)

Income Tax Department notifies forms for firms to avail lower corporate tax rates announced in September last year

FirstpostThe income tax department has notified forms for companies to avail the reduced corporate tax rates that were announced in September last year New Delhi: The income tax department has notified forms for companies to avail the reduced corporate tax rates that were announced in September last year. The Central Board of Direct Taxes has notified Forms 10-IC and 10-ID for existing companies that want to avail lower I-T rate and new manufacturing firms, respectively. In September 2019, the government announced a cut in base corporate tax for existing companies to 22 percent from the current 30 percent; and for new manufacturing firms, incorporated after 1 October, 2019, and starting operations before 31 March, 2023, to 15 percent from the current 25 percent. Similarly, Form 10-ID would be filed electronically by new domestic manufacturing companies, incorporated after 1 October, 2019 that wish to be taxed as per the new tax regime, that offers a concessional tax rate of 15 percent, provided all the incentives and exemptions are forgone by the companies.

History of this topic

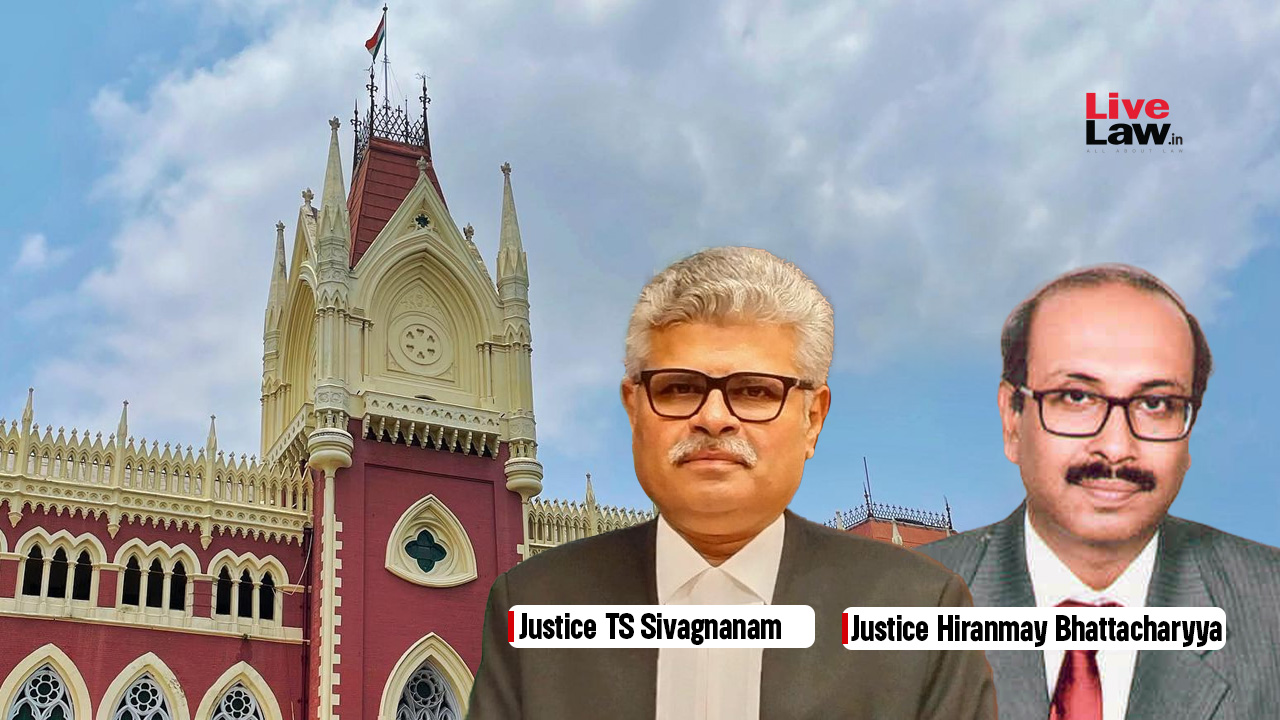

Direct Tax Cases Weekly Round-Up: 02 To 08 June 2024

Live Law

Direct Tax Cases Monthly Round Up: January 2024

Live Law

New I-T regime needs stability: CBDT chair

Live Mint

CBDT Notifies Rule 21AHA And Form 10-IFA For New Manufacturing Co-Operative Societies To Opt For 15% Concessional Tax Rate

Live Law

Tax Cases Weekly Round-Up: 28 May to 3 June, 2023

Live Law

Filing Of Form 10–IC Is Mandatory Condition To Claim The Benefit Of Reduced Corporate Tax Rate For The Domestic Companies: ITAT

Live Law

Collection Of Corporate Tax Rises By 16.73%, Income Tax By 32.30% Between April 1 To Oct 8: Finance Ministry

ABP News

Direct tax collection exceeds FY-21 estimate by 4.42% at ₹9.45 lakh crore

Hindustan Times)

Direct Tax Collection for Ongoing Financial Year Drops by 17.6% Till December 15: Report

News 18

Corporate tax cut to mostly benefit less than 1% of companies: Economic Survey

Live Mint)

Companies opting for new lower corporate tax rate can't claim MAT credit, other deductions: CBDT

Firstpost)

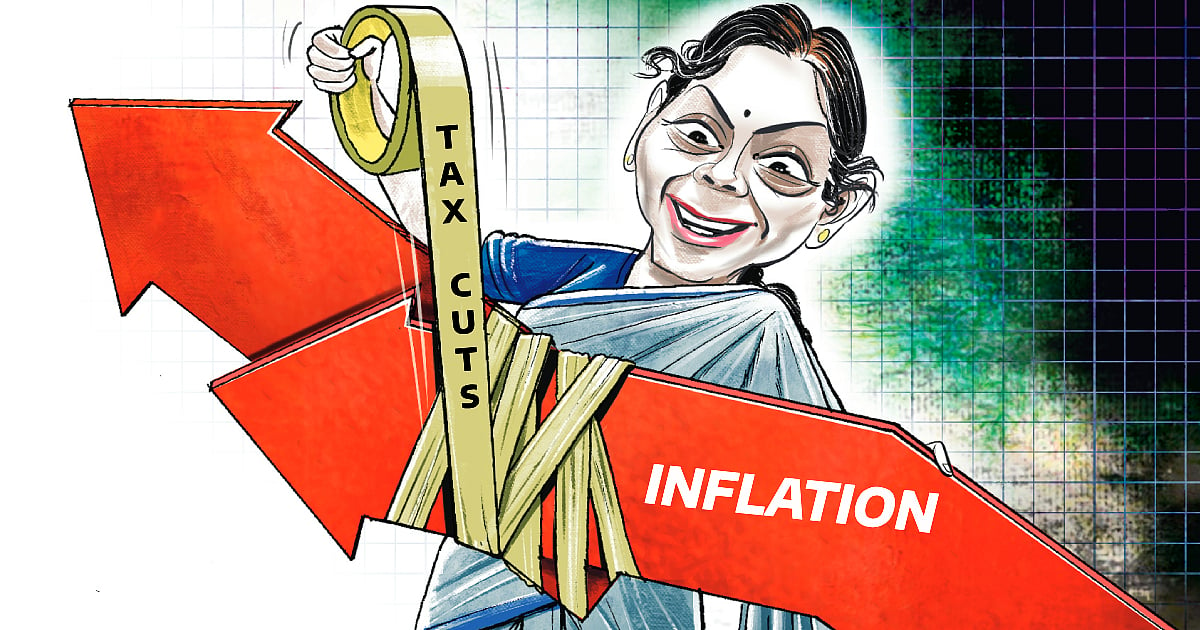

Corporate tax cut makes India an investment destination; to attract foreign firms to set up units: Nirmala Sitharaman

Firstpost

To promote growth, just cut tax rates: Here is the likely impact of tax rates for corporates being slashed by the Modi govt

Op India

Corporate tax reliefs to spur growth, create jobs: India Inc

The Quint

Reduction in corporation tax rate welcome, doubtful whether investment will revive: Jairam Ramesh

India TV News

Highlights of announcements on corporate tax and fiscal measures made by FM Nirmala Sitharaman

India TV News

7 key takeaways from Nirmala Sitharaman's just announced new taxation laws

India TV News

CII seeks doubling of I-T exemption, hike in 80C deductions

Live Mint)

Direct tax mop up rises 14.1% to Rs 8.74 lakh cr during Apr-Dec 2018; net collections increase by 13.6% to Rs 7.43 lakh cr

Firstpost)

Direct tax-GDP ratio of 5.98% during FY18 best in a decade; returns filings up 80% in last four years: Finance ministry

Firstpost)

Hindustan Unilever pitches for reducing corporate tax rate; urges govt to relax local sourcing norms

Firstpost

Govt says no scope for corporate tax cut in near future

Live Mint

Corporate Tax to be Cut Only When Exemptions End: Arun Jaitley

India TV NewsDiscover Related

)

![Tax Weekly Round-Up [23rd December - 29th December 2024]](https://www.livelaw.in/h-upload/2024/12/02/574161-tax-weekly-round-up.jpg)

![Tax Weekly Round-Up [16th December - 22nd December 2024]](https://www.livelaw.in/h-upload/2024/12/02/574161-tax-weekly-round-up.jpg)