)

No Change in Tax Structure a Sign of Swift Fiscal Consolidation: Budget 2021 gets a Thumbs Up From Industry Experts

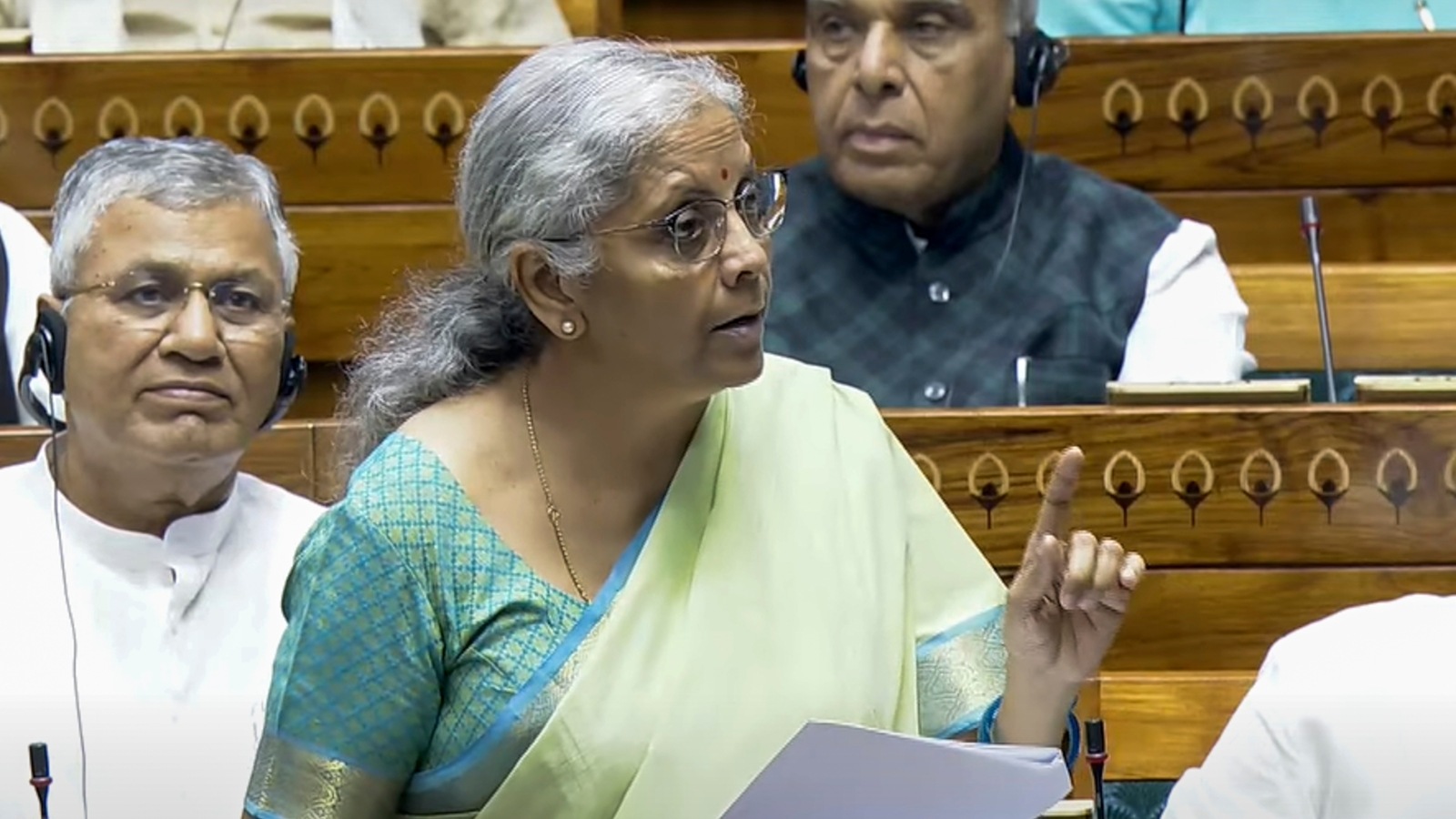

News 18Surprising everyone, especially the markets which closed with the biggest Budget-day gains of 5 per cent, the Union Budget 2021 left all taxes unchanged barring for some cess to fund the farm sector or increase any direct taxes. EY India’s Sudhir Kapadia said no major changes in the design or rates of direct taxation signals strong resolve to have stability in the tax regime. Sonu Iyer of EY India said the continued focus on making the lives of the taxpayers easy by measures like no tax return filing requirement for persons over 75 years and above earning only pension income, pre-filling of tax returns with capital gains and interest income details, and faceless tax assessments expanded to include tax tribunals and dispute resolution committee, among others, is very positive. Sitharaman said the Employee Provident Fund is aimed at the welfare of workers and any person earning less than Rs 2 lakh per month will not be affected by the Budget proposal. “In order to rationalise tax exemption for the income earned by high-income employees, it is proposed to restrict tax exemption for the interest income earned on the employees’ contribution to various provident funds to the annual contribution of Rs 2.5 lakh,” Sitharaman said in her Budget 2021-22 speech.

History of this topic

'Must Keep Tax Structure Simple to Expand Tax Base': Ex-NITI Aayog Vice-Chairman Rajiv Kumar's Lowdown Ahead of Budget 2024

News 18)

Union Budget 2021: Govt should introduce framework for fiscal consolidation of infra firms

Firstpost

Budget 2021: ’Tax payers hope no new tax as Covid Cess is introduced’

Live MintDiscover Related

)

)