Budget 2024: Income tax slabs changed, standard deduction increased. Read details

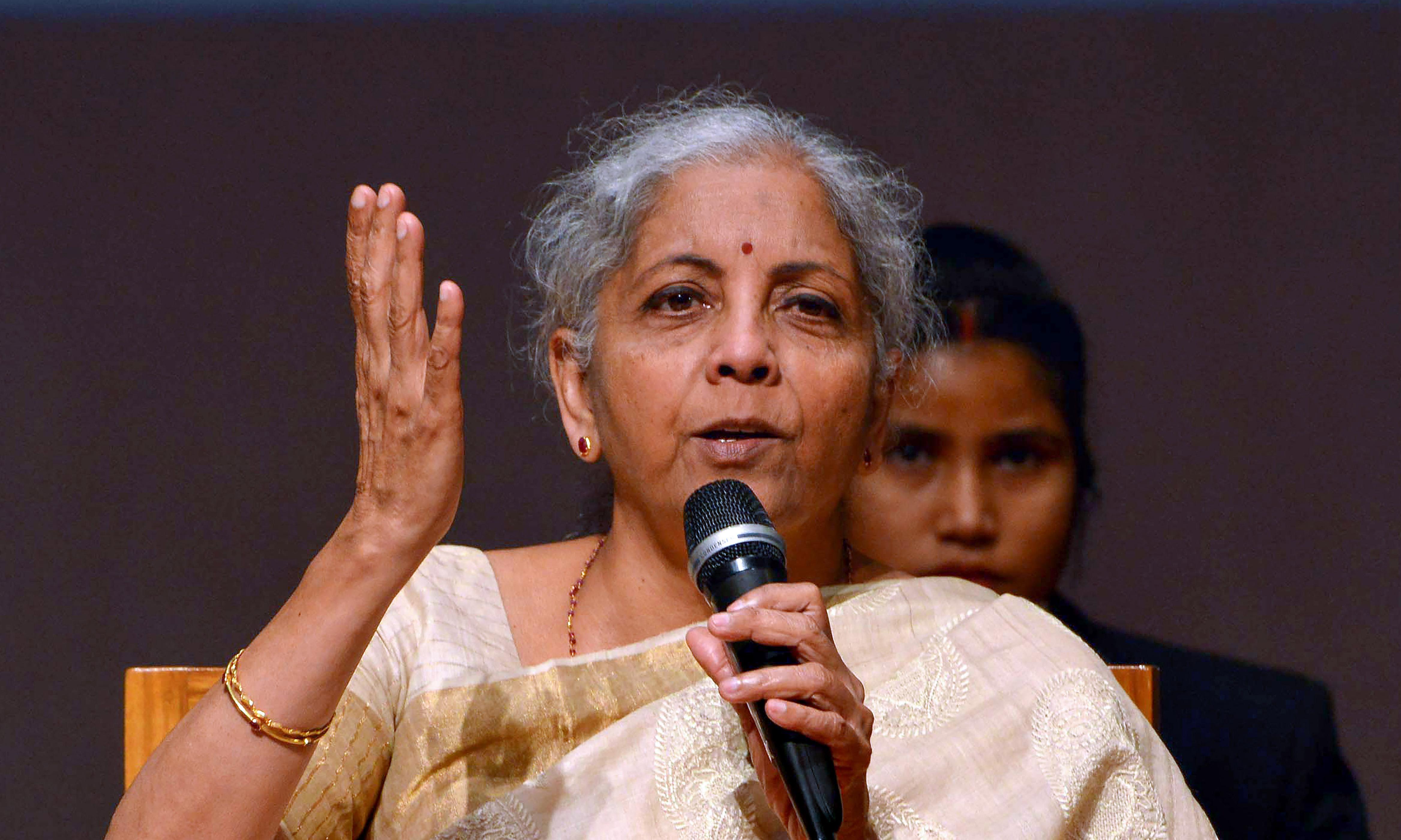

Op IndiaOn Tuesday, Finance Minister Nirmala Sitharaman presented the Annual Financial Statement before the Lok Sabha. The Finance Minister has given relief to taxpayers who choose to opt for the New Tax regime as the tax slabs have been revised and the Standard deduction limit has been increased from Rs 50,000 to Rs 75,000. Personal Income Tax: The Union Finance Minister made 2 announcements for those who adopt the new Tax regime. In the New Tax regime: The revised tax structure is – Rs 0-3 lakh – nil Rs 3 – 7 lakh – 5% Rs 7-10 lakh- 10% Rs10-12 lakh – 15% Rs 12-15 lakh – 20% Above Rs 15 lakh – 30% Under the Nex Tax regime, a salaried employee is expected to save up to Rs 17,500 in Income tax. #WATCH | On personal income tax rates in new tax regime, FM Sitharaman says, "Under new tax regime, tax rate structure to be revised as follows – Rs 0-Rs 3 lakh -Nil; Rs 3-7 lakh -5% ; Rs 7-10 lakh-10% ; Rs 10-12 lakh-15%; 12-15 lakh- 20% and above Rs 15 lakh-30%."

History of this topic

Only 6.68 pc of population filed income tax return in 2023-24 fiscal | DEATILS

India TV News)

Eyes on income tax, customs duty and capex reforms as Sitharaman begins Budget 2025 meetings

Firstpost

Tax action in the Union budget for 2025-26 could set the course for Viksit Bharat

Live Mint

India Expects to Surpass Rs 22 Lakh Cr Direct Tax Target

Deccan Chronicle

Relief to middle class? Inflation offsets hike in tax exemption limit

New Indian Express)

State of income tax in India: Rich pay more, middle class less

Firstpost

Income Tax Returns data shows that 5 times more people are earning over 50 lakhs per year since PM Modi came to power, pay over 75% of taxes

Op India

Income tax share from below ₹10 lakh group shrinks over 10 years, high earners dominate

Live Mint

Can you expect major income tax changes in Budget 2025? Check details

India Today

Major income tax reforms in pipeline, Budget 2025 to ease filing process: Sources

India Today)

India is investing more in mutual fund SIPs, and paying more tax too

Firstpost

Centre’s net direct-tax revenue grows 15.4% to ₹12.1 trillion in April-Nov

Live Mint

Education, welfare in focus of ₹2.94 lakh-cr Andhra budget

Hindustan Times

It is time India started indexing tax slabs and exemptions with inflation

Live Mint

India's Tax Filers Surge Fivefold, With 52% of Salaried Individuals Reporting Income Over Rs 1 Crore

ABP News

Income Tax Department Sees Doubled Number of Income Taxpayers in 10 Years

New Indian Express

Centre launches process to revamp income-tax regime

Hindustan Times

Net direct tax collection grows 22 per cent to Rs 6.93 lakh crore for current fiscal: Govt data

India TV News

Lok Sabha passes Bill to allow government expenditure for FY 2024-25

The Hindu

Tax defaults in India skyrocket by 1000% over last 10 years, litigations double: Report

Hindustan Times

Lok Sabha approves Union Budget 2024-25

India TV News

Budget 2024 is an exercise to simplify the tax regime - Revenue Secretary Sanjay Malhotra

Hindustan Times

Union Budget 2024: Political Uproar Expected in Parliament Today, Watch Video | ABP News

ABP News

Budget 2024: The government’s focus is on ease of paying taxes

The Hindu

Union Budget 2024 reforms of the new tax regime may reduce tax burden and allow option to choose again

Hindustan Times

Budget 2024: Is the new income tax regime beneficial for all salaried taxpayers?

Hindustan Times

Budget 2024: These 4 TDS changes announced by Nirmala Sitharaman will impact you

Hindustan Times

New income tax regime: Check how much tax you will pay now

India Today)

Budget 2024 creates a template for reforms in Modi 3.0

Firstpost

Budget 2024: Time to opt out of old tax regime? Explained

Hindustan Times

Budget 2024 | Old or new tax regime: Which will be more beneficial for you? Know here

India TV News

Mixed reactions to revised Income Tax rates, deductions in Andhra

New Indian Express

The rationale for the tax proposals

The Hindu

Budget 2024: The Indian middle class expected more

Hindustan Times

Income tax benefits, capital gains tax hike, cheaper phones | Key Budget takeaways

Hindustan Times

Budget 2024: How the changes in new tax regime will benefit the salaried, explained

Hindustan Times

Watch: Budget 2024 | What’s in it for markets and investors?

The Hindu

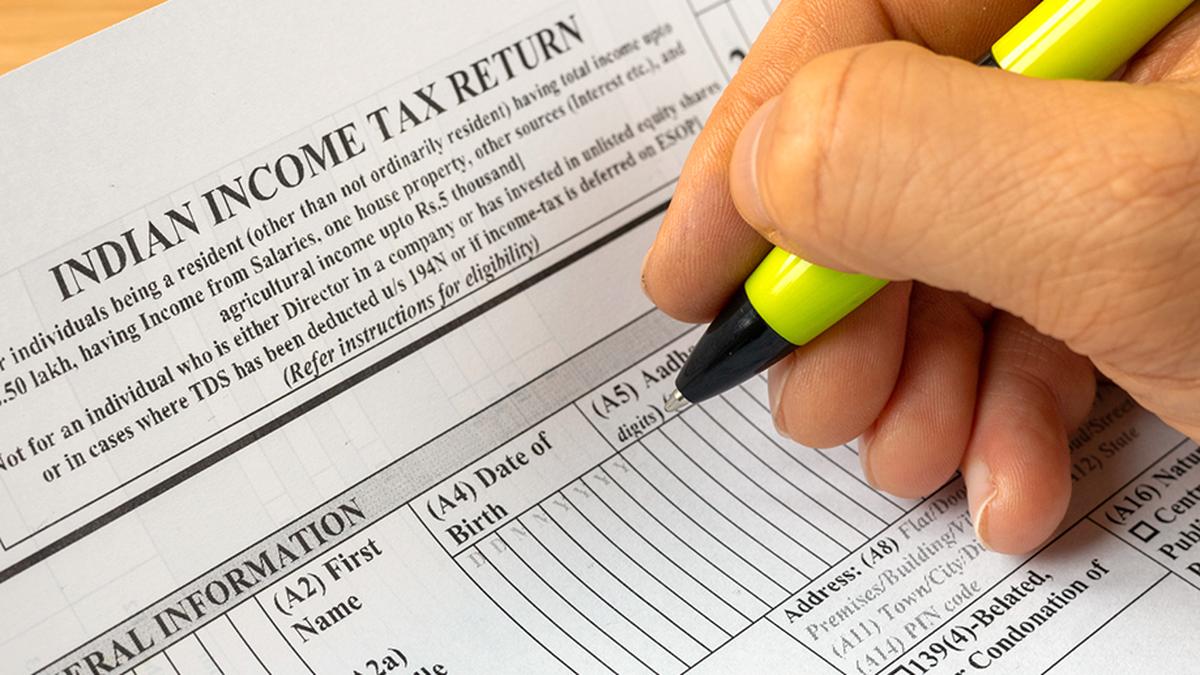

Revised income tax slab rates, Budget 2024: Salaried individuals stand to save up to ₹17,500, standard deductions hiked

The Hindu)

Union Budget 2024: Should you pick new tax regime? How can you save Rs 17,500 in income tax every year?

Firstpost

Government cuts borrowing target to ₹14.01 lakh crore for 2024-25

Hindustan Times

'EMPLOYMENT': Nirmala Sitharaman's acronym for Budget 2024 theme

India Today

Budget 2024: How the new tax regime announced by Sitharaman will impact taxpayers?

India TV News)

Calculation: Will you pay more income tax or less after Budget 2024 changes?

Firstpost

Budget 2024: How will it impact the common people and consumers? CHECK here

India TV News

Union Budget 2024: Where does Centre spend the most money?

Hindustan Times

Budget 2024 Capital Gains taxation: Corporate tax for foreign companies slashed to 35%, charities, cruise operations taxation revised

The Hindu

Afternoon briefing: New tax regime slabs revised in Budget 2024; IIT Delhi's submission to SC in NEET row; and more

Hindustan Times

Old vs proposed income tax slabs under new regime. What has changed?

Hindustan Times

Budget 2024: Modi govt reduces fiscal deficit target to 4.9 per cent of GDP for FY25

India TV NewsDiscover Related

)

)