CAD set to widen, inflation to remain high: Deloitte report

Live MintIndia’s current account deficit is set to worsen going forward led by higher imports and slower exports, Deloitte warned in a report shared exclusively with Mint. The report pointed out that the pressure on the rupee is “worrisome” and that India may want to consider restricting imports of non-essential items or scouting for cheaper import sources. It is the only nation expected to see a sizeable rise in CAD due to higher imports and slower exports… The pressure on rupee is worrisome and India could deal with the situation by restricting imports of non-essentials or looking for alternative cheaper import destinations,” said Deloitte in the report. The report said that although India’s forex reserves declined from 13 months of import cover at the beginning of 2021 to eight months due to foreign institutional investment outflows, “India is not in a worrisome situation as the country has accumulated sizeable forex reserves over the years by importing capital.” The report flagged that inflation will continue to remain high, compelling the RBI to keep the monetary policy tight, which is expected to hurt consumption and investment over the next year, thereby moderating the economic demand.

History of this topic

India’s fiscal deficit will be 4.8 pc in FY25, below budget estimate of 4.9 pc: CareEdge Ratings

Live Mint

Monetary policy review: RBI should stick to its price stability mandate

Live Mint

India’s GDP growth estimated to decelerate to 6.3% in 2025, says Goldman Sachs; sees shallow RBI rate cut from Q1CY25

Live Mint

India’s current account deficit to remain manageable in FY25, Rupee to remain in pressure: Bank of Baroda

Live Mint

India's current account deficit gap widens in April-June: RBI

Hindustan Times

India’s Current Account Balance Turns Surplus in Q4FY24

Deccan Chronicle

India's June quarter current account deficit narrows to 1.1 per cent: RBI

Hindustan Times

Balance of payment data gives fewer reasons to cheer

Live MintCAD narrows to 0.2% of GDP in Q4 FY23 on lower trade deficit, higher services exports

The Hindu

India's current account deficit dips to 0.2% of GDP in Q4 FY23: RBI data

India TV News

RBI's Annual Report: India's Growth Momentum Likely To Be Sustained In 2023-24

ABP News)

Pakistan's current account deficit decreases as imports grind to near standstill

Firstpost

Indian economy to grow 6-6.8% next fiscal year: Eco Survey

Deccan Chronicle

Economic Survey 2023: Current Account Deficit May Continue To Widen Due To Rising Commodity Prices

ABP NewsEconomic Survey 2022-23 highlights need to monitor current account deficit

The Hindu

Mint Explainer: After covid, the unfolding of an unfair world

Live Mint

DC Edit | Economic data spreading cheer, jobs still a concern

Deccan Chronicle

High CAD, Fed’s rate hike course likely to keep rupee under pressure in 2023

Live Mint

Indian economy poised for further growth in 2023 despite global headwinds

Deccan Chronicle

DC Edit | Promising signs in economy

Deccan Chronicle

Govt sees GDP growth dipping below the RBI forecast

Live Mint

Demonetisation behind the buoyancy in tax collections, says RBI MPC member

The Hindu

RBI Bulletin: Battle Against Surging Inflation Will Be Dogged, Prolonged

ABP News

Asian Development Bank pares 2022-23 GDP growth forecast for India to 7% from 7.5%

The Hindu

RBI raises rates, vows nimble policy

The Hindu

Data | Why the rupee is under pressure — explained in seven charts

The Hindu)

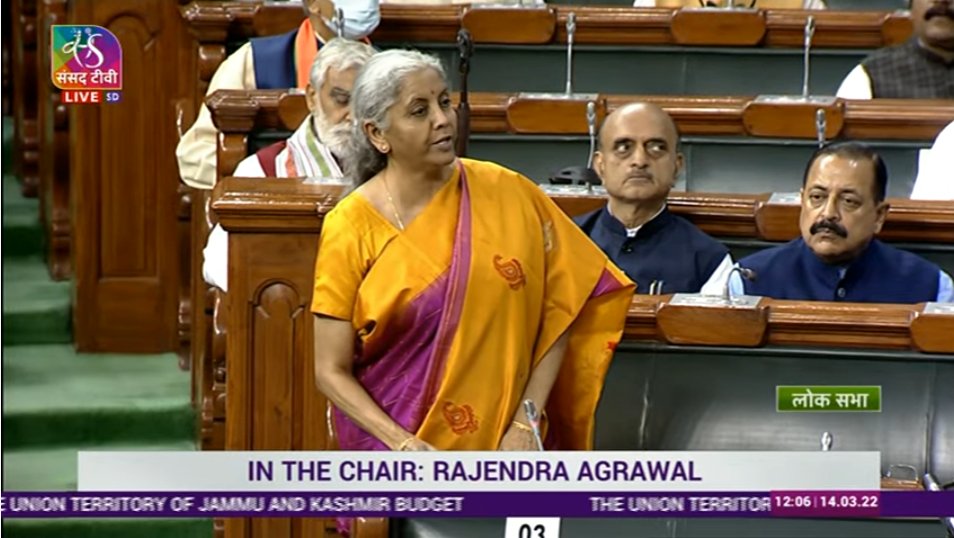

Current Account Deficit: Govt Carefully Monitoring Situation, Taken Few Steps, Says FM

News 18

Current Account Deficit expected to deteriorate in FY23 on costlier import: FinMin Report

The Hindu

India’s currency could keep falling without failing us

Live Mint

Indian rupee hits record low on CAD concerns

The Hindu

India\'s GDP growth forecast cut to 7.9 per cent: Morgan Stanley

Deccan ChronicleInvestor exuberance amidst real economy recession

The HinduRBI holds rates, sees shallower GDP contraction at 7.5%

The Hindu)

India Reports Current Account Surplus for Second Straight Quarter at 3.9% of GDP in April-June

News 18

India inflation could surge to 12% on 2nd stimulus, Rabobank says

Live MintDiscover Related