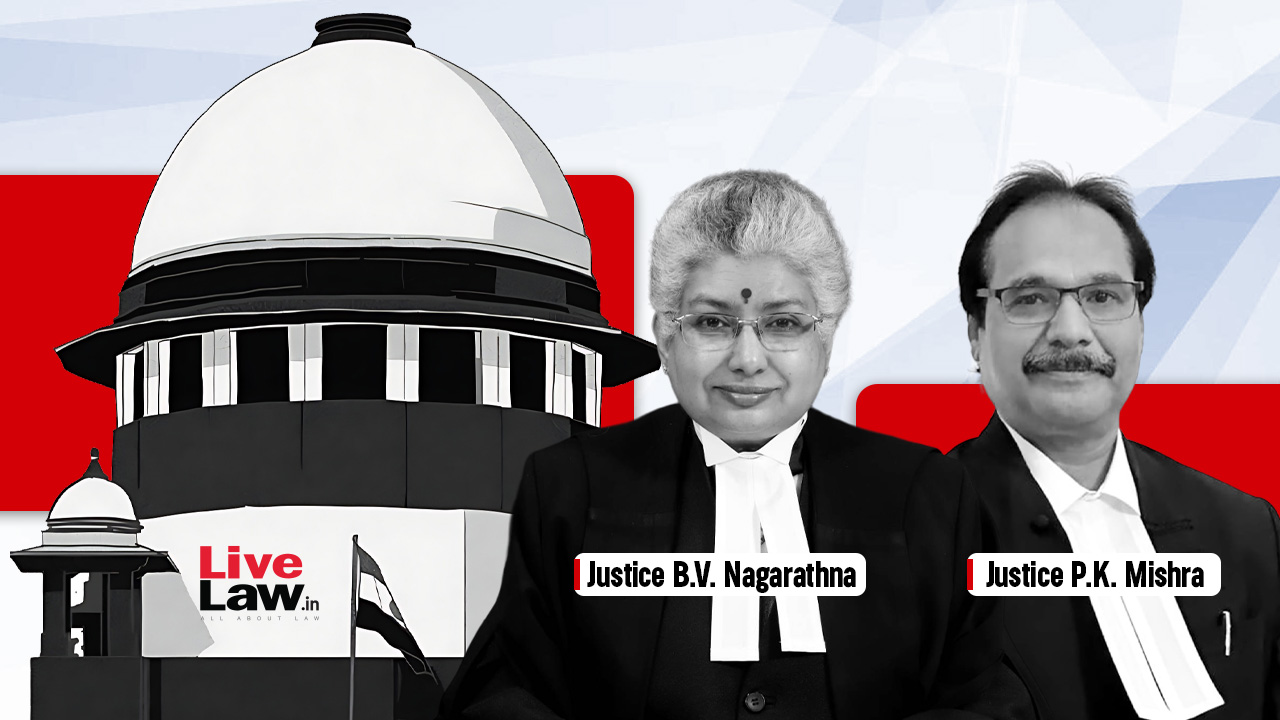

SC Refers To Winston Churchill's 'Unpaid Debt' To Bangalore Club In Wealth Tax Judgment

Live LawThe Supreme Court in its judgment delivered on Tuesday shared an interesting information about the connection between Bangalore Club and former Prime Minister of Great Britain, Winston Churchill. In the judgment delivered today, the Court held that 'Bangalore Club' is not liable to pay Wealth tax under the Wealth Tax Act. In 2013, in Bangalore Club v. CIT 5 SCC 509, the court had held that, for income tax purposes, the Bangalore Club is treated as an association of persons. We cannot accede to the argument that being taxed as an association of persons under the Income Tax Act, the Bangalore Club must be regarded to be an 'association of persons' for the purpose of a tax evasion provision in the Wealth Tax Act as opposed to a charging provision in the Income Tax Act, the bench said while allowing the appeal.

History of this topic

Discover Related

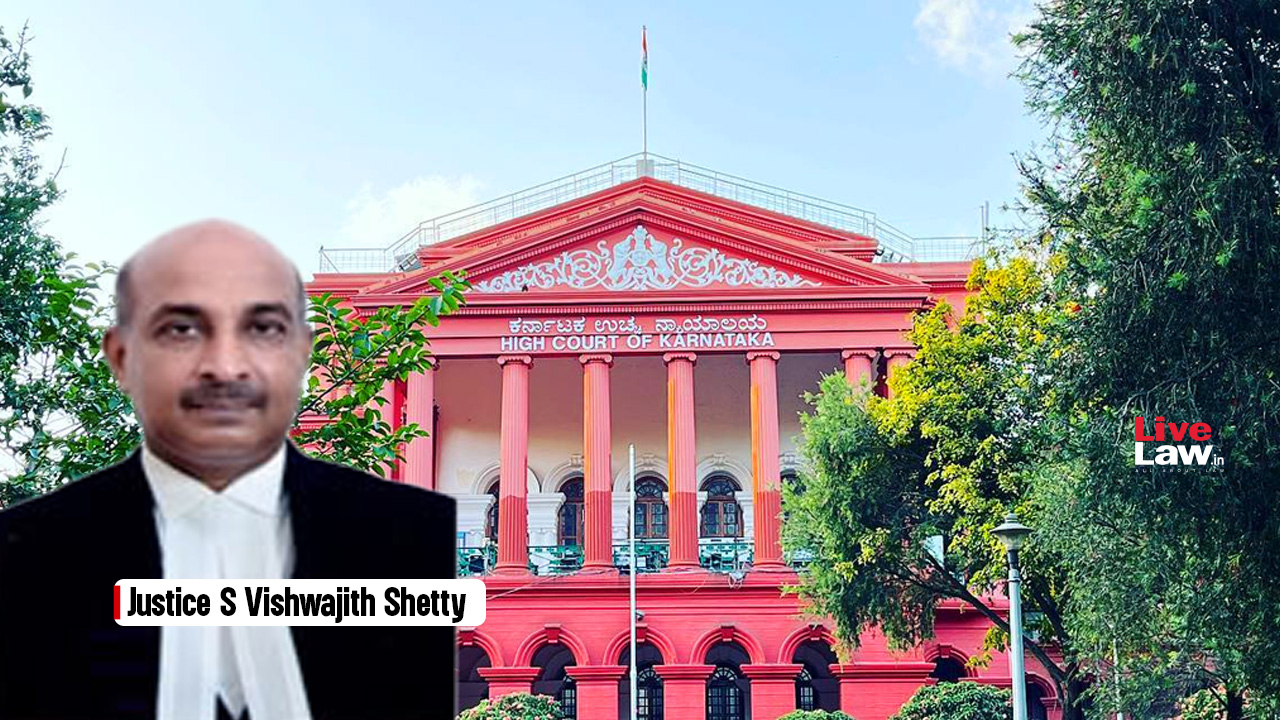

![[S.29 Karnataka Excise Act] Partnership Firm's Bar License Can Be Cancelled Over Unpaid Fees Following Change In Partners: High Court](https://www.livelaw.in/h-upload/2021/03/14/390554-karnataka-high-court-judgment-debtor-must-continue-to-pay-interest-until-compensation-is-settled-despite-court-deposit-during-appeal.jpg)

![Bangalore Club Not Liable To Pay Wealth Tax, Holds Supreme Court [Read Judgment]](https://www.livelaw.in/h-upload/2020/08/05/379504-justice-rf-nariman-justice-navin-sinha-justice-indira-banerjee.jpg)