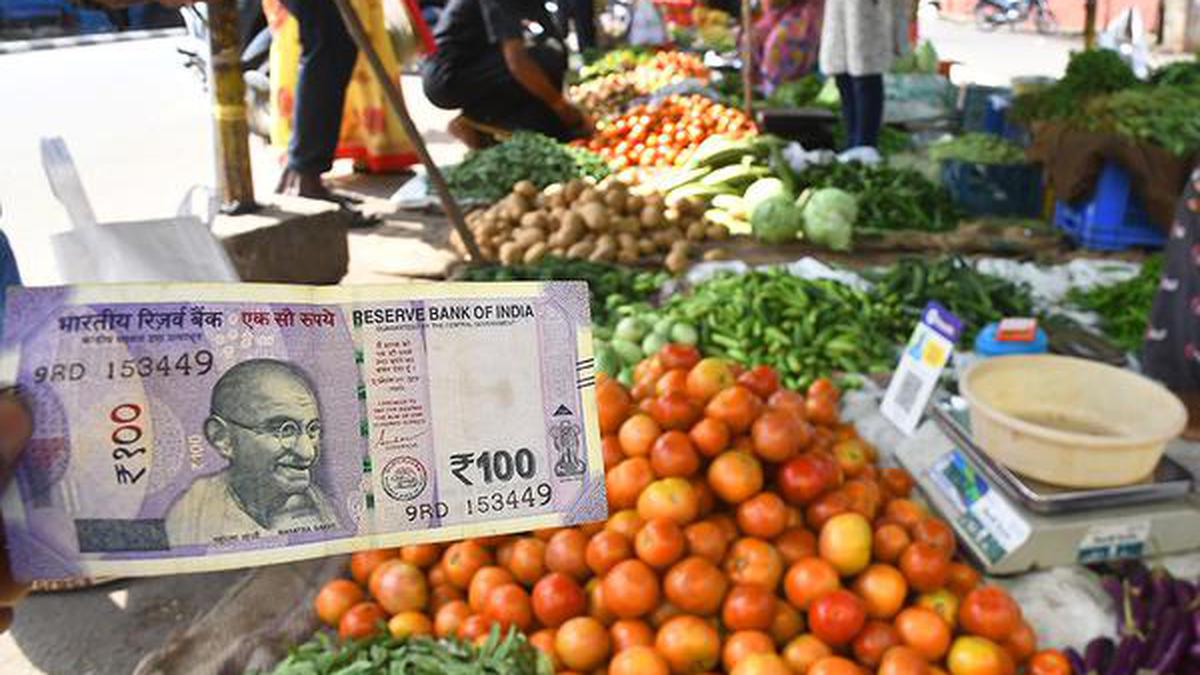

RBI Monetary Policy: FY24 Inflation Forecast Raised To 5.4 Per Cent On Higher Vegetable Prices

ABP NewsAn inflation gauge tracked by the Federal Reserve falls to its lowest point in 2 years

Associated PressInflation falls sharply on tumbling fuel costs, and may allow RBA to hold off on an interest rate rise

ABC

Why inflation is worse than anyone expected – and what comes next

The Telegraph

CPI report: US inflation is coming back down to Earth

CNN

Europe sees inflation drop to 6.1%, but real relief for consumers will take months

Associated Press

A measure of inflation that is closely tracked by the Federal Reserve increased in April

Associated Press

Inflation measure closely tracked by US Fed rose in April

Al Jazeera

Inflation Momentum Softer Than Anticipated: RBI's State Of The Economy Report

ABP News

Inflation is dipping, but RBI may not slash rates

Hindustan Times

Inflation inches up in Europe ahead of interes rate decision

The Independent

US wholesale inflation pressures eased sharply last month

Associated Press)

US inflation eases to lowest level in nearly two years

Firstpost

Consumer inflation eases to 5.66% in March

The Hindu

Inflation eased in March but prices are still climbing too fast for comfort

NPR

Inflation may have eased in March, but economists are still worried. Here's why

India Today

A key inflation gauge tracked by the Fed slowed in February

Associated Press

Inflation expected to come down over the year: RBI MPC member Ashima Goyal

Deccan Chronicle

Bank policymaker says pausing interest rate rises ‘risks worst of both worlds’

The Independent)

‘Must stick to plan to bring down nightmare inflation,’ says UK finance minister Jeremy Hunt

Firstpost

An inflation gauge tracked by the Fed slows to still-high 6%

Associated Press

Make no mistake, the government shares in the responsibility for sky-high inflation

The Independent

Inflation hits new record high of 10.7% in Europe, slowing economy

India TV News

Column: You may not have noticed yet, but inflation has started to come down

LA Times

Key inflation gauge slowed to still-high 6.3% over past year

Associated Press

The Fed’s favorite inflation measure fell in April, but prices are still uncomfortably high

CNN

‘Rate increases may not cool price gains driven by war’

The Hindu

Economists predict that inflation will jump to 9% this week

Daily MailDiscover Related

)

)

)

)