Foreign investors set to expand A-share play

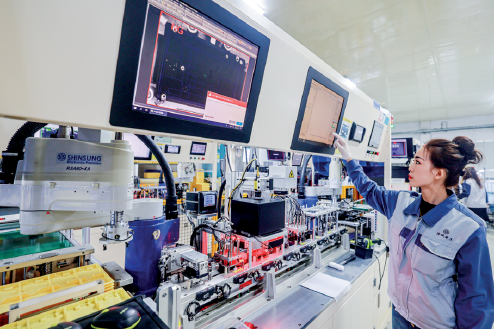

The IndependentThe Beijing Stock Exchange, which opened for business on November 15, 2021, has attracted the local capital markets’ spotlight that hitherto shone on bigger bourses such as the Shanghai Stock Exchange. The DBS management team said foreign investment banks are more experienced in seeking qualified foreign institutional investors or QFIIs, making more effective underwriting plans for issuers and attracting leading industry investors and strategic investors. Because UBS has received a licence to conduct secondary market brokerage businesses at the BSE, the firm would like to bring more overseas experiences to the Chinese market, said Eugene Qian, its chairman. Apart from bringing the experiences of exchanges from all over the world, JP Morgan will work to help companies float on the BSE and obtain refinancing, said Houston Huang, chief executive and head of investment banking at JP Morgan Securities Co Ltd. “We would like to introduce more institutional investors and overseas investors into the Chinese market, as JP Morgan has multiple channels and a rich client base,” Huang said. “It is our hope that this group of investors can take part in trading on the BSE via the QFII mechanism or other channels approved by regulators.” JP Morgan announced in early August that the China Securities Regulatory Commission has approved the registration of JP Morgan International Finance Ltd with 100 per cent ownership of JP Morgan Securities Co Ltd, making it the first foreign firm to fully own a securities venture in China.

History of this topic

Foreign financial firms beef up China investment

China Daily

Foreign financial firms beef up China investment

China Daily

Foreign financial firms beef up China investment

China Daily

Financial giants to further tap A shares

China DailyDiscover Related

)