Zombies: Ranks of world's most debt-hobbled companies are soaring - and not all will survive

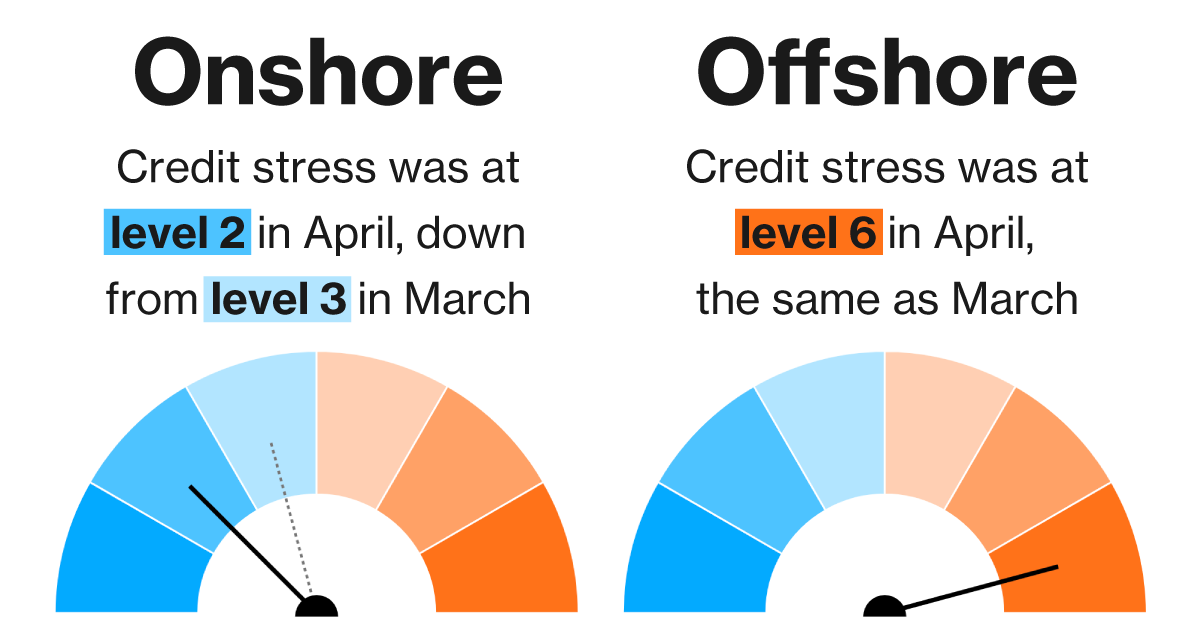

The IndependentFor free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails Sign up to our free breaking news emails Sign up to our free breaking news emails SIGN UP I would like to be emailed about offers, events and updates from The Independent. Added Miami investor Mark Spitznagel, who famously bet against stocks before the last two crashes: “The clock is ticking.” Zombies are commonly defined as companies that have failed to make enough money from operations in the past three years to pay even the interest on their loans. AP's analysis found their ranks in raw numbers have jumped over the past decade by a third or more in Australia, Canada, Japan, South Korea, the United Kingdom and the U.S., including companies that run Carnival Cruise Line, JetBlue Airways, Wayfair, Peloton, Italy’s Telecom Italia and British soccer giant Manchester United. “They don’t see risk.” WARNING SIGNS The dangers of companies piling on debt has been warned about by credit rating agencies and economists for years as interest rates fell but got a big push when central banks around the world cut benchmark rates to near zero in the 2009 financial crisis and then again in the 2020-21 pandemic. “They’ve papered over the cracks but we’ve been in decline for more than a decade,” said fan lobbying group head Chris Rumfitt after a recent downpour sent water cascading from the upper stands in what spectators dubbed “Trafford Falls.” “There have been zero investments in infrastructure.” The Glazers, who separately own the NFL’s Tampa Bay Buccaneers, recently brought in a new part owner at Manchester United who has promised to inject $300 million into the business.

History of this topic

Hundreds of zombies killed by Massachusetts AG — zombie loans, that is

NPR

Zombie Companies on the Brink of Bankruptcy as Interest Rates Soar

Live Mint

Zombies: Ranks of World’s Most Debt-Hobbled Companies Are Soaring, and Not All Will Survive

Deccan ChronicleZombies: Ranks of world’s most debt-hobbled companies are soaring, and not all will survive

Associated Press

With zombie companies likely to fail, insurance firms up premiums

Al Jazeera

Dutch have few ‘zombie companies’ but wave of bankruptcies is around the corner

Dutch NewsDiscover Related

)

)

)

)

)