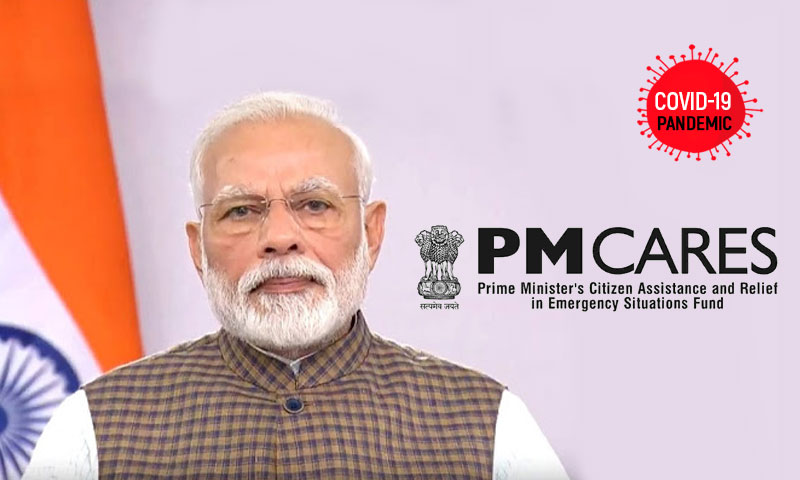

No Control Of Central Or State Govts In Functioning Of PM CARES Funds Trust : PMO Tells Delhi High Court

Live LawAn affidavit has been filed on behalf of the PM-CARES Fund Trust before the Delhi High Court, claiming that it is a public charitable trust and that it is not created by or under the Indian Constitution or any other statute, and the amount received by it does not go in the Consolidated Fund of India. The Petitioner, Samayak Gangwal, also challenges the PMO's order rejecting his RTI application stating that PM CARES was not a "public authority" within the meaning of Section 2 of the RTI Act. A Public authority means any authority/ body self-government constituted: by or under the Constitution; by any other law made by the Parliament; by any other law made by State Legislature; by notification issued or order made by the appropriate Government, and includes any- body owned, controlled or substantially financed; non-Government organization substantially financed, directly or indirectly by funds provided by the appropriate Government. In this backdrop, the Fund claims, "PM CARES Fund has been set up as a public charitable trust and is not created by or under the Constitution of India or by any law made by the Parliament or by any State Legislature… this Trust is neither intended to be or is in fact owned, controlled or substantially financed by any Central Government or State Government or any instrumentality of the any Government. It adds: PM CARES Fund comprises of voluntary donations made by individuals and institutions and is not a part of business or function of the Central Government in any manner; Merely because some Government officer provides ex gratia services to the public trust, can have no relevance; Composition of the board of trustees can never be a determinative factor to ascertain whether the respondent is a "public authority" or not; A Government officer providing secretarial assistance on honorary basis while discharging his official duties can never be a relevant consideration for declaring a body to be a public authority; Mere grant of certain tax exemptions with regard to the voluntary donations made to a public trust is not a determinative factor for the purpose of section 2 of the RTI Act; It is further claimed that the Trust functions with transparency and its funds are audited by an auditor who is a Chartered Accountant drawn from the panel prepared by the Comptroller and Auditor General of India.

History of this topic

Delhi HC quashes CIC order directing I-T dept to disclose PM CARES Fund info

Hindustan Times

PM CARES Fund Is A State, High Constitutional Functionaries Have Represented It As Govt Of India’s Initiative: Sr Adv Shyam Divan To Delhi High Court

Live Law

PM CARES Fund Not A Fund Of Government Of India, Cannot Be Labelled ‘Public Authority’: PMO To Delhi High Court

Live Law)

Delhi High Court to hear pleas on PM CARES Fund in January next year

Firstpost

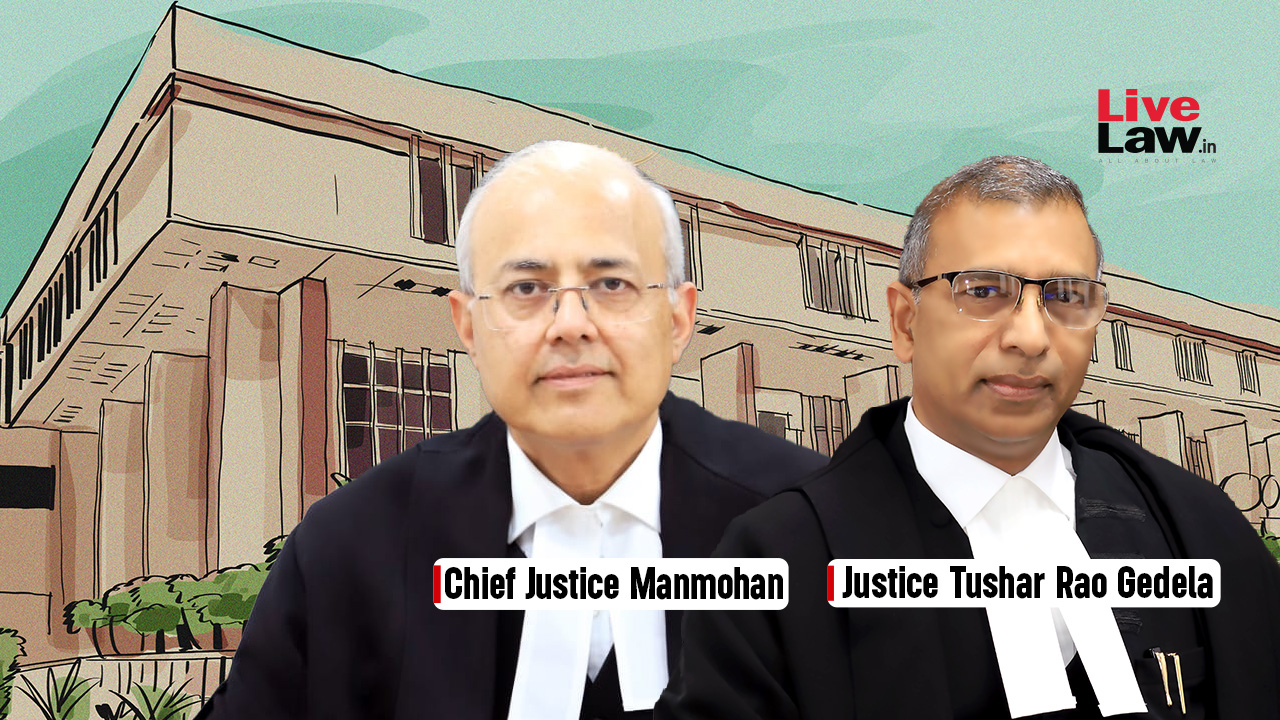

Delhi High Court Grants Further Time To Centre For Filing Detailed Response In Plea To Declare PM Cares Fund As 'State'

Live Law

Delhi HC Pulls Up Centre for Filing One-Page Response to PIL on PM Cares Fund

The Quint

PM Cares Trust Comprise Constitutional Functionaries, Can't Run A Private Show: Sr Adv Shyam Divan Argues In Delhi High Court

Live Law

PMO Opposes PIL To Remove Prime Minister's Name & Image From PM Cares Fund In Bombay High Court

Live Law

Delhi HC prepones hearing on pleas to declare PM CARES Fund ‘State’, public authority under RTI Act

India TV News

Delhi HC Prepones Hearing on Pleas to Declare PM CARES Fund a 'State' Under Constitution

News 18A fund without a care for the RTI

The Hindu)

PM-CARES Fund not a fund of Government of India, Centre informs Delhi HC

Firstpost

Delhi High Court Seeks Centre's Response On Plea For Declaring PM CARES Fund As State Under Article 12 Of Constitution

Live Law

Wife Seeks Financial Assistance From PM Cares & State CM's Relief Fund: Supreme Court Issues Notice To Krishna Institute Of Medical Sciences Limited

Live Law

Delhi High Court Declines To Issue Notice On Plea Seeking Declaration Of PM CARES Fund As "State" Under Constitution, Lists In April

Live Law![Prime Minister's National Relief Fund(PMNRF) Not A 'Public Authority' Under RTI Act : PMO [Read Reply]](https://www.livelaw.in/h-upload/2020/09/06/381053-narendra-modi.jpg)

Prime Minister's National Relief Fund(PMNRF) Not A 'Public Authority' Under RTI Act : PMO [Read Reply]

Live Law![APTEL Permits Party To Deposit Cost To NDRF After It Is Contended That PM Cares Is Not A Govt Fund [Read Order]](https://www.livelaw.in/h-upload/2020/06/30/377300-373268-pm-cares-fund-2.jpg)

APTEL Permits Party To Deposit Cost To NDRF After It Is Contended That PM Cares Is Not A Govt Fund [Read Order]

Live Law

PM CARES Fund Not A 'Public Authority' Under RTI Act: Centre Tells In Lok Sabha

Live Law)

PM CARES Fund Received Rs 3,076 Cr Within First 5 Days of Launch; Why No Names, Asks Chidambaram

News 18

Plea In Allahabad HC Questions Legality Of PM CARES

Live Law

Bombay HC dismisses plea seeking declaration of PM CARES funds

Live Mint

Government Accountability & Transparency: SC Cares?

Live LawDiscover Related

![Justice Ajay Kumar Tripathi Foundation Convenes A Trialogue, “Samvaad: संवाद” On “Separation Of Powers And The Idea Of India Therein” [16th November]](https://www.livelaw.in/h-upload/2024/11/18/571797-untitled-design-2024-11-18t151533335.jpg)