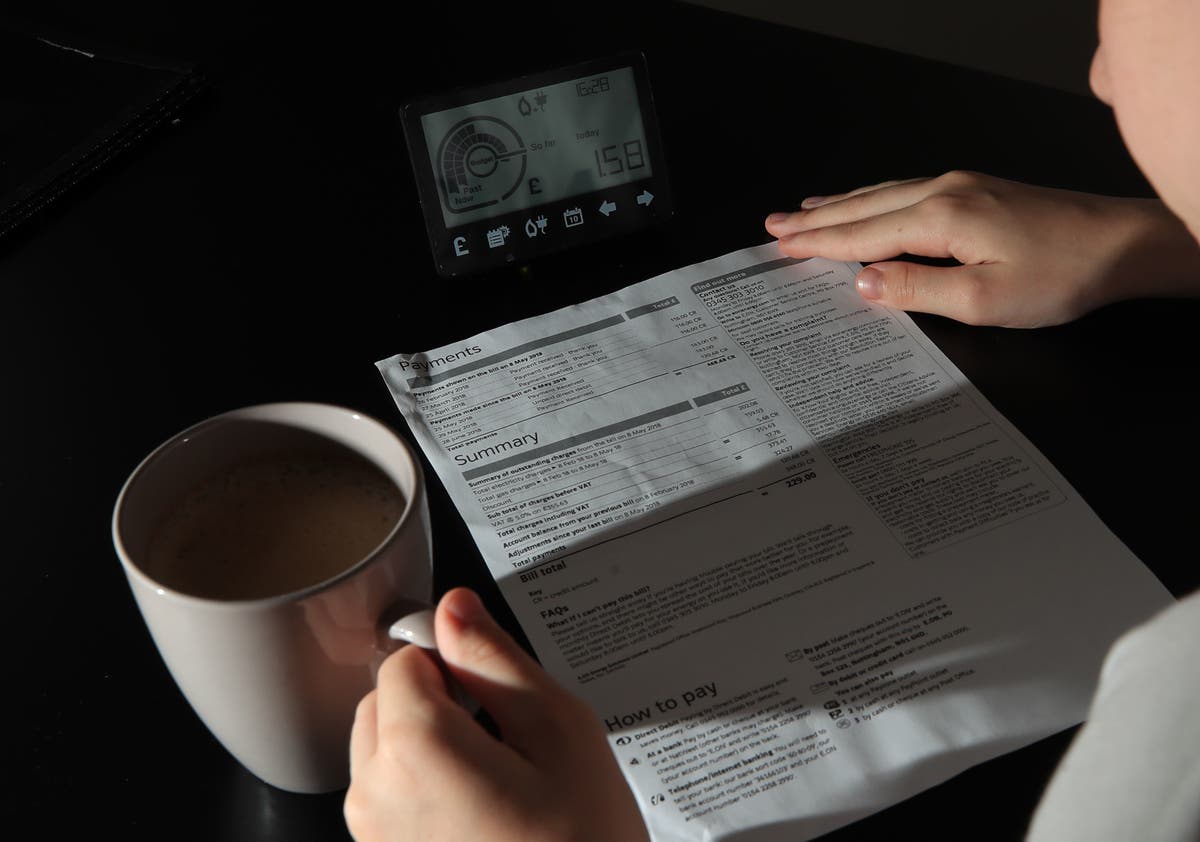

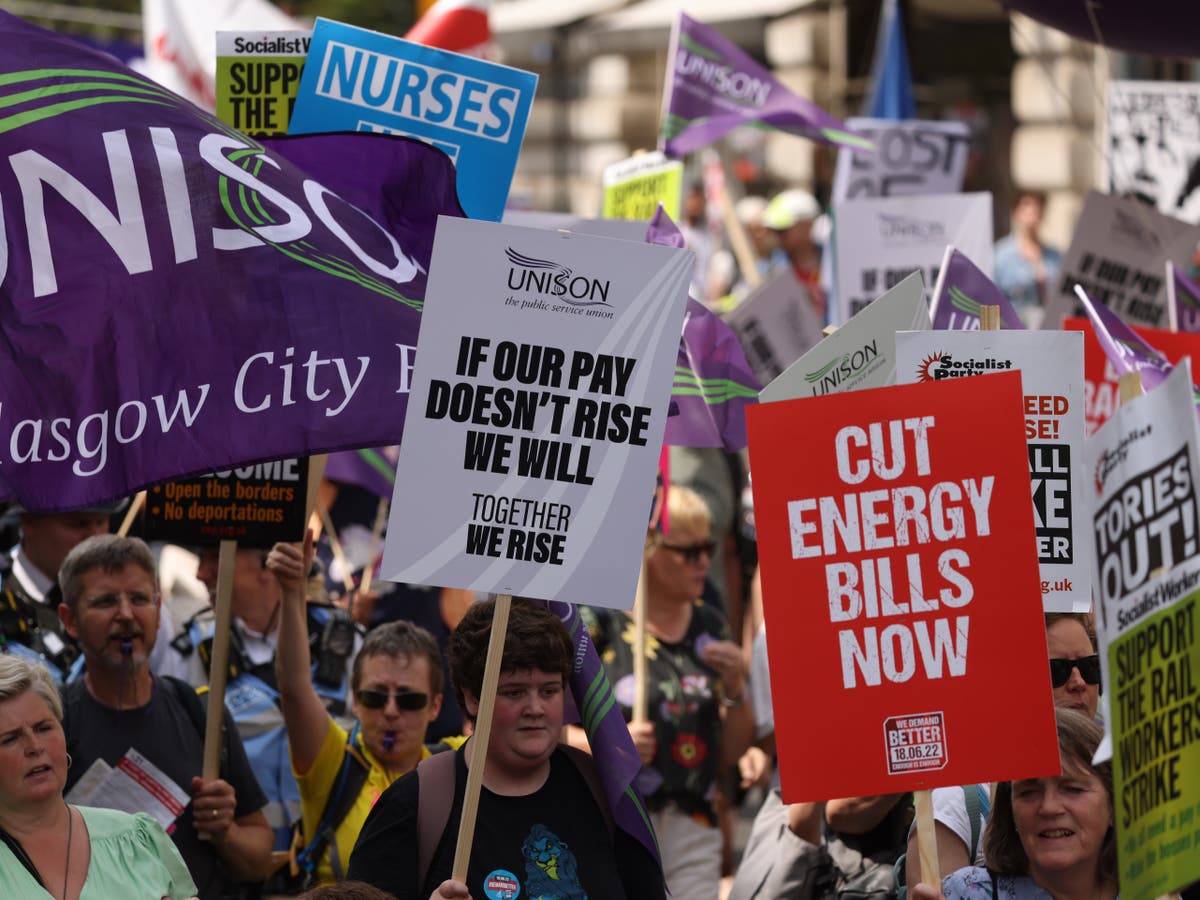

Household saving to fall by 71% to a weekly average of £26 as living costs soar

The IndependentFor free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails Sign up to our free breaking news emails Sign up to our free breaking news emails SIGN UP I would like to be emailed about offers, events and updates from The Independent. Read our privacy policy Household saving is expected to fall by 71% on last year to an average of £26 a week as inflationary pressures drastically reduce families’ ability to put money away, figures suggest. Not only are people going to be able to put away less money, but they may also have to rely on existing savings to maintain their normal standard of living Kevin Brown, Scottish Friendly Household saving soared during the pandemic and peaked in the first three months of 2021 with the average household saving £152 a week. Kevin Brown, savings specialist at Scottish Friendly, said: “Household savings are set to fall well below pre-pandemic levels in the second quarter of this year as Brits’ take-home pay drops and their outgoings rise. To make sure people keep more of what they earn we’ve cut the universal credit taper rate for lower income households, giving 1.7 million households an average extra £1,000 a year.

History of this topic

Poorest families left £600 a year worse off by ‘regressive’ Budget, economists warn

The Telegraph

One in 10 people has less than £25 left each month after bills, survey finds

The Independent

Households pull record £4.6bn in savings amid inflation squeeze

The Telegraph

Soaring inflation sees household incomes fall for record four quarters in a row

The Independent

Millions falling behind on bill payments as cost of living crisis mounts

The Independent

UK set for severe drop in living standards, as inflation curbs growth

The Independent

Households will have average of €40 a month less to spend in 2022

Dutch News

Households will have average of €40 a month less to spend in 2022

Dutch News

Families with children at home ‘face £1,000-a-year savings gap’

The IndependentDiscover Related