RBI must keep playing it safe

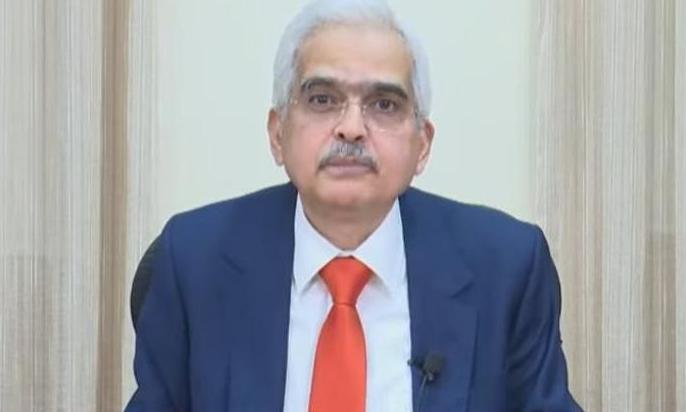

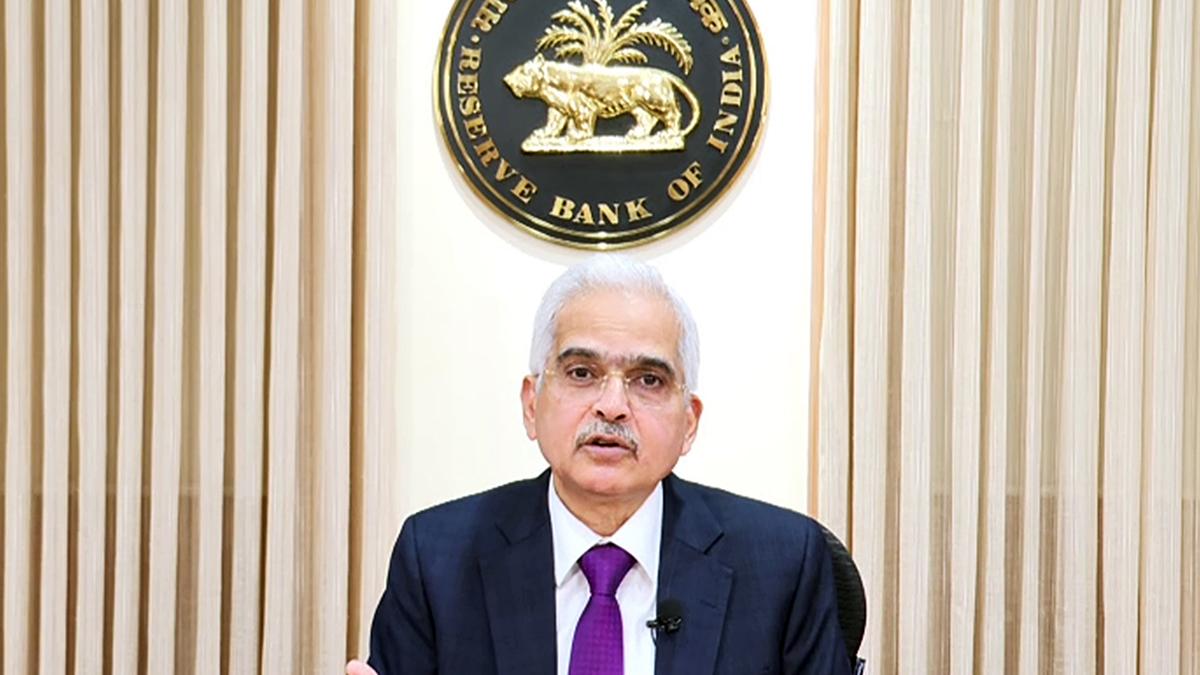

Hindustan TimesThe last three years have shown why fiscal and monetary policy have to remain conservative and nimble, and why policymakers themselves have to be resolute. Last week, the monetary policy committee of the Reserve Bank of India raised the interest rate by 0.35 percentage points to 6.25% and, according to its policy statement, “decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.” On Monday, data showed retail inflation in November cooling to 5.88%, the first time this calendar year that it came in under 6%, the upper band of RBI’s tolerance level, even as industrial output for October contracted by 4%, with manufacturing contracting 5.6%, and consumer-facing categories contracting by 13-15%. But a closer reading shows core inflation remains high, with food prices largely being responsible for the sharp dip in November inflation, both retail and wholesale. And as RBI governor Shaktikanta Das said while presenting the policy statement, “In a hostile international environment, the Indian economy remains resilient, drawing strength from its macroeconomic fundamentals …”. That, and the bank’s policy statement, which spoke of “firm” core inflation, presaged another interest rate increase, albeit a small one, in February – and Monday’s data has not done enough to change the outlook.

History of this topic

Vivek Kaul: RBI’s new governor will have to confront a tricky old trilemma

Live Mint

Growth slowdown: Why lay a deeper economic malaise at RBI’s door?

Live Mint

Why RBI is central to the country’s economy

New Indian Express

Mint Quick Edit: Lower inflation raises the likelihood of an RBI rate cut

Live Mint

DC Edit | FM, new RBI chief signal cut

Deccan Chronicle

Retail inflation eases to 5.48% in November from above 6% in October

India Today

Inflation likely eased to 5.5% in November: Mint poll

Live Mint

DC Edit | Will RBI tweak inflation focus?

Deccan Chronicle

Staying the course: On the RBI and inflation

The Hindu

RBI monetary policy decision: Is an RBI rate cut coming after Union Budget 2025? What experts suggest

Live Mint

RBI cuts GDP growth projection to 6.6%, repo rate unchanged at 6.5%

Deccan Chronicle

RBI monetary policy: MPC projects FY25 inflation at 4.8%

Live Mint

RBI Monetary Policy: Inflation remains a concern; FY25 growth estimates trimmed-5 key highlights from RBI MPC outcome

Live Mint

RBI to Announce Interest Rate Decision Amid High Inflation

Deccan Chronicle

RBI must restore balance between inflation, growth

New Indian Express

RBI keeps interest rate unchanged at 6.5%, lowers GDP projection to 6.6%, cuts CRR to 4%

New Indian Express

RBI keeps key lending rate unchanged at 6.5%, focus remains on tackling inflation

India Today

RBI cuts growth forecast to 6.6 per cent, revises inflation estimate to 4.8 per cent for FY25

India TV News

RBI must restore balance between inflation, growth

New Indian Express

RBI MPC meet: Growth needs a boost, but will inflation hold back rate cut?

India Today

Monetary policy review: RBI should stick to its price stability mandate

Live Mint

RBI MPC: FX, not inflation, curbing degrees of policy freedom

Live Mint

Monetary policy: Emotive choices and immediate response mechanism

Live Mint

RBI to keep repo rate unchanged at meeting next week, chances of rate cut in Feb increased: Report

Live Mint

Finance Ministry ‘cautiously optimistic’ on India’s economic outlook; geopolitical fragility remains a concern

Live Mint

India’s GDP growth estimated to decelerate to 6.3% in 2025, says Goldman Sachs; sees shallow RBI rate cut from Q1CY25

Live Mint

Stable Inflation Is Bedrock for Sustained Growth Says RBI Gov

Deccan Chronicle

Unchecked 'sticker shock' from inflation can hurt manufacturing and economy, RBI says

Hindustan Times

Inflation behaving more like a magician who tricks you again and again

New Indian Express

Indian Economy to Grow 7.2 Percent in 2024, Moody’s Forecasts

Deccan Chronicle

India Has Navigated Global Turbulence With Resilience Says RBI Governor

Deccan Chronicle

Mint Quick Edit | Inflation above 6%: There goes a December rate cut

Live Mint

India's Economy Shows Satisfactory Performance in First Half of FY25, But Risks from Geopolitical Conflicts and Global Factors

Hindustan Times

RBI Maintains Status Quo on Benchmark Rates, Emphasizes Price Stability

Live Mint

'We Still Have Distance To Cover', Says RBI Guv Shaktikanta Das Amid Moderate Inflation

News 18‘Abandoning RBI’s inflation target regime could be risky, counterproductive’

The Hindu

Can the Reserve Bank of India rein in food inflation?

Hindustan Times

RBI maintains calm against global noise

Live Mint

RBI MPC 2024: RBI can’t ignore food inflation while framing monetary policy: RBI Governor Shaktikanta Das

The Hindu

Core inflation at four-year low in FY24: Economic Survey

Hindustan Times

Explained: Why Economic Survey 2024 has taken a cautious stance

India Today

RBI MPC Meeting: Repo rate unchanged at 6.5% for 8th time in a row

The Hindu

RBI monetary policy: MPC keeps FY25 inflation forecast unchanged at 4.5%

Live Mint

Monetary policy: Things to watch out for in the coming months

Live Mint

Strong macroeconomic fundamentals will help growth: FM

Deccan Chronicle

What is the outlook on the global economy? | Explained

The Hindu

DC Edit | Cautious RBI targets inflation

Deccan Chronicle

Both dovish and hawkish

Hindustan Times

‘Elephant has gone for a walk’: RBI governor Shaktikanta Das on inflation after MPC meet

Hindustan Times

RBI MPC Keeps Repo Rate Same At 6.5% For 7th Time; FY25 GDP Pegged At 7%, CPI Inflation At 4.5%

News 18Discover Related

)