)

Faceless Appeal Scheme Not Available in Serious Fraud, International Tax Cases

News 18The Income Tax faceless appeal scheme is not available in cases relating to serious fraud, major tax evasion, international tax and those under black money Act and benami property, the Finance Ministry said on Wednesday. The faceless appeal scheme was launched on September 25 and provides a fully faceless procedure for appeals to Commissioner. However, cases relating to serious frauds, major tax evasion, sensitive and search matters, international tax, black money Act and benami property are not covered under the scheme, it added. Listing out the steps taken by the tax department, the Office of Finance Minister in a series of tweets said in order to make tax compliance more convenient, pre-filled Income tax Return forms have been provided to individual taxpayers.

History of this topic

CBDT launches faceless income tax appeals

India TV News)

Govt Launches 'Faceless Income Tax Appeals' System, All You Need to Know

News 18)

Govt Looks to Extend Faceless Assessment Scheme to 8 More I-T Proceedings

News 18

‘Faceless assessment system will not displace tax officials’: CBDT chairman

Hindustan Times

What is faceless appeal, faceless assessment as part of BIG Ticket tax reforms: All you need to know

India TV News

What is ‘faceless’ tax assessment? All you need to know

Hindustan TimesDiscover Related

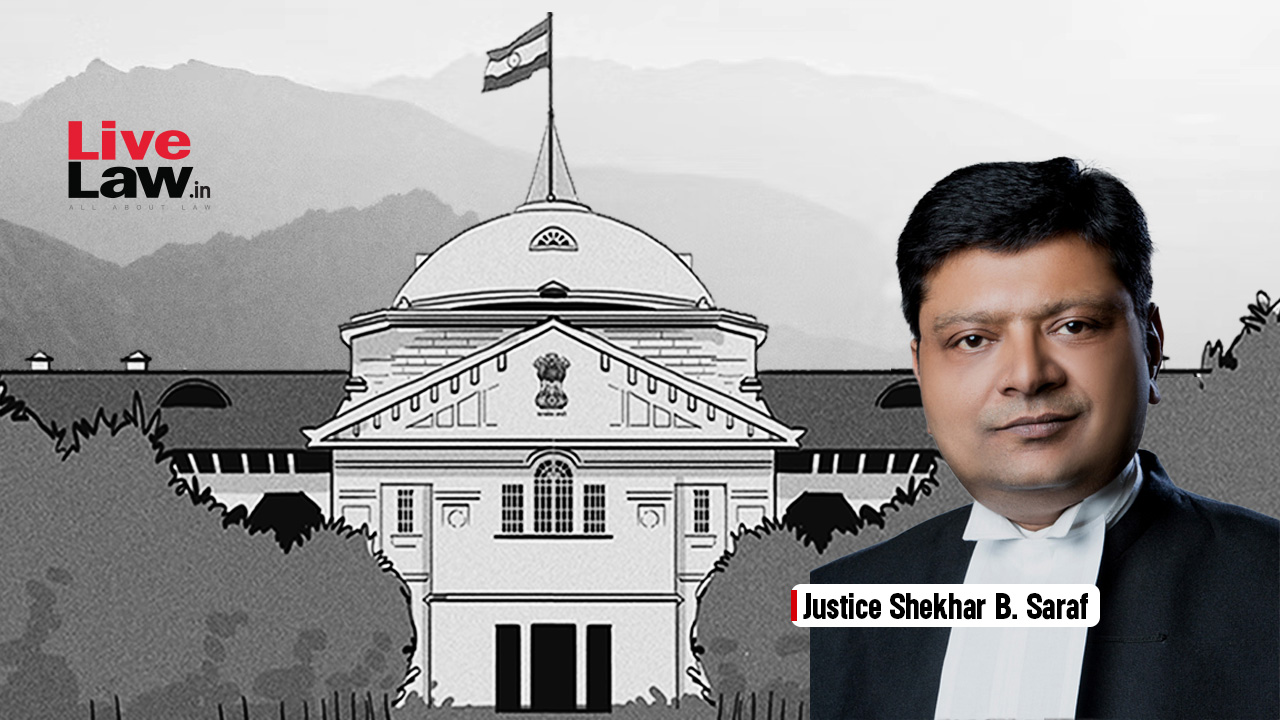

![[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court](https://www.livelaw.in/h-upload/2024/10/31/568956-allahabad-high-court-prayagraj.jpg)