Proposals relating to Capital gains in Finance Bill 2023

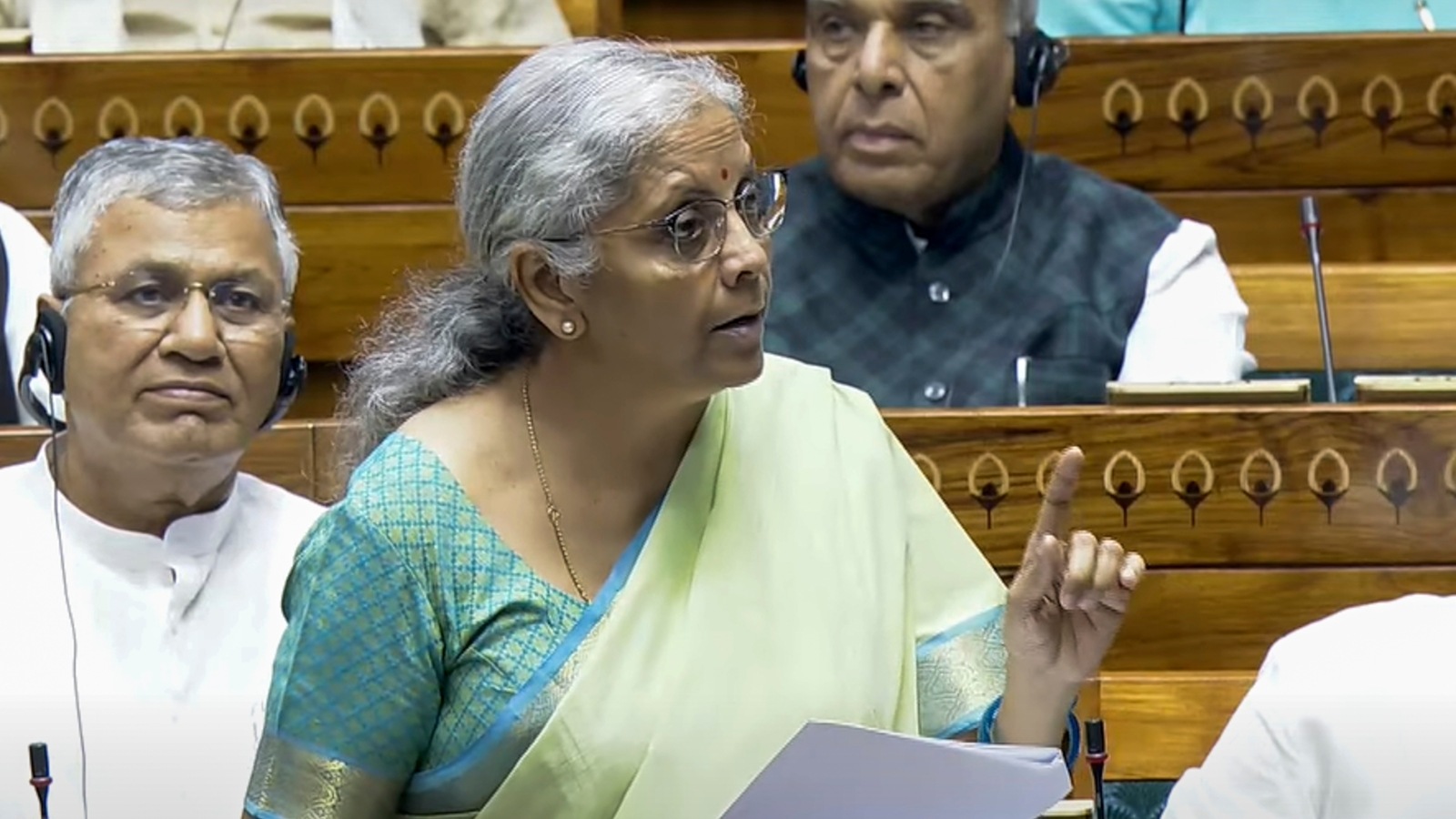

Live MintThe finance minister has proposed some provisions dealing with capital gains in the budget presented Wednesday. Cap on availing long term capital gains by Investment in a residential house Present Tax laws allow you exemption from long term capital gains if you invest in acquiring a residential house within specified time limits. Section 54 allows you exemption on long term capital gains on sale of a residential house if you invest the indexed long term capital gains for purchasing or constructing a resident house within specified time limits. Likewise, Section 54F allows you exemption from long term capital gains on sale of any asset other than a residential house if you invest the net consideration received to buy or construct a residential house within specified time limits. The finance minister has proposed that any profit made on market linked debentures shall be treated as short term capital gains irrespective of the holding period.

History of this topic

How much gold you can keep at home? Limits and income tax rules explained

Live Mint

Understanding capital gains tax exemption under Section 54

Business Standard)

Budget 2020: Income tax rules on gains from gold, property sale, stocks likely to change; tax treatment for LTCG may be revised

Firstpost

Three different routes to save tax on long-term capital gains

Live MintDiscover Related

)