Can reducing cess levies ease high fuel prices?

The HinduThe story so far: Ratings agency ICRA recently postulated that the government had room to cut cess levies on retail prices of petrol and diesel, thereby easing prices. Would a reduction in fuel cesses affect the government’s ability to pay interest and principal on oil bonds issued to public oil marketing companies as compensation for subsidies? The agency has estimated that the Centre needs ₹20,000 crore in the current financial year to service the interest and principal related to special oil bonds issued to oil marketing companies in the period 2005-2010. The MPC’s prescription to address this reads: “Excise duties, cess and taxes imposed by the Centre and States need to be adjusted in a coordinated manner to contain input cost pressures emanating from petrol and diesel prices.” Lower pump prices of the transport fuels would ease some pressure on retail inflation and thus allow the RBI a little more elbow room to continue to keep the cost of borrowings lower.

History of this topic

Congress asks the government why it can’t pass on the benefit of lower crude prices to consumer

The Hindu

Retail prices of petrol, diesel may not be cut due to volatile oil market

Hindustan Times

Centre pares windfall tax on crude, scraps petrol exports levy

The Hindu

Maharashtra to cut petrol prices by ₹5/ litre and diesel prices by ₹3/litre

Hindustan TimesData Point | Explaining India’s recent fuel tax cuts

The Hindu

Inflation May Cool Down By This Much Following Petrol, Diesel Excise Duty Cut; Know Details

News 18

India trims taxes on fuel, commodities to fight inflation

Al Jazeera

Many States reluctant to cut fuel tax

The Hindu

Excise cuts make fuel cheaper

Deccan Chronicle

Govt Reduces Excise Duty on Petrol by Rs 8 per Litre, Diesel by Rs 6; PM Says 'It's Always People First for Us'

News 18

Inflation impact: The falling mileage of paying for soaring fuel costs

The Hindu

The big picture on fuel taxation

Hindustan Times)

'Making gains by plundering poor': Congress slams Centre over fuel price hike

Firstpost

Why Indian govt may cut tax on petrol, diesel, according to Morgan Stanley

Live Mint

Fuel price cut in consonance with national mood

New Indian Express

Petrol, diesel price cut across country as Centre cuts excise duty, states reduce VAT. Details

India TV News

BJP Lauds Modi Govt's Cut in Petrol, Diesel Prices

News 18)

Cracking News: On eve of Diwali, Centre cuts excise duty on petrol by Rs 5, diesel Rs 10

Firstpost

Central govt slashes excise duty on petrol and diesel by Rs 5 and Rs 10

Op India

Petrol price cut by Rs 5, diesel by Rs 10 as govt slashes excise duty

India Today)

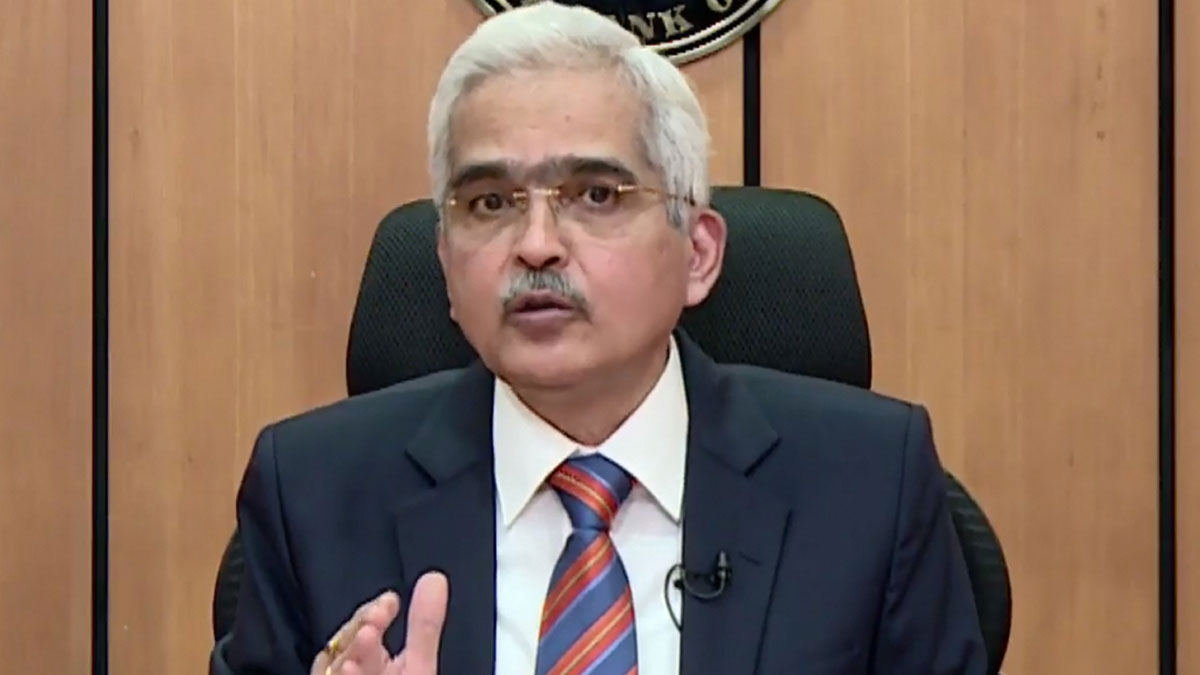

RBI Gov Shaktikanta Das flags concerns on high petrol taxes, says up to government to take further decision

Firstpost

Surprised that reducing tax on petrol had increased consumption, generating revenue for Centre: P Thiaga Rajan

India Today

Centre sensitive to fuel price hike, public to get relief in upcoming month: Union Petroleum Minister

India TV News)

Respite From Sky-High Petrol, Diesel Prices May be Far, Chief Economic Adviser Says Fuel Tax Cut Unlikely

News 18Centre can cut fuel cess by ₹4.5 per litre without revenue loss: ICRA

The Hindu

Fuel prices at record high: How it is impacting low-income households

India Today)

Reserve Bank of India Has A Suggestion to Tackle Rising Petrol, Diesel Price

News 18)

Petrol, Diesel Prices Slashed for the Second Time in 6 Days. Check Latest Rates in Metros

News 18

Need coordinated action between centre, states on tax reduction in fuel prices: RBI Governor

India TV News

For petrol, diesel price reduction, centre and state need to coordinate says RBI

Hindustan Times

Petrol touches ₹100/litre in some cities, here’s why it’s so costly

Live Mint

Explained: How higher petrol, diesel prices impact you

India Today

New cess on petrol and diesel: Will it effect fuel prices

Op India)

Rahul Gandhi slams Centre over fuel price hike, says Narendra Modi govt only 'busy collecting tax'

Firstpost

Petrol prices continue to scale higher, selling at record ₹84.70/litre in NCR

Live Mint

Explained: Why fuel prices are rising sharply in India

India Today

Fuel-tax hikes are putting brakes on India’s recovery

Live Mint

Centre insensitive to fuel prices hike: Congress

The Hindu

Fleecing fuel users: The Hindu Editorial on hike in petrol, diesel prices

The HinduDiscover Related

)

)

)