Here’s a look at Income Tax changes impacting homebuyers from April 1

Hindustan TimesBudget 2025 had some good news for homeowners and homebuyers. If a homeowner does not occupy the property for specific reasons, i.e., due to employment or business or profession carried out at any other place, then the annual value of an additional property so occupied is also considered as NIL as per Budget 2025, which was not the case earlier,” says Hemal Mehta, Partner, Deloitte India. It will effectively let homeowners own two self-occupied properties without any additional income tax under the heading ‘income from house property’. Proposed Amendment to Section 194-I of the Income-tax Act, 1961 As per the existing provisions of Section 194-I of the Income-tax Act, 1961, any person responsible for paying rent to a resident is required to deduct tax at source if the total rental payment exceeds ₹2,40,000 in a financial year. No Tax Up to An Income Of ₹ 12 lakh Since there will be no tax up to an income of ₹12 lakh as proposed in the budget, starting April 1, people who have a salaried income of ₹12 lakh will have an additional tax saving of ₹80,000 under the new tax regime.

History of this topic

Budget 2025: Good News for Homebuyers – Discover the Benefits

The Hindu

Tax Relief, Easier Regulations, And More Funds: How Budget 2025 Has Enhanced Affordable Housing

ABP News

Homeowners can now claim tax relief on two properties. Budget 2025 eases the tax burden

Hindustan TimesHow Union Budget 2025 could be a ‘game changer’ for Bengaluru's property market

Hindustan Times

Builders hail ₹15K cr fund for stalled projects, but feel Budget falls short of their expectation

Live Mint

Budget 2025: What is SWAMIH Fund 2 scheme, how will it benefit middle-class families?

Live Mint

Budget 2025: What is SWAMIH Fund 2 scheme, how will it benefit middle-class families?

Live MintWhat Budget 2025 means for homebuyers: More money in hand, sweetener on self-occupied properties to boost real estate

Hindustan Times

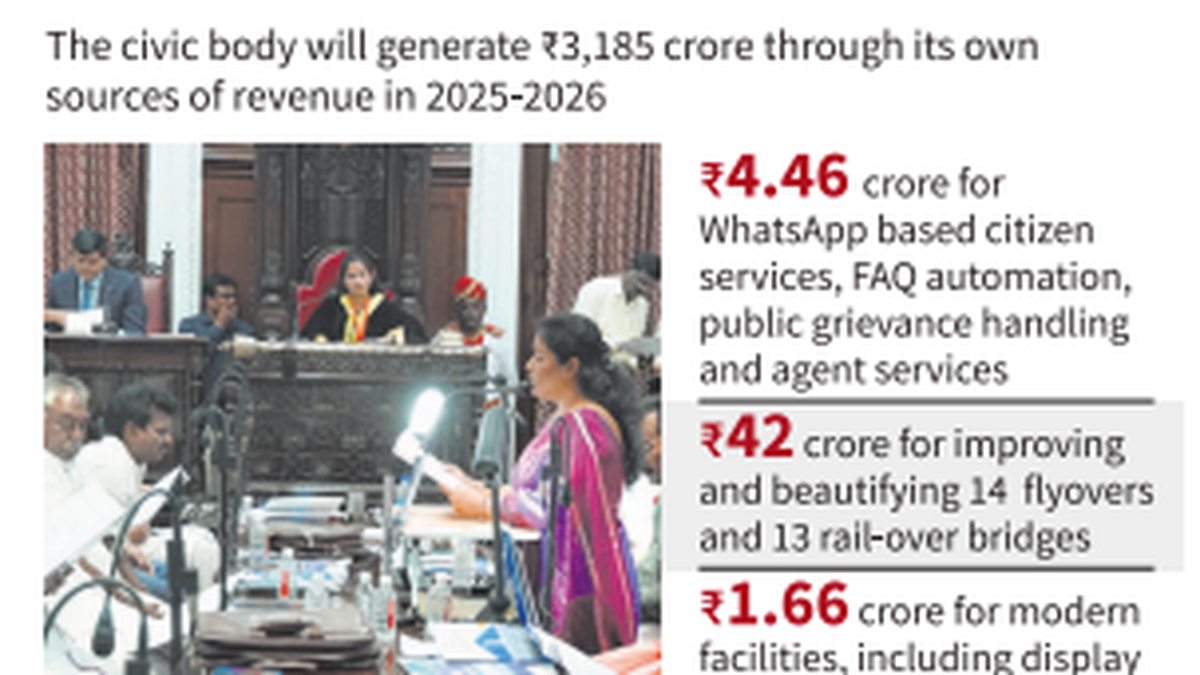

Budget 2025: Govt. announces ₹15,000 cr fund for stressed housing projects; framework to push GCCs in Tier 2 cities

Live Mint

Budget 2025: What homebuyers want from Finance Minister Nirmala Sitharaman

India TV News

Budget 2025: Will Budget 2025 fulfill the expectations of home buyers? Experts put these demands

India TV NewsBudget 2025 wishlist: This is what homebuyers look forward to from the finance minister

Hindustan Times

Budget 2025: From Infrastructure status to reforms in Affordable Housing, here’s what real estate sector demands

Live Mint

Budget 2024: 5 Things the real estate sector looks forward to from the finance minister

Hindustan Times

Maharashtra Budget 2024 allocates ₹7425 crore for construction of 35 lakh affordable homes

Hindustan Times

Real Estate Budget 2024: Focus on infrastructure, new housing scheme for the middle class

Hindustan Times

Budget 2024: New housing scheme to be introduced for middle class

Op India

Real Estate Budget 2024: Govt to launch housing scheme for the middle class

Hindustan Times

Budget 2024-25:NAREDCO seeks funds for completing residential projects under GST

Live Mint

NAREDCO seeks ₹50,000 crore more under SWAMIH Fund in Budget 2024

Hindustan Times

SWAMIH fund completes over 20,000 homes since 2019. Know what's its purpose

Hindustan Times)

A Budget for All: Ahead of 2024 general elections, Modi sarkar gets it right

Firstpost

Budget 2023: Here’s what the real estate sector is expecting from FM Sitharaman

Hindustan Times

Budget 2023: Will FM Sitharaman Make Property Purchase Easier for Homebuyers?

News 18

Budget 2023: Real Estate Sector Seeks Higher Tax Exemption On Home Loan Interest From Govt

ABP News)

Budget 2022: Additional supply side reforms with higher incentives for home buyers can boost realty’s performance

Firstpost

Budget 2022: More Tax Benefits on Home Loans, Affordable Housing, Real Estate Changes to Expect

News 18)

Budget 2022: Cut in home loan interest rate, infra upgrades may make PM’s housing for all a reality

Firstpost

Union Budget 2022-23: What real estate sector, homebuyers expect from govt

India Today_1613986804832_1613986824966.jpg)

Budget 2021: What high-income earners need to know

Live Mint

‘Housing for all’ scheme gets ₹18,000 cr

Live Mint

Tax slabs for home buyers unchanged

India TV News)

Budget 2019: Aim at policies to reintroduce income tax deduction on principal and interest on a second home loan

Firstpost)

Budget 2017: Experts hail infrastructure status to affordable housing

FirstpostDiscover Related