Lok Sabha Passes Finance Bill 2021

Live LawThe Lok Sabha on Tuesday passed the Finance Bill, 2021 to give effect to the financial proposals of the Central Government for the financial year 2021-2022. Apart from the Finance Act, the Bill also proposes to amend the Income Tax Act, 1961; Life Insurance Corporation Act, 1956; the Securities Contracts Act, 1956; the Central Sales Tax Act, 1956; the SEBI Act, 1992; etc. As per the proposed Section 194P under the Income Tax Act, such senior citizen must be a resident of India having income of the nature of pension and no other income except interest received from any account maintained by such individual in the same specified bank in which he is receiving his pension income. Such senior citizen shall be required to furnish a Declaration to the Bank, which shall then, after giving effect to the deduction allowable under Chapter VI-A and rebate allowable under section 87A, compute the total income of such specified senior citizen for the relevant assessment year and deduct income-tax on such total income on the basis of the rates in force. Faceless proceedings before Income Tax Appellate Tribunal The Income-tax Settlement Commission shall cease to operate with effect from 1st February, 2021.

History of this topic

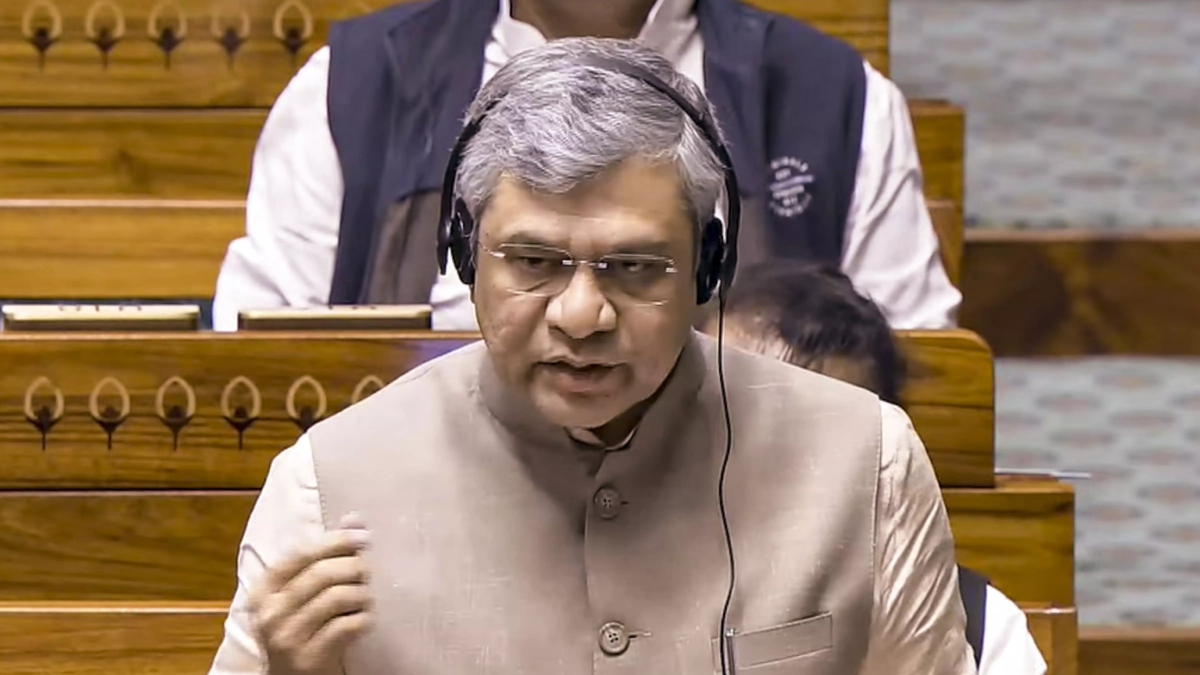

Parliament Winter Session 2024 highlights Day 14: MoS Nityanand Rai responds to discussion on Disaster Management (amendment) Bill in Lok Sabha

The Hindu

Nirmala Sitharaman reviews Income Tax Act 1961

Live Mint

Capital gains tax on real estate: Lok Sabha passes Finance Bill, amends LTCG tax provision on immovable properties

The Hindu

Parliament Monsoon Session: Lok Sabha passes Finance Bill 2024

India TV News

Lok Sabha passes Bill to allow government expenditure for FY 2024-25

The Hindu

The Hindu Morning Digest, December 21, 2023

The Hindu

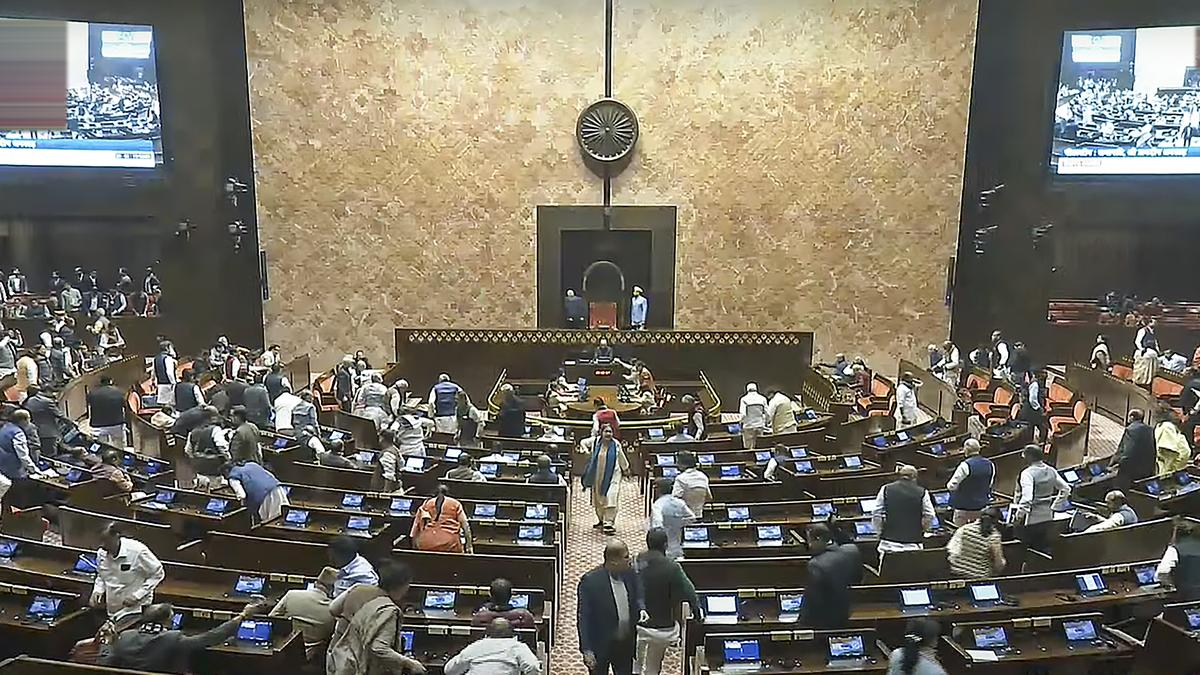

Parliament proceedings | Lok Sabha passes Bills to replace British-era criminal laws

The Hindu

Bill to ease setting up of GST tribunals

Live Mint

Parliament Winter Session Live Updates Day 7

The Hindu

Section 245C(5) Of Income Tax Act Is Read Down By Removing Retrospective Last Date Of 1st Feb 21 As 31st March 21: Madras High Court

Live Law

Lok Sabha Passes Competition (Amendment) Bill, 2022

Live LawLok Sabha passes Finance Bill 2023

Deccan Chronicle

Finance Bill 2023 was approved with amendments. Here are the highlights

The Hindu

Finance Bill 2023 passed in Lok Sabha with THESE major amendments. Details here

Live Mint

Bill Introduced In Lok Sabha To Repeal 65 Obsolete Laws Including One Enacted 135 Yrs Ago

Live Law

Lok Sabha updates | March 30, 2022

The Hindu

Lok Sabha passes Finance Bill

Deccan ChronicleParliament proceedings updates | August 10, 2021

The Hindu

India’s sovereign right to tax intact after amendment: FM

Live Mint

Rajya Sabha approves Tax Amendment bill to end retrospective taxation

Live Mint)

Centre introduces Bill in Lok Sabha to withdraw retrospective tax demands on Cairn, Vodafone

Firstpost

Govt amends Income Tax Act, retrospective tax rule junked

India TV News

BREAKING : Centre Introduces Taxation Laws Amendment Bill To Nullify Retrospective Tax Demand Provision Brought By Finance Act 2012

Live Law

Lok Sabha approves bill to abolish tribunals

Live Mint)

Income Tax, Corporate Tax, Merger of More Banks: Key Expectations from a 'Never Before' Budget 2021

News 18![Centre Notifies Bills To Relax Tax Filings; Allow RBI Supervision Over Cooperative Banks [Read Notifications]](https://www.livelaw.in/h-upload/2019/12/06/367638-ram-nath-kovind-04.jpg)

Centre Notifies Bills To Relax Tax Filings; Allow RBI Supervision Over Cooperative Banks [Read Notifications]

Live Law![Lok Sabha Clears Bill To Decriminalize Minor Procedural Offences/ Technical Lapses Under Companies Act 2013 [Read Bill]](https://www.livelaw.in/h-upload/2020/05/18/374972-companies-act-2013.jpg)

Lok Sabha Clears Bill To Decriminalize Minor Procedural Offences/ Technical Lapses Under Companies Act 2013 [Read Bill]

Live Law![Lok Sabha Clears Bill For RBI Supervision Of Cooperative Banks [Read Bill]](https://www.livelaw.in/h-upload/2019/11/27/367204-parliament-of-india.jpg)

Lok Sabha Clears Bill For RBI Supervision Of Cooperative Banks [Read Bill]

Live LawParliament proceedings Sept. 15 updates | Lok Sabha passes Essential Commodities (Amendment) Bill, 2020

The HinduDiscover Related

)

)

![IBC Weekly Round Up [2nd December To 8th December, 2024]](https://www.livelaw.in/h-upload/2024/08/01/552807-weekly-digest-of-ibc-cases.jpg)