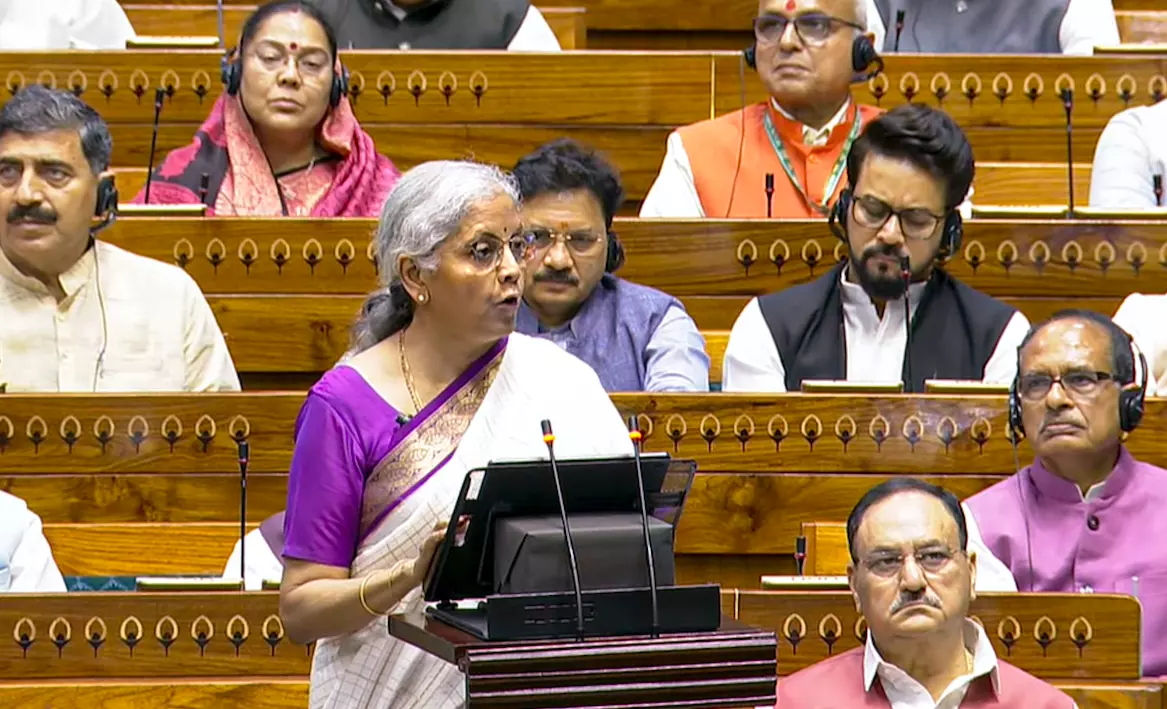

"Personal Jewellery" Of Person Coming To India Not Subjected To Customs Duty: Delhi High Court

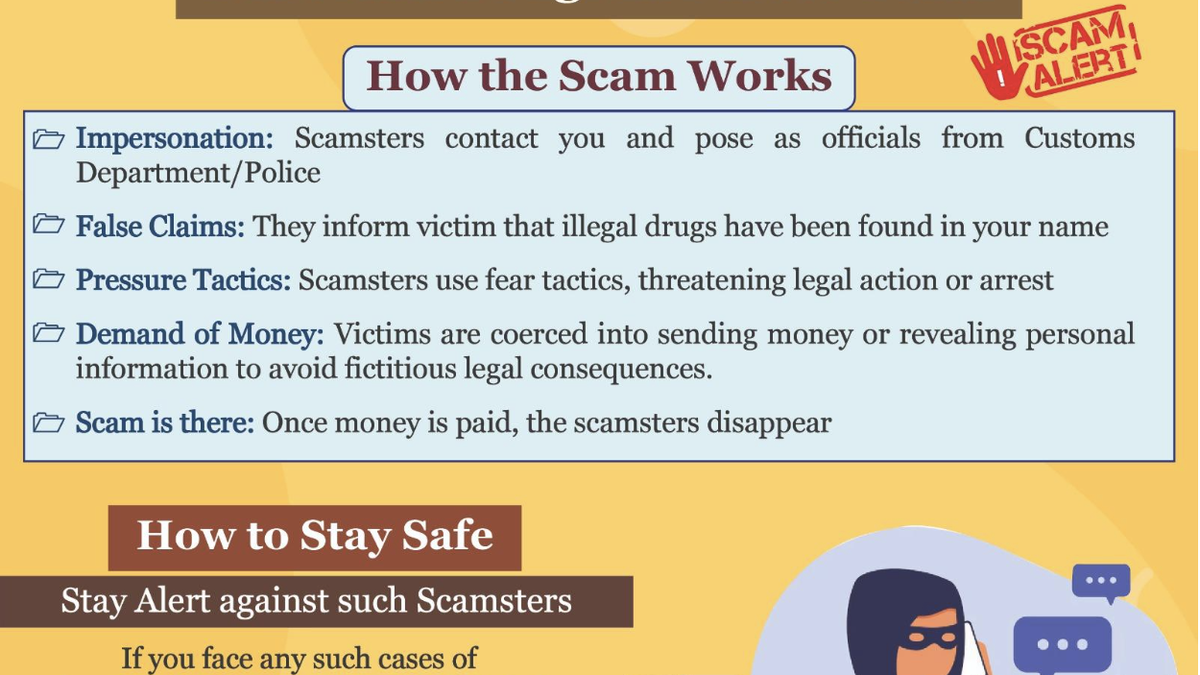

Live LawThe Delhi High Court recently granted relief to a woman whose over 200 gm gold jewellery was confiscated by the Customs on her return from Dubai. In doing so, a division bench of Justices Yashwant Varma and Ravinder Dudeja held that “personal jewellery” which is not found to have been acquired on an overseas trip and was always a “used personal effect” of the passenger would not be subject to duty under the Baggage Rules, 2016. At the outset, the High Court cited a Circular issued by the Ministry of Finance, in relation to the erstwhile Baggage Rules, 1998, clarifying that the phrase “personal effects” would include “personal jewellery”. This however, the High Court said, “would not detract from the distinction which the respondents themselves acknowledged in the Circular and intended customs officers to bear in mind the distinction which must be recognised to exist when construing and identifying 'personal jewellery' as opposed to 'jewellery' per se.” It cited Directorate of Revenue Intelligence and others vs. Pushpa Lekhumal Tulani where the Supreme Court held that the respondent was not carrying any dutiable goods because the goods were the “bona fide jewellery of the respondent for her personal use”. Hence, the High Court concluded, “If the expression “personal effects” were borne in consideration, it would include all items which are carried by an incoming passenger for satisfying daily necessities.

History of this topic

Delhi HC Directs Customs To Release Azerbaijan National's 'Personal' Gold Jewellery, Restrains Her From Selling It In India

Live Law

Delhi HC: Jewellery Worn by Foreign Nationals Exempt from Customs Duty

Deccan Chronicle

Foreign National Wearing Personal Jewellery To India Not Subject To Import Duty: Delhi High Court

Live Law

Foreigners Wearing Gold/ Silver Jewellery Worth Over ₹50,000 Must Declare To Customs: Madras High Court Upholds Penalty On Srilankan Family

Live LawDiscover Related

![[Confiscation] No Provision For Waiver Of Show Cause Notice U/S 124 Of Customs Act: Delhi High Court](https://www.livelaw.in/h-upload/2024/10/09/565132-justice-vibhu-bakhru-justice-swarana-kanta-sharma-delhi-high-court.jpg)