Lok Sabha passes Finance Bill, amends LTCG tax provision on immovable properties

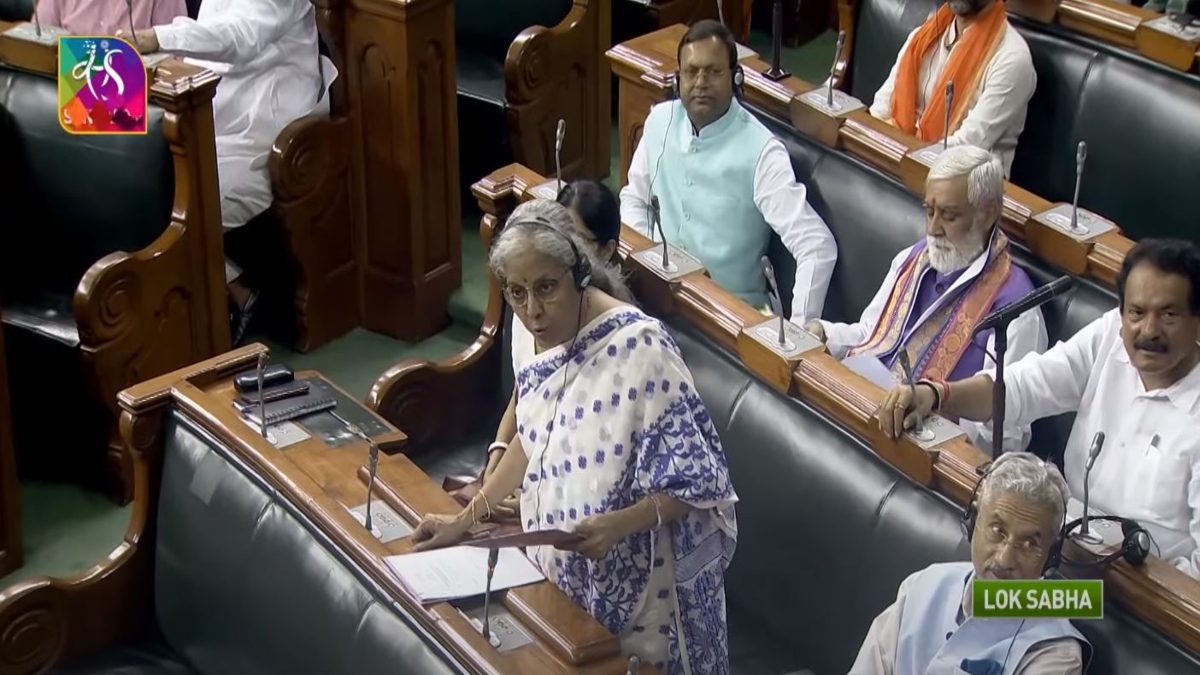

New Indian ExpressNEW DELHI: The Lok Sabha on Wednesday passed the Finance Bill 2024, after the government relaxed the just-introduced new capital gains tax on real estate, giving taxpayers the option to switch to a new lower tax rate or stay with the old regime that had a higher rate with indexation benefit. Finance Minister Nirmala Sitharaman, in her Budget for 2024–25, proposed to lower the long-term capital gains tax on real estate to 12.5 percent from 20 percent, but without the indexation benefit, moved an amendment to the bill to give the option. Now, individuals or HuFs who purchased houses before July 23, 2024, can opt to pay LTCG tax under the new scheme at the rate of 12.5 percent without indexation, or claim the indexation benefit and pay 20 percent tax. She said that the hike in tax exemption limit on long-term capital gains in listed equities and bonds to Rs 1.25 lakh from Rs 1 lakh will benefit the middle class investing in stock markets.

History of this topic

55th GST council meeting in Jaisalmer on December 21, 2024: Finance Minister Nirmala Sitharaman media briefing

The Hindu

Nirmala Sitharaman on LTCG amendment: 'We have courage to change'

Hindustan Times

Capital gains tax on real estate: Lok Sabha passes Finance Bill, amends LTCG tax provision on immovable properties

The Hindu

LTCG amendment: Experts cheer decision to restore indexation benefit for property. Why this govt move matters

Live Mint

Parliament Monsoon Session: Lok Sabha passes Finance Bill 2024

India TV News

Lok Sabha passes GST Bills to levy 28% tax on e-gaming, casinos

Hindustan Times

Parliament: Lok Sabha passes Bill to levy 28 pc tax on on e-gaming, casinos

India TV News

Levy Of GST On Mining Royalty And Allied Charges: Jharkhand High Court Grants Interim Protection

Live LawDiscover Related