AO Fails To Examine Relevant Material For Determining FMV Of Interest Rate For Availing Unsecured Loans: Mumbai ITAT Remits Matter

Live LawObserving that the relevant material for determining the fair market value of the interest rate for availing unsecured loans has not been examined, the Mumbai ITAT restored the issue of disallowance of excessive interest payment on unsecured loans to the file of AO for de novo adjudication. The AO however held that the average bank rates are 12% and therefore, rate of interest @18% paid by assessee to the related persons is unreasonable. The Bench accepted that the parties to whom assessee has paid interest are related parties within the meaning of section 40A, and the AO by considering the rate of interest @18% paid to related persons on unsecured loans as excessive, disallowed the interest paid in excess of 12%. In the present case, the Bench found that the AO by considering the average interest rates charged by the banks @12% treated the rate of interest @18% paid by the assessee to related persons as excessive and unreasonable u/s 40A of the Act.

History of this topic

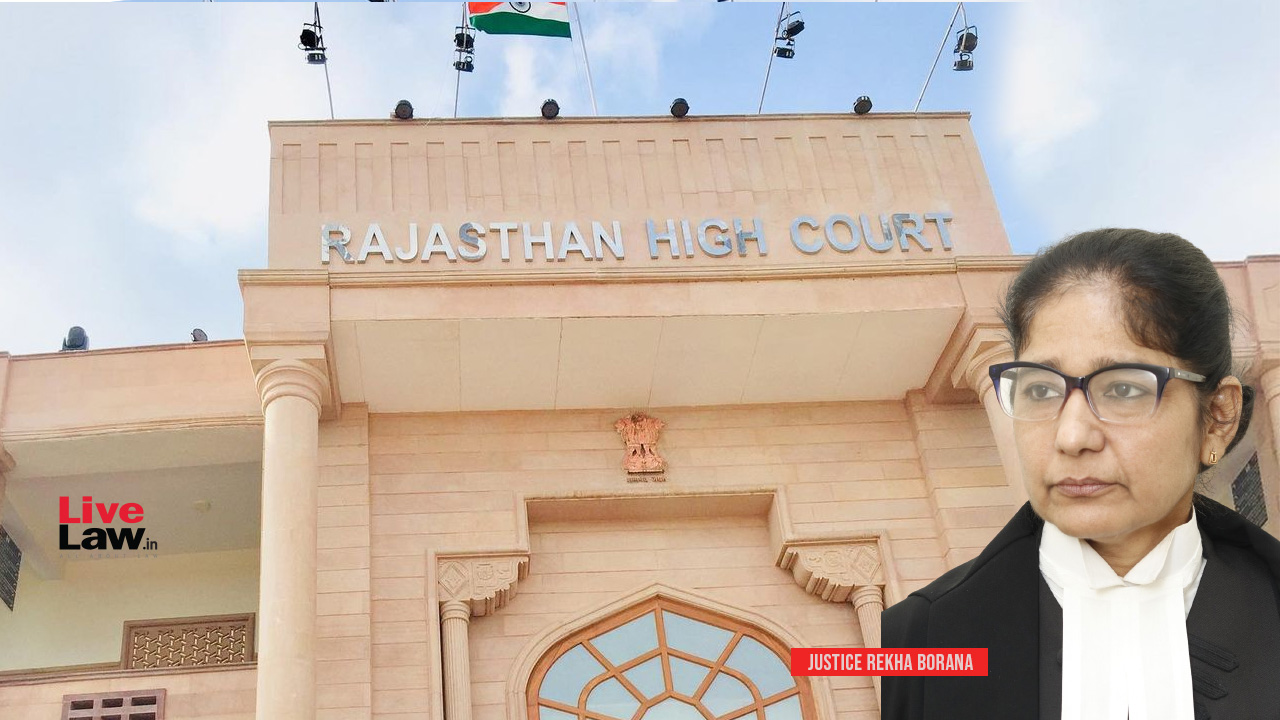

Arbitral Tribunal Imposing Exorbitant Interest Not Violative Of Fundamental Policy Of Indian Laws: Delhi High Court

Live Law

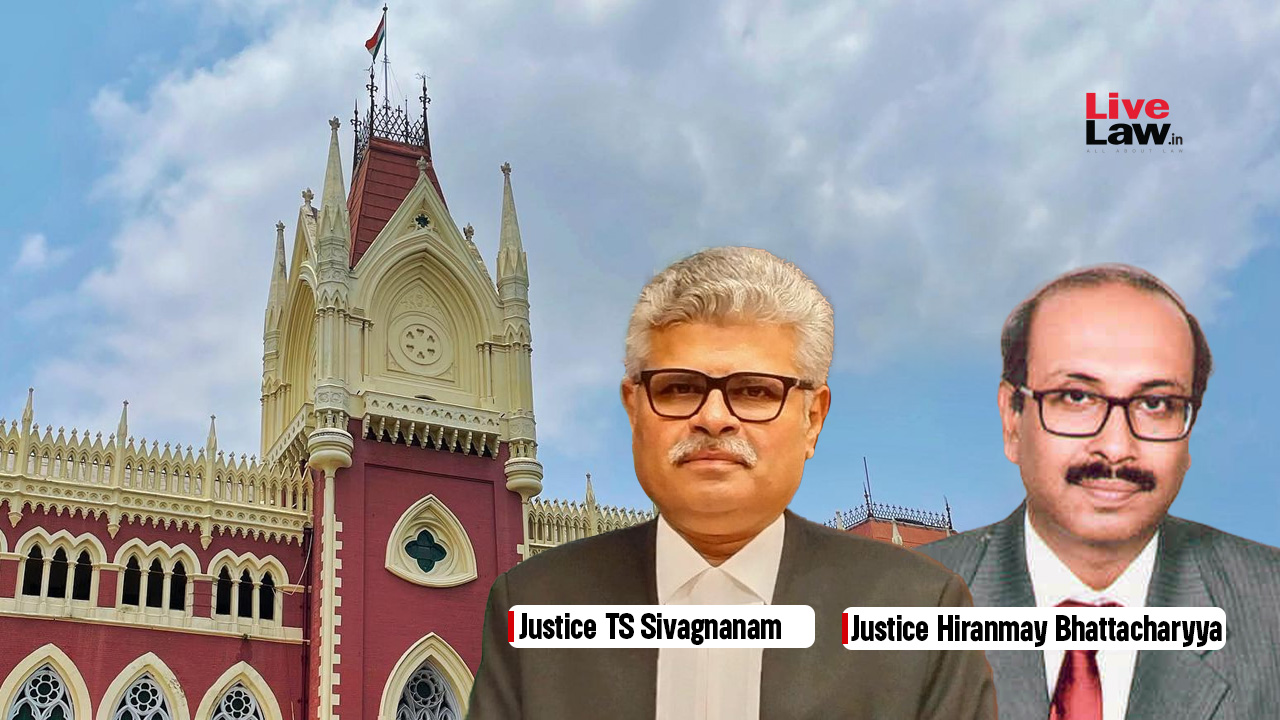

Once Cash Deposits In Bank A/C Of Lender Firm Is Accepted As Coming From Explained Sources, No addition Is Permitted U/s 68 As Unsecured Loan: Delhi ITAT

Live Law

Non-Existence Of Parties Who Gave Loan To Assessee Is Indication Of Its Prima Facie Bogus Nature: ITAT

Live Law

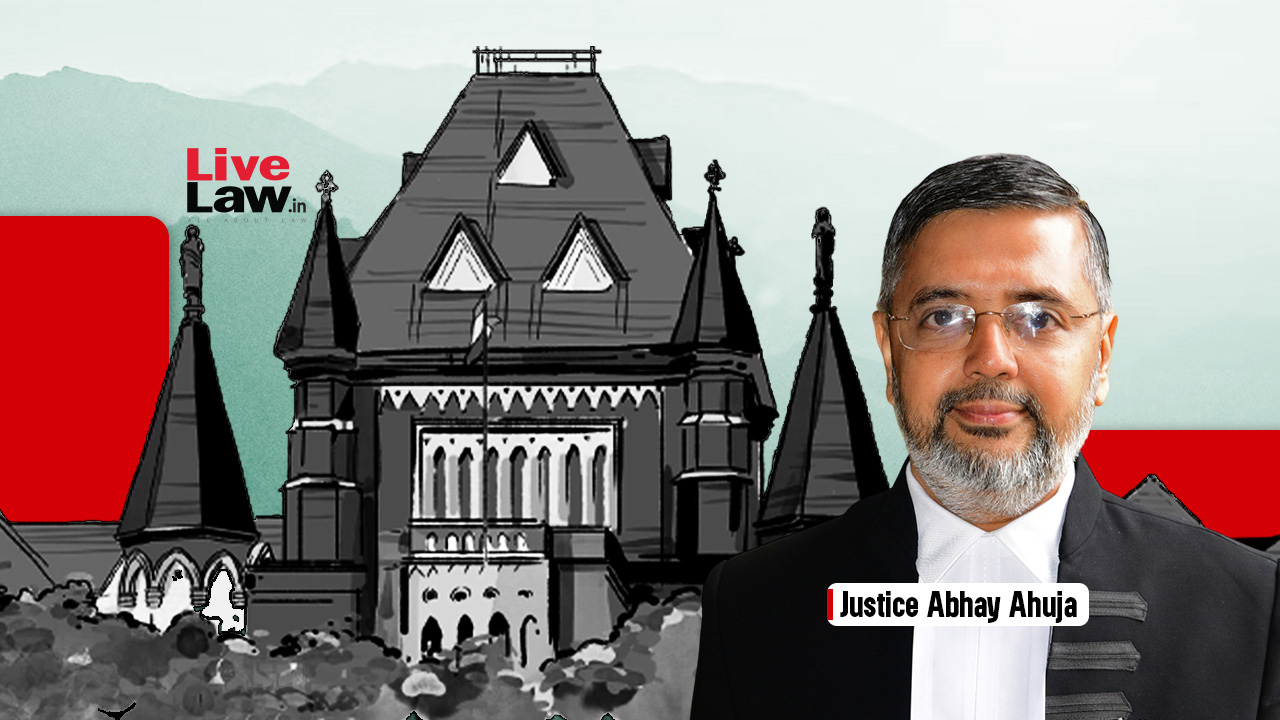

Rate Of Interest In A Contract May Be Modified By The Court On Equitable Grounds: Andhra Pradesh High Court

Live LawDiscover Related

![[Cheque Dishonour] Accused Often Get Away Due To Lack Of Evidence, Courts Must Acknowledge Friendly Cash Loans Between Parties: Delhi HC](https://www.livelaw.in/h-upload/2024/03/29/531055-750x450397355-cheque-book.jpg)