Against The Run of Play: 28% Possible GST on Online Gaming Worries Industry Experts about Future Growth

News 18The government’s proposal to tax online gaming at the highest rate under the goods and services tax has the sector concerned about its prospects for future expansion. According to them, it could slow down the expansion of online gaming companies and force fantasy sports companies to provide smaller prize pools, which could cause their loyal customers to quit the platforms in pursuit of greater games. Komandur said that Prime Minister Narendra Modi firmly stated that “the gaming market is huge internationally and the number of youth connected to this market globally is increasing” and the Ministry of Electronics and Information Technology held a meeting with multiple online gaming platforms, including some of the major gaming unicorns to discuss the framework. “The government is now looking to impose 28% GST on the online gaming industry, as a move to regulate the sector, citing the example of horse racing. Vashisht also said: “Only the platform fee charged by skill gaming operators constitutes the value of supply.” As reported, other industry experts are also concerned that the prize pool reduction may drive many gamers to offshore betting companies that offer fantasy sports, online rummy, and poker.

History of this topic

Amid lack of regulation, online gaming in limbo, failing to attract investment

Live Mint

GST Council to deliberate on taxation of insurance premium, report on online gaming

The Hindu

GST Council to deliberate on taxation of insurance premium, report on online gaming

New Indian Express

53rd GST Council Meet Tomorrow: What's The Key Expectations?

Live Law

GST Council to meet on June 22, likely to review online gaming taxation

India TV News

Online Gaming Industry Complies With New GST Law But Retro Tax Still A Threat

The Quint

Karnataka to come out with legislation to curb cricket betting and online gaming, says Home Minister Parameshwara

The Hindu

West Bengal Assembly passes bill to impose 28% GST on online gaming, horse racing, casinos

India TV News

Online gaming taxation: Look for a practical way out

Live MintOnline gaming companies get ₹1 lakh crore GST show cause notices so far

The Hindu

Why Dream11 filed a suit challenging India’s tax demands? | Explained

The Hindu

All states for 28% GST on online money gaming effective from 1 Oct: Revenue Secy

Live Mint

52nd GST Council Meeting: What Lies Ahead For Online Gaming, SGST & Beyond?

News 18

Online gaming companies to collect 28% on full bet value, offshore platforms to be GST registered from October 1

The Hindu

28 per cent GST rate on online gaming from October 1

Hindustan Times

Review of GST on online gaming, casinos likely next fiscal

Hindustan Times

Nearly A Dozen Online Real-Money Gaming Companies Slapped With Rs 55 Cr Tax Notices: Report

ABP News

Only intention of online gaming companies is to make money through inducements and addiction, Tamil Nadu govt. tells Madras High Court

The Hindu

Mint Explainer: What do GST law amendments say?

Live Mint

Parliament clears 28% GST on online gaming, casinos

Live Mint

Parliament clears 28% GST on online gaming, casinos, horse racing clubs

Live Mint

Parliament paves way for 28% GST on online gaming

The Hindu

Central GST (Amendment) Bill To Be Tabled To Include 28% GST On Online Gaming, Casinos, Horse Race Clubs

Live Law

MPL cuts half of workforce amidst 28% GST regime for online gaming

India TV News

Bengaluru-based MPL to lay off 350 employees

Hindustan Times

28% GST on online gaming: How will new tax work for players and companies

Business Standard

GST Council sticks to its guns, imposes 28% tax on online gaming

The Hindu

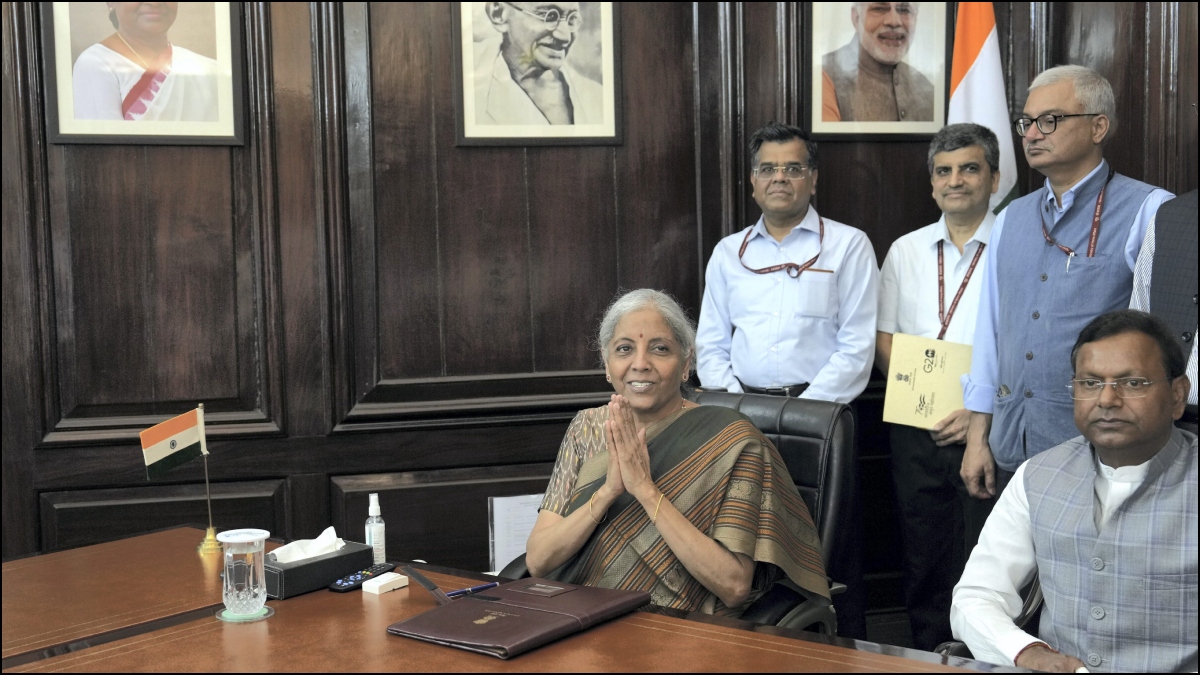

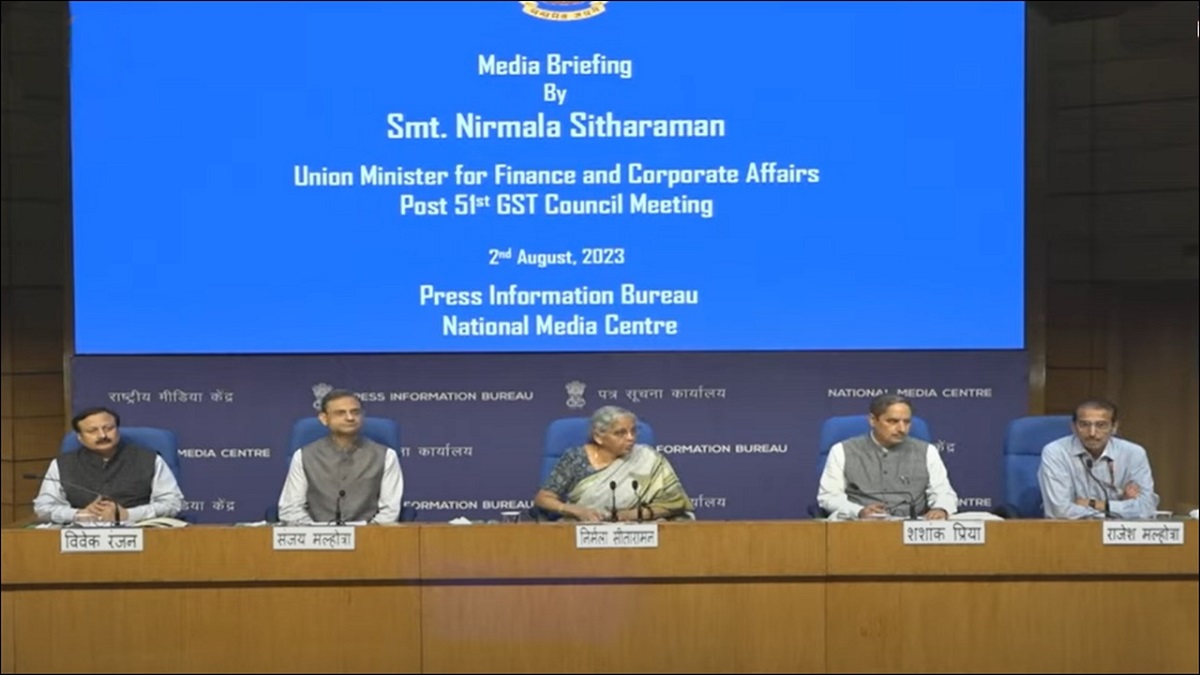

GST council meet: 28% tax on online gaming effective from Oct 1, announces FM

Hindustan Times

GST Council Keeps 28% Tax on Online Gaming, To Be Effective From Oct 1, Review After 6 Months

News 18

51st GST Council At 4 pm Today To Finalise Modalities For 28% Tax On Online Gaming

News 18

28 per cent tax on online gaming to be implemented from October 1: Nirmala Sitharaman

India TV News

GST Council To Meet On August 2 On Online Gaming, Casino Rules: Reports

News 18Video-gaming firms write to PMO seeking distinction from real-money gaming industry

The Hindu

GST Council to meet on August 2 to finalise 28% online gaming tax: Report

India Today

Online Gaming GST Tax Rajeev Chandrasekhar MeitY Approach Council Once Sustainable Framework Is Established

ABP NewsExplained | Will 28% GST on online gaming affect its growth?

The Hindu

Govt Has Played A ‘Game Over KO’ To Online Gaming Firms With 28% Tax

ABP News

Online Gaming GST Council 28 percent Nirmala Sitharaman India Industry Reaction Ashneer Grover Twitter

ABP News

IT drags Sensex below 65,400, Nifty ends 55 pts lower; Infosys, Adani Ent shed

Live Mint

T.N. underlines ban on online games in GST council meeting

The Hindu

’Implementation of 28% GST rate will bring challenges to online gaming industry’

Live Mint

GST Council Meet: 28% Tax Imposed On Online Gaming On Full Face Value

ABP News

Delta Corp shares in focus after GST Council clears 28% tax on online gaming

Live Mint

‘Time for startup founders to enter politics’: Ashneer criticises 28% GST on online gaming

Hindustan Times

Real money gaming industry reacts with shock to GST on deposits

The Hindu

GST Council to impose 28% tax on online gaming firms

The Hindu

28% GST on online gaming, horse racing, casinos on full face value. Explained

Hindustan Times

50th GST council meeting: Setback for online gaming, horse racing, casinos; to attract 28% tax

India TV News

Online Gaming Companies Are Providers of Service and Should be Taxed As Such

Deccan Chronicle

Online Rummy Games Played Are Not Taxable As ‘Betting’ And ‘Gambling: Karnataka High Court Quashes GST Intimation Notice Demanding Rs. 21,000 Crores Against Gameskraft

Live LawDiscover Related

![GNLU: 3rd Legislative Drafting Competition : Online Gaming And Gambling Regulation Act 2025 [Register By 26th December]](https://www.livelaw.in/h-upload/2024/12/10/575538-untitled-design-82.jpg)

)

)