Skydance’s David Ellison nearing deal for Paramount after sweetened offer

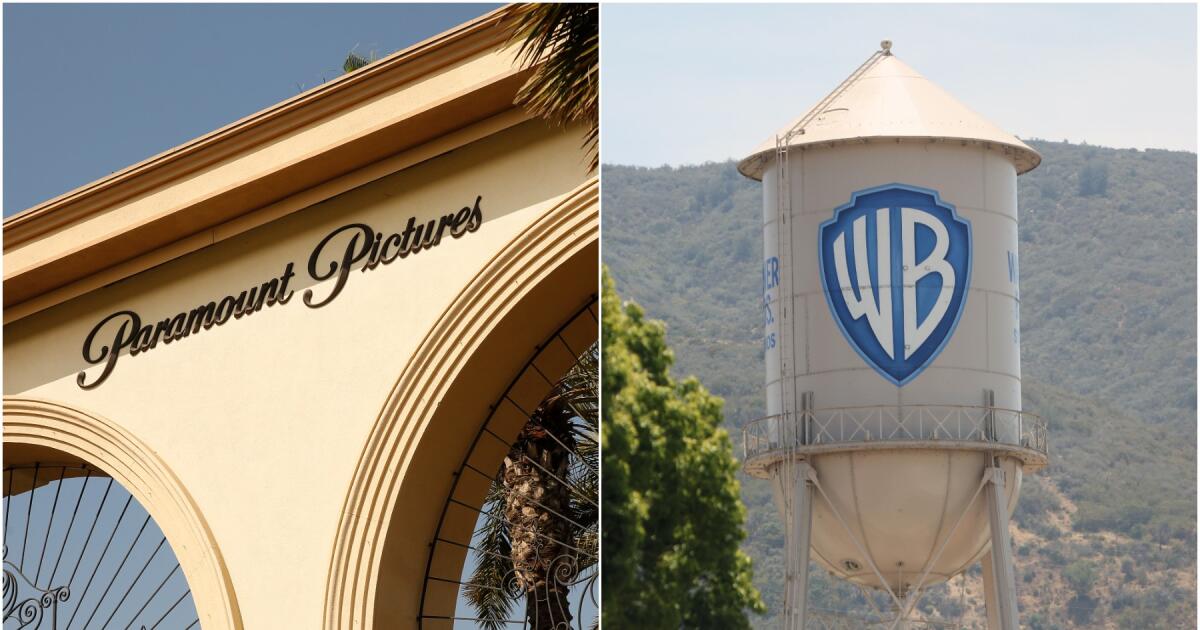

LA TimesDavid Ellison’s Skydance Media is close to clearing a major hurdle in its pursuit of Paramount Global. The Skydance proposal would give the Redstone family more than $2 billion for National Amusements, including money to pay off its debts, and its voting shares in Paramount. Hollywood Inc. David Ellison’s Skydance explores possible merger with Paramount through National Amusements Skydance Media is exploring an all-cash deal to acquire National Amusements, the company that owns the bulk of Paramount Global voting stock, as part of a deal to merge Skydance and Paramount together. The latest Skydance and RedBird offer also includes a $1.5- billion cash infusion to shore up Paramount’s balance sheet and help reduce debt, according to one of the sources. Some Hollywood film producers and agents also have been rooting for the Skydance bid, believing it represents the best chance to preserve one of Hollywood’s oldest studios, known for such gems as “The Godfather,” “Chinatown,” “Terms of Endearment,” “Top Gun” and “Forrest Gump.” The Wall Street Journal first reported that Redstone was considering other offers for National Amusements.

History of this topic

David Ellison, not Larry, to control family’s Paramount stake after deal

LA Times

Edgar Bronfman Jr. withdraws offer for Paramount, allowing Skydance merger to go ahead

Hindustan Times

Bronfman drops out of Paramount bidding; Skydance to claim prize

LA Times

Could Paramount’s flirtation with Bronfman strain the Skydance deal?

LA Times

Bronfman ups bid for control of Paramount to $6 billion

LA Times

Paramount, Skydance deal draws shareholder scrutiny

LA Times

Hollywood’s Paramount rule

Live Mint

Paramount and Skydance merge, signaling end of a family reign in Hollywood and the rise of new power

Hindustan Times

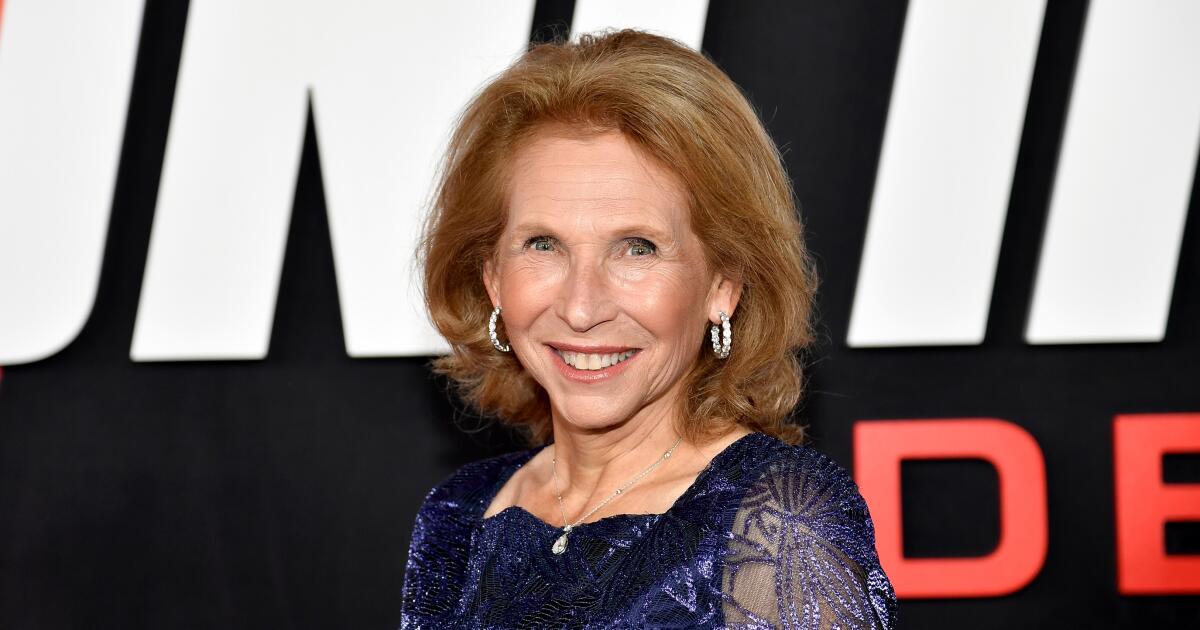

Paramount-Skydance deal: Shari Redstone, David Ellison agree to merger terms.

SlateParamount and Skydance merge, signaling end of a family reign in Hollywood and the rise of new power

Associated Press

David Ellison is taking control of Paramount. Now the real work begins

LA Times

Paramount, Skydance to merge and end Redstone family’s reign in Hollywood

Al Jazeera

Paramount and Skydance agree to merge, marking a new chapter for the storied media company

LA Times

So the Paramount and Skydance deal is back on track. What happened and what’s next?

LA Times

David Ellison agrees to buy Redstone family firm that controls Paramount

LA Times

Paramount leaders address ‘simply unacceptable’ profit declines after sale talks collapse

LA TimesParamount Global owner calls off merger talks with Skydance Media

Associated Press

Why Shari Redstone went cold on a Paramount sale to Skydance

LA Times

Paramount Global sale collapses after Shari Redstone pulls support for David Ellison deal

LA Times

Skydance talks for Paramount near finish line, but Redstone family decision looms

LA Times

Paramount Global unveils business plan and job cuts as sale looms

LA Times

David Ellison’s Skydance Media sweetens offer for Paramount

LA Times

Deal or no deal for Paramount? Here are the options on the table

LA Times

A media heiress’s bid to sell sets off mayhem inside Paramount

Live Mint

Paramount, Shari Redstone face investor angst over possible Skydance deal

LA Times

Paramount Global is for sale. Who’s buying and how did we get here?

LA Times

David Ellison’s Skydance explores possible merger with Paramount through National Amusements

LA TimesDiscover Related