)

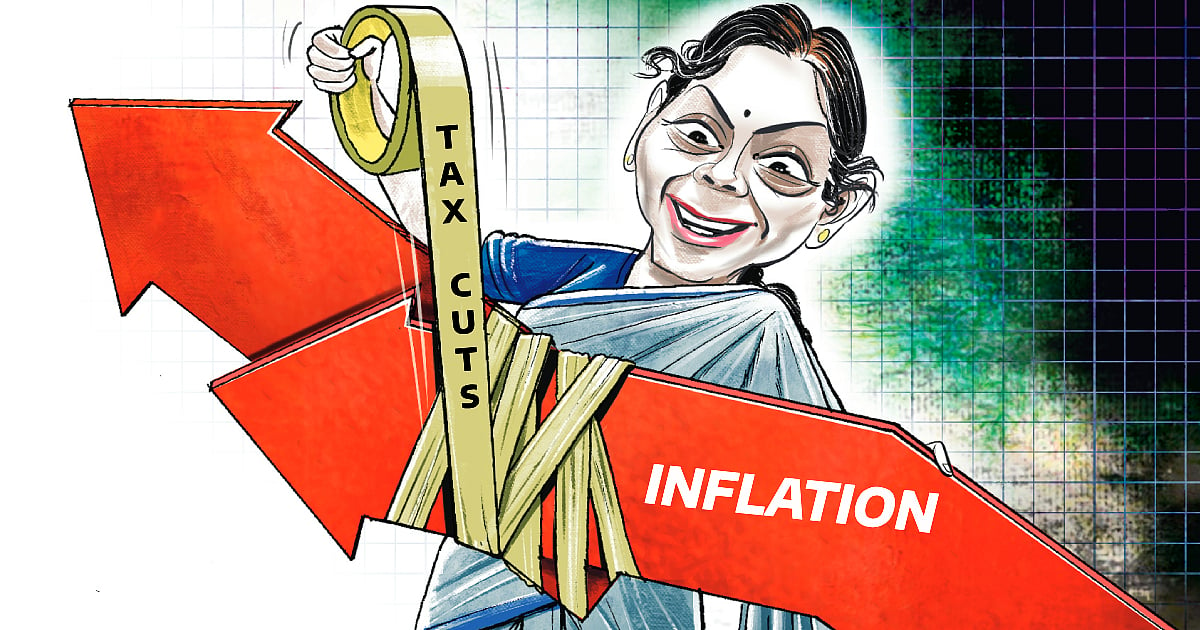

Hindustan Unilever pitches for reducing corporate tax rate; urges govt to relax local sourcing norms

FirstpostIn February this year, Finance Minister Arun Jaitley lowered corporate tax rate to 25 percent for businesses with turnover up to Rs 250 crore. New Delhi: Ahead of the Union Budget, FMCG major Hindustan Unilever CMD Sanjiv Mehta on Thursday pitched for reducing corporate tax rate and redressal of technical glitches and procedural matters of the goods and services tax. He said that the taxation burden for multi-national corporations can be reduced by “bringing down their corporate tax rate at par with the rate applicable in neighbouring countries”. “Certain restrictive clauses like sourcing norms have undermined the realisation of full benefits of the measure,” Mehta said, adding that there was a need for harmonisation of Indian standards in line with the global standards when it comes to the regulatory and policy environment in the context of MNCs.

History of this topic

Budget may make some announcements to enable Global Minimum Tax

Deccan Chronicle

India’s tax burden shifted from boardrooms to petrol pumps during Covid-19

Hindustan Times)

Income Tax Department notifies forms for firms to avail lower corporate tax rates announced in September last year

Firstpost

Corporate tax cut to mostly benefit less than 1% of companies: Economic Survey

Live MintIf India has to grow faster, States have to grow faster: Bibek Debroy

The Hindu

Rajya Sabha members uncertain over investments flow after corporate tax reduction

India TV News

Software, mining, books printing industry not qualify for 15% corporate tax cut: Nirmala Sitharman

Live Mint![Lok Sabha Passes Bill To Slash Corporate Tax Rates [Read Bill]](https://www.livelaw.in/h-upload/2019/01/08lok-sabha.jpg)

Lok Sabha Passes Bill To Slash Corporate Tax Rates [Read Bill]

Live Law

Under Modi, India is ‘red carpet society’: Sitharaman

The Hindu)

Companies opting for new lower corporate tax rate can't claim MAT credit, other deductions: CBDT

Firstpost

Corp tax cut may be the beginning of more reforms

Live Mint

Corporate tax cut makes India attractive destination for investment: Guv Das

Live Mint)

Corporate tax cut makes India an investment destination; to attract foreign firms to set up units: Nirmala Sitharaman

Firstpost)

Industry, stock market experts term Sitharaman's corporate tax cut 'revolutionary', say will make Indian firms globally competitive

Firstpost

To promote growth, just cut tax rates: Here is the likely impact of tax rates for corporates being slashed by the Modi govt

Op India

Corporate tax cut can translate into maximum of 5 per cent product price reduction, say industry veterans

India Today

A deep cut: On corporate tax cuts

The HinduThe Hindu Explains | What corporate tax cut means for the Indian economy

The Hindu

Corporate tax reliefs to spur growth, create jobs: India Inc

The Quint

Ravi Shankar Prasad asks electronics manufacturers to take full advantage of tax incentives

India TV News)

Corporate tax cut historic; govt leaving no stone unturned to make India a better place to do business: Narendra Modi

Firstpost

Reduction in corporation tax rate welcome, doubtful whether investment will revive: Jairam Ramesh

India TV News

Highlights of announcements on corporate tax and fiscal measures made by FM Nirmala Sitharaman

India TV News

7 key takeaways from Nirmala Sitharaman's just announced new taxation laws

India TV News

Govt cuts corporate tax rate to 22%, relief on buyback tax

Live Mint

Corporate tax rates slashed as govt announces ₹1.45 lakh crore stimulus

Live Mint

How Arun Jaitley steered landmark economic reforms

Live Mint)

Corporate tax for companies over Rs 400 cr to be cut gradually to 25%, says Nirmala Sitharaman

Firstpost

14% rise in revenues of 20 states after GST: Arun Jaitley

Live Mint)

Union Budget 2019: Finance Minister should consider bringing down corporate tax rate for all companies, irrespective of turnover

Firstpost)

Income Tax Department proposes new norms for taxing MNCs in India; invites comments from stakeholders

Firstpost

Budget 2019: Cut in corporate tax, higher income tax threshold, PHD Chamber asks

Live Mint

Arun Jaitley moots the idea of ‘one nation, one tax’

Live Mint

Govt says no scope for corporate tax cut in near future

Live Mint

Corporate Tax to be Cut Only When Exemptions End: Arun Jaitley

India TV NewsDiscover Related