Income Tax: These deductions and exemptions are allowed only under old tax regime

Live MintIn the financial year 2023-24, the new tax regime became the default regime. Here, we list some of the common deductions allowed under the old tax regime. Please note that these exemptions are allowed only under the old tax regime. It is vital to note that the old tax regime has slightly higher tax rates than the new tax regime. Income Tax rate Surcharge Up to ₹ 2,50,000 Nil Nil ₹ 2.5-5 lakh -- 5% above ₹ 2.5 lakh NIL ₹ 5-10 lakh ₹ 12,500 + 20% above ₹ 5,00,000 NIL ₹ 10-50 lakh 1.125 lakh + 30 percent above 10 lakh NIL ₹ 50 lakh - one crore 1,12,500 + 30 percent above 10 lakh 10% ₹ 1-2 croe 1,12,500 +30 percent above ₹ 10 lakh 15% ₹ 2-5 crore 1,12,500 + 30% above ₹ 10 lakh 25% Above ₹ 5 crore 1,12,500 + 30 percent above ₹ 10 lakh 37% Meanwhile, resident individuals are also entitled to a rebate of up to 100 per cent of income tax subject to a maximum limit depending on tax regimes as under:

History of this topic

Pre-budget outlook: How to make the new tax regime more enticing and simplify compliance

Live Mint

Income Tax: New tax regime continues to allow these deductions and exemptions

Live Mint

How to switch to old tax regime from new tax regime for filing income tax

Hindustan Times

Which income tax regime should salaried employees choose? Details here

Hindustan Times

Income tax new regime: These are the deductions you can still claim

Live Mint

Opt new tax regime if deduction, exemption claims less than Rs 3.75 lakh: Official

India Today

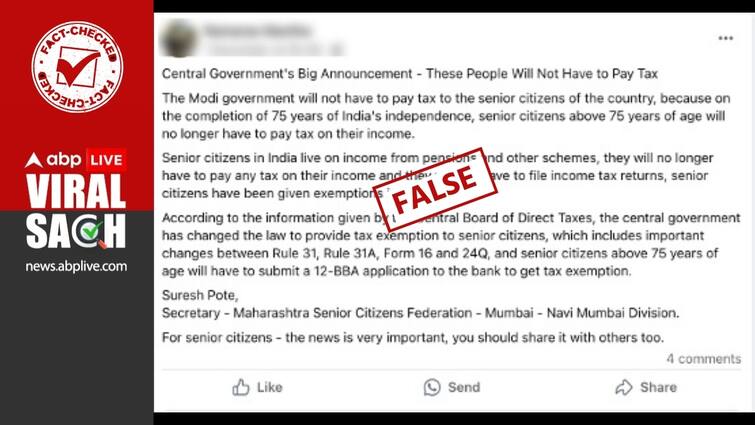

New Tax Regime Will Be Default System, Payers Can Opt For Old Regime

ABP News

Budget 2023: Will 'new' Income Tax regime have some more exemptions?

India TV News

How the new tax regime can be made attractive

Live Mint

Union Budget 2022-23: Taxpayers may get incentives for moving to new income tax regime

India Today

Thought new tax regime is good for you? Think again

India Today

Budget 2020: Full list of deductions and exemptions you can avail in new tax regime

India Today

Budget brings new income tax slabs, but old regime also stays | Explained

India TodayDiscover Related

)

)

)