Govt proposes WTO-compliant schemes to boost Make in India

Live MintThe commerce ministry under outgoing trade minister Suresh Prabhu has come up with a World Trade Organization -compliant export promotion scheme along with a production based support scheme to boost Make In India as part of its 100-day action plan ahead of prime minister-designate Narendra Modi’s swearing in ceremony on Thursday. The new export promotion scheme may replace the existing Merchandise Export from India Scheme as the US has challenged India’s existing export subsidy schemes at the WTO on the grounds of its incompatibility with multilateral rules. The major un-rebated levies are state value added tax/ central excise duty on fuel used in transportation, captive power and farm sector, mandi tax, duty on electricity, stamp duty on export documents, purchases from unregistered dealers, embedded central goods and services tax and compensation cess, coal used in production of electricity. Under the special and differential provisions of the WTO’s Agreement on subsidies and countervailing measures, so-called least-developed countries and developing countries whose gross national income per capita is below $1,000 a year at the 1990 exchange rate are allowed to provide export incentives to any sector that has a share below 3.25% in global exports.

History of this topic

Trade and service sector leaders meet FM, urge tax cuts, export support

Live Mint

India targets $1 trillion exports by 2030: Coimbatore DGFT

New Indian Express

India plans to expand production-linked incentives for small textile firms: minister

Hindustan Times

Apple shows the way for electronics exports

Hindustan Times

Will WTO ruling impact Make-in-India plans?

Live Mint

Government vows swifter nod for exporters

The Hindu

India could export 6 mn tonnes sugar despite WTO ruling: Trade officials

Live Mint‘Plan to boost electronics manufacturing on anvil’

The Hindu)

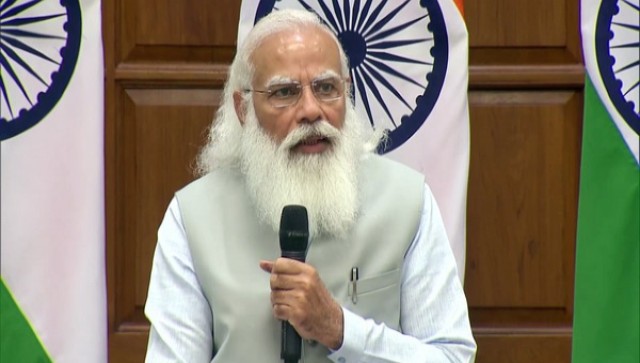

Tap opportunities in post-COVID world to meet $400 billion export target, says PM to heads of Indian missions abroad

Firstpost

Production-linked incentives: A well-designed scheme

Live Mint

Govt to offer production linked incentives to boost manufacturing

India Today

India set to lose major WTO dispute to the US

Live Mint

Why driving manufacturing and exports is critical

India Today

Tirupur hub for WTO-compliant sops

Deccan Chronicle

India’s exports performance ‘extremely good’, but I’m not fully satisfied: Suresh Prabhu

Live MintDiscover Related

)

)

)

)

)