)

Explained: How Union Budget has given India’s middle class much to rejoice

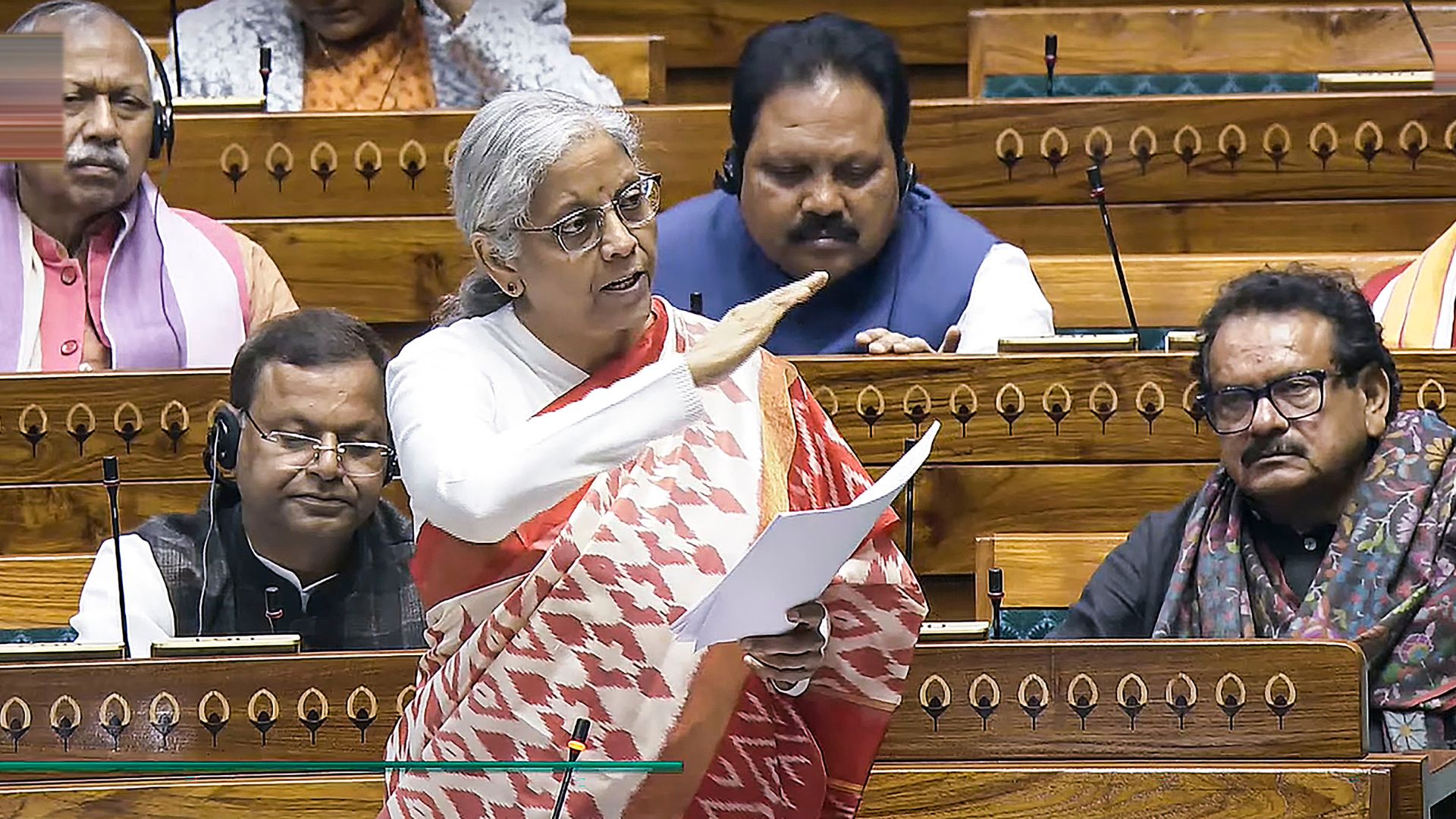

Firstpost‘Amrit Kaal’s first Budget’ has brought the much-awaited income tax reliefs for the country’s salaried middle class. In a much-awaited respite, the government increased the income tax rebate limit from Rs 5 lakh to Rs 7 lakh in the new tax regime. Here are the new tax rates under the new tax regime: For Rs 0-3 lakh income – nil For income above Rs 3 lakh and up to Rs 6 lakh – 5 per cent For income over Rs 6 lakh and up to Rs 9 lakh – 10 per cent For income above Rs 12 lakh and up to Rs 15 lakh – 20 per cent For income above Rs 15 lakh – 30 per cent Explaining the changes, the finance minister said: “An individual with an annual income of Rs 9 lakh will be required to pay only Rs 45,000. Similarly, an individual with an income of Rs 15 lakh would be required to pay only Rs 1.5 lakh or 10 per cent of his or her income, a reduction of 20 per cent from the existing liability of Rs 1,87,500.” Standard deduction extended The government has also extended the benefit of the standard deduction for the salaried class and the pensioners, including family pensions, in the new tax regime. Highest surcharge rate reduced The finance minister said India levies one of the highest tax rates on personal income which stands at 42.74 per cent.

History of this topic

)

Eyes on income tax, customs duty and capex reforms as Sitharaman begins Budget 2025 meetings

Firstpost

Tax action in the Union budget for 2025-26 could set the course for Viksit Bharat

Live Mint

Relief to middle class? Inflation offsets hike in tax exemption limit

New Indian Express

Nirmala Sitharaman said this to X user seeking relief for middle class

India Today)

State of income tax in India: Rich pay more, middle class less

Firstpost

Income tax share from below ₹10 lakh group shrinks over 10 years, high earners dominate

Live Mint

Can you expect major income tax changes in Budget 2025? Check details

India Today

Major income tax reforms in pipeline, Budget 2025 to ease filing process: Sources

India Today)

India is investing more in mutual fund SIPs, and paying more tax too

Firstpost

It is time India started indexing tax slabs and exemptions with inflation

Live Mint

Union Budget 2024 reforms of the new tax regime may reduce tax burden and allow option to choose again

Hindustan Times

New income tax regime: Check how much tax you will pay now

India Today

Middle class discontented, real estate sector applauds tax reforms

The Hindu

Budget 2024: The Indian middle class expected more

Hindustan Times

Income tax benefits, capital gains tax hike, cheaper phones | Key Budget takeaways

Hindustan Times

Budget 2024: How the changes in new tax regime will benefit the salaried, explained

Hindustan Times

Revised income tax slab rates, Budget 2024: Salaried individuals stand to save up to ₹17,500, standard deductions hiked

The Hindu)

Union Budget 2024: Should you pick new tax regime? How can you save Rs 17,500 in income tax every year?

Firstpost

Budget 2024: How the new tax regime announced by Sitharaman will impact taxpayers?

India TV News)

Calculation: Will you pay more income tax or less after Budget 2024 changes?

Firstpost

Old vs proposed income tax slabs under new regime. What has changed?

Hindustan Times

Budget 2024: Income tax slabs changed, standard deduction increased. Read details

Op India

Budget 2024 Highlights on income tax: FM Sitharaman revises personal income tax slabs; taxation rates remain unchanged

The Hindu

What Budget means for taxpayers: 10 points

Hindustan Times

FM Says Salaried Employees Under New Tax Regime To Save Rs 17,500 Annually, Here's How

News 18

Budget 2024 Boost To New Tax Regime: Standard Deduction Raised To Rs 75k From Rs 50k

News 18

Budget 2024: Will common man and salaried class get income tax relief? | Here's what we know

India TV News

Income Tax Budget Highlights: Govt proposes tax cuts, more standard deduction

Hindustan Times

New tax regime slabs revised, standard deduction hiked to Rs 75,000. Details here

India Today

Budget 2024 announcements on new tax regime: Standard deduction increased, check new tax slabs

India TV News

Budget 2024 HIGHLIGHTS: Andhra Pradesh, Bihar major gainers; special focus on jobs, new tax regime

India TV News

Budget 2024: Will FM Nirmala Sitharaman fulfill your income tax wishes?

India Today

Budget 2024: Will Nirmala Sitharaman bring cheer to middle-class with income tax changes?

Hindustan Times

Budget 2024: Taxpayers, you can expect these 6 income tax benefits on July 23

Hindustan Times

Budget 2024: This change to old income tax regime can provide relief to millions

India Today

Union Budget 2024: Will Nirmala Sitharaman bring income tax relief for middle class?

Hindustan Times

Tax reform imminent for fairer society and growth

China Daily

Tax reform imminent for fairer society and growth

China Daily

Budget 2024: Low-income individuals likely to get big tax relief, says report

India Today

Budget 2024: Finance minister Nirmala Sitharaman to increase income tax exemption limit?

Hindustan Times

Budget 2024: Exemption limit under new tax regime may be hiked to Rs 5 lakh, says report

India Today

Budget 2024: Which income categories can expect tax relief?

India Today

New Tax regime rules to come into effect from today: Check deductions, rebates, changes in tax slab

India TV News

Major Income Tax Reforms Effective From April 1: What You Need To Know

ABP News

Budget 2024: It’s tax buoyancy that shrank the deficit

Live Mint

Budget 2024: No change in direct taxes. What does it mean for India's middle class?

Hindustan Times

Income Tax Budget Highlights: Salaried class 'disappointed,' says this expert

Hindustan Times

Budget 2024: No change in tax regime this year; check old, new tax slabs

India TV News

Budget 2024: 6 key changes taxpayers want from FM Sitharaman

India Today

Budget 2024: Old vs new tax regime, which is better for salaried employees?

Hindustan TimesDiscover Related