Bank mergers aimed at economic growth | Highlights from Nirmala Sitharaman's briefing

India TV NewsFinance Minister Nirmala Sitharaman Friday addressed a press conference Friday, wherein she announced the merger of public sector banks. Many of these fugitives we are trying to get back were encouraged during their time, says Sitharaman 04:58 pm: Non-official directors to perform role analogous to independent directors, says Finance Minister 04:57 pm: Bank boards given the flexibility to fix sitting fee of independent directors, says Sitharaman 04:56 pm: Public sector banks enabled to do succession planning, says Sitharaman as she unveils governance reforms in PSBs 04:55 pm: Finance Minister Nirmala Sitharaman announces non-official directors to perform role analogous to independent directors 04:54 pm: Bank boards given the flexibility to fix sitting fee of independent directors, says Sitharaman 04:52 pm: After today's announcement post-consolidation, India will now have 12 Public Sector Banks from 27 Public Sector Banks, says Finance Minister 04:48 pm: We shall continue with 2 banks which will have a national presence - Bank of India with Rs 9.3 Lakh Crores of business size and Central Bank with Rs 4.68 Lakh Crores of business size, says Nirmala Sitharaman 04:42 pm: Big banks enhanced capacity to increase credit, FM Nirmala Sitharaman says in prelude to the announcement of new bank mergers 04:39 pm: Indian Bank merged with Allahabad Bank will be the 7th largest Public Sector Bank with a business of Rs 8.08 lakh crores, says Finance Minister 04:37 pm: Union Bank of India, with Andhra Bank and Corporation Bank shall become the 5th largest public sector bank now, says Sitharaman 04:36 pm: Canara Bank with Syndicate Bank will be the 4th largest Public Sector Bank with business of Rs 15.20 lakh crores, says Nirmala Sitharaman 04:34 pm: Punjab National Bank, Oriental Bank of Commerce and United Bank will be brought together and they shall form the 2nd largest public sector bank with a business of Rs 17.95 Lakh Crore, says Sitharaman 04:32 pm: Gains are visible from reforms in PSBs as 14 of them reported a profit in the first quarter of 2019-20, says Finance Minister Sitharaman 04:30 pm: Loans above Rs 250 crores are being strictly monitored by specialised agencies, says Sitharaman 04:27 pm: The market capitalisation is expected to touch 50,000 crores, says Finance Minister Sitharaman 04:25 pm: There is no government interference in commercial decisions of banks, says Nirmala Sitharaman 04:24 pm: Partial credit guarantee scheme for NBFCs executed; Rs 3,300 cr liquidity support given and Rs 30,000 cr in the pipeline, says Sitharaman 04:23 pm: Talking of provisional coverage ration, Sitharaman says the highest in the last 7 years has happened 04:22 pm: Record levels have been reached in loan recovery and Gross Non Performing Assets have come down from 8.65 lakh crores to 7.90 crores, says Finance Minister Sitharaman 04:21 pm: The measures to be announced today will aim to increase credit in the market. The government is also focussed on giving banks a good governance model, says Finance Minister Nirmala Sitharaman 04:20 pm: Foreign branches are rationalised, says Sitharaman 04:18 pm: 3.38 shell companies have been shut down and the 4 NBFCs have found solutions, says Nirmala Sitharaman 04:14 pm: We need to lay a very strong foundation of the banking sector. In the last several years, we have implemented major banking reforms, says Sitharaman 04:12 pm: The first few steps we are talking about are associated with the banking sector, says Sitharaman Among the measures Sitharaman announced last week were a withdrawal of the 'super-rich surcharge' imposed on foreign investors, an infusion of Rs 70,000 in public sector banks, and steps meant to increase demand in the auto sector.

History of this topic

Sitharaman Rebukes Rahul Gandhi Over Allegations on Public Sector Banks

Deccan Chronicle

Banks urged to focus on core business, innovate for higher deposits: FM Sitharaman

India TV News

Government may introduce amendments to laws to push banking sector reforms in Budget session

The Hindu

India’s growing economy needs bigger banks

Live Mint

India needs more SBI-sized banks, or three times larger: FM Nirmala Sitharaman

Live Mint

FM Sitharaman calls for more SBI-sized banks as India’s economy grows

Live Mint

Privatisation Of Banks To Go Forward As Per Schedule: Finance Minister Nirmala Sitharaman

ABP News

Finance minister Nirmala Sitharaman to address RBI board on February 14

India TV News

Amid bank strike, Nirmala Sitharaman says not all banks will be privatised

India TV News

Govt to work with RBI for execution of bank privatisation plan: Nirmala Sitharaman

India TV News)

Union Budget 2021: Sitharaman defends privatisation of PSBs in interview with News18, says India needs more efficient banks

Firstpost)

Engaging With RBI on Privatisation of Govt-Run Banks in Big Way, Can't Have Laggards: Nirmala Sitharaman

News 18Nirmala Sitharaman press meet updates | Finance Minister announces 12 schemes to boost economy

The Hindu

Finance minister Nirmala Sitharaman moves bill to amend Banking Regulation Act

Hindustan Times

Nirmala Sitharaman press conference on economic package | Top announcements

India TV NewsGovt closely monitoring coronavirus impact on economy: Nirmala Sitharaman

The Hindu)

Budget 2020: Banking sector is feeling the heat of economic slowdown; can Nirmala Sitharaman clear the mess?

Firstpost)

Union Budget 2020: Finance Minister Nirmala Sitharaman has her task cut out for crisis-ridden banking sector

FirstpostNirmala Sitharaman says govt. cleaning up banking mess from Raghuram Rajan-Manmohan Singh days

The HinduWill speak to RBI Governor, Nirmala Sitharaman assures PMC bank depositors

The Hindu

Niti Aayog VC pitches for governance reforms in banking sector

India TV News

No concern to asset quality post UBI, OBC merger: PNB CEO

India TV News)

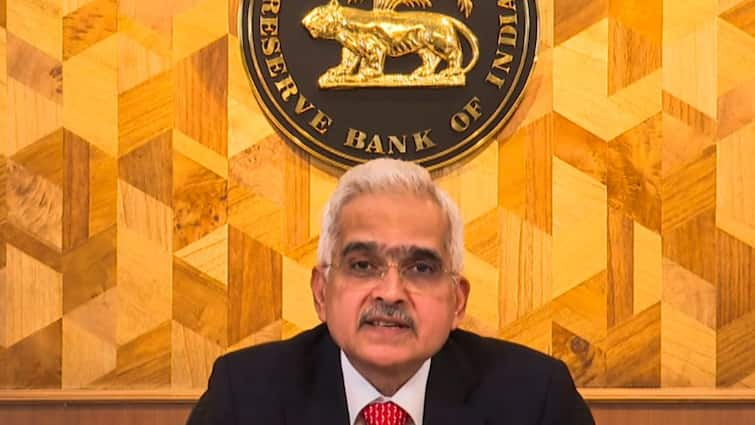

RBI to ensure mega bank mergers non-disruptive, central bank in discussion with govt: Shaktikanta Das

Firstpost

Five things to watch out for in Nirmala Sitharaman’s meeting with PSB heads

Live Mint

Nirmala Sitharaman to review bank merger preparedness amid strike call on Sept 26-27

India TV News

Nirmala Sitharaman 'clueless' in dealing with economic slowdown, steps to boost economy 'cosmetic': Congress

India TV News

Make or break: Why next 2 months will be crucial for Indian economy

India TodayWatch | Merger of public sector banks

The Hindu

Bank merger: Officers associations to meet in Delhi on September 5

India TV News

Opinion | Bank mergers are no silver bullet for India

Live Mint)

Public sector banks' merger to act as building block for $5 trillion economy target, says Finance Secretary Rajiv Kumar

Firstpost)

There will not be a single job loss due to merger of banks, assures Nirmala Sitharaman

Firstpost

Will bank mergers result in job losses? Nirmala Sitharaman rules it out

India TV News

Nirmala's big bank reform: Will it boost the economy?

India Today

Banks merger reflects govt resolve to address economic slowdown: India Inc

India TV News

What will change, what won’t for account holders as 10 PSU banks are merged into 4

Hindustan Times

PNB, Oriental Bank and United Bank to be merged: FM Nirmala Sitharaman

Hindustan Times

10 public sector banks to be merged into four

Live Mint)

FM Nirmala Sitharaman to address press conference at 4 pm today; likely to announce major plan for merger of PSU banks

Firstpost

Modi govt's mega bank merger drive: Now there will be only 12 PSU banks

India Today

Finance Minister Sitharaman gets thumbs up on steps to combat economic slowdown

India TV News

Finance Minister Nirmala Sitharaman combats slowdown

India Today

10 things to know from Nirmala Sitharaman's BIG push to economy

India TV News

Sitharaman's BIG announcement: Home, vehicle loans to become cheaper. Here's how

India TV News

Govt to upfront infuse Rs 70,000-cr capital into public sector banks: Nirmala Sitharaman

India TV News)

Govt, RBI on same page on steps to boost economy, will meet industry people from next week: Nirmala Sitharaman

Firstpost

Twitterati flood Nirmala Sitharaman with advice to rekindle economic growth

India TV News)

Why a trial by fire awaits Narendra Modi’s new finance minister, Nirmala Sitharaman

Firstpost

Markets surprised at Nirmala Sitharaman becoming Finance Minister

New Indian ExpressDiscover Related

)