Landlords rush to incorporate their buy-to-lets to help 'shelter' from higher interest rates

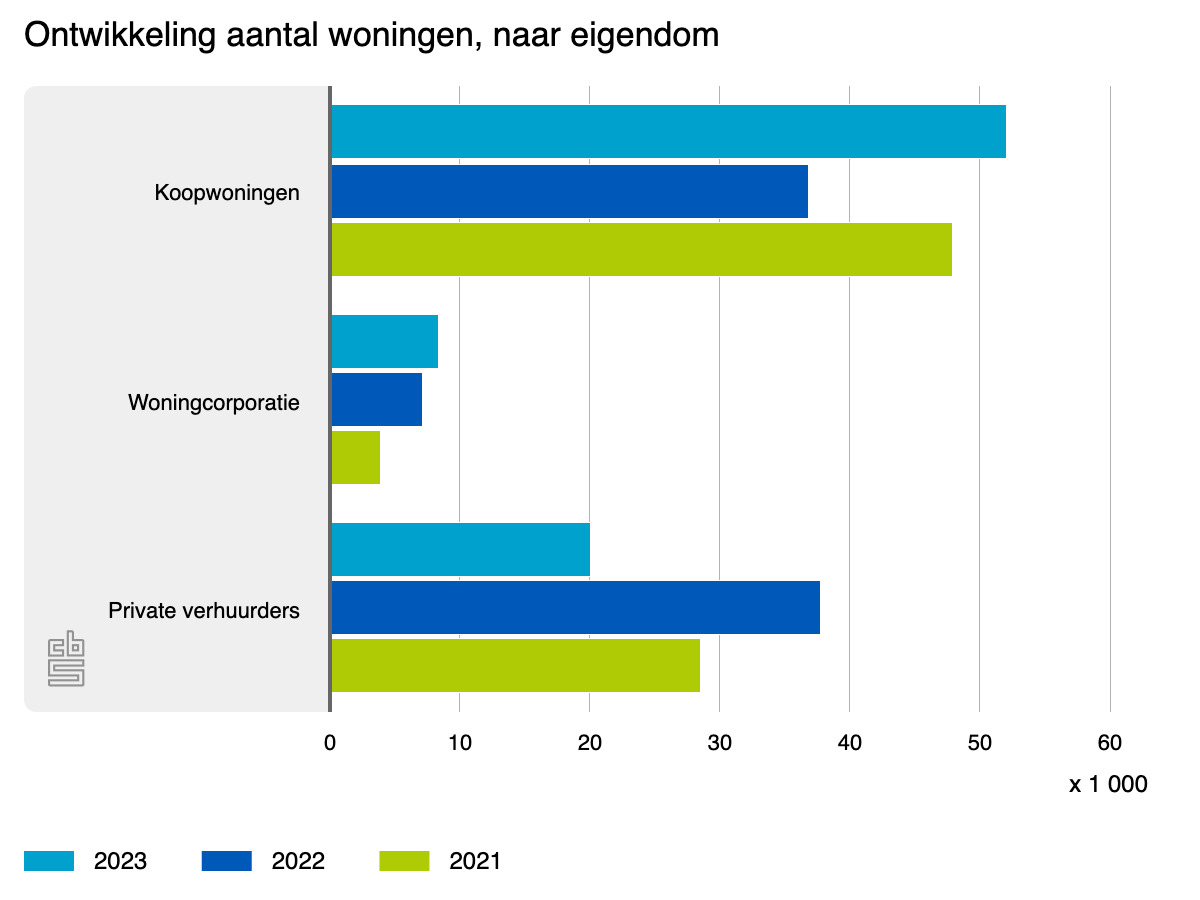

Daily MailLandlords have set up a record number of companies to hold buy-to-let properties as they seek to 'shelter themselves' from higher interest rates, new data reveals. Hamptons reveals the number of new UK limited companies set up to hold buy-to-let homes Aneisha Beveridge, of Hamptons, said that the current tax regime for landlords means more are looking to 'shelter themselves from higher interest rates' by buying their property through a company. Of the 615,077 limited company buy-to-let properties, 458,838 have a mortgage charge against them However, companies set up after 2016 still only own 38 per cent of all buy-to-lets held in a limited company. It means that limited companies set up to hold buy-to-let property now account for 24 per cent of all properties held in any sort of limited company structure, up from 16 per cent in 2016. Between 2016 and the end of 2023, the total number of properties owned by all limited companies, not just those set up to hold buy-to-let property, rose by 21 per cent.

History of this topic

Buy-to-let mortgage market shrinks for the first time in almost three decades

The TelegraphDiscover Related