ATM For Coins To Soon Become Reality? What We Know About RBI's Next Move

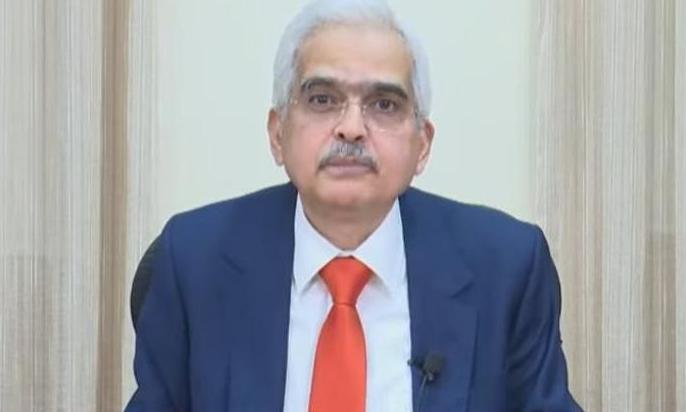

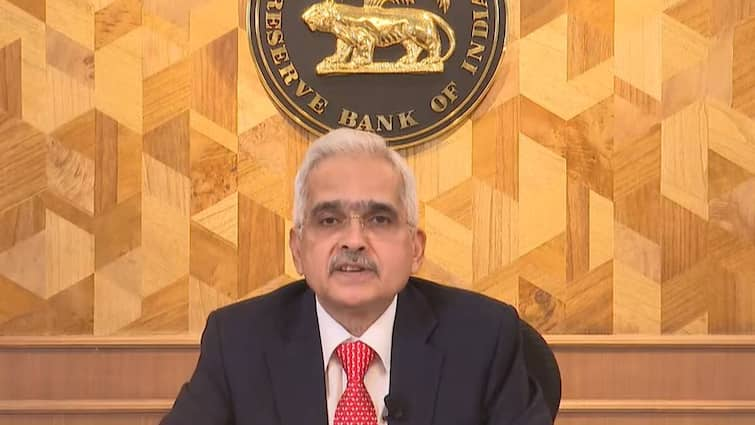

News 18The Reserve Bank Of India will launch a QR-based coin vending machine on a pilot basis. The decision was taken on February 8 when RBI Governor Shaktikanta Das announced 2023’s first Monetary Policy Committee. “The global economic outlook doesn’t look as grim now as it did a few months ago, growth prospects in major economies have improved while inflation is on a descent though inflation remains well above the target in major economies,” observed RBI Governor Shaktikanta Das. However, Mr Das observed that the Indian economy remains resilient amid volatile global developments and high investment activity in the country’s growth. Here are some key takeaways from the Monetary Policy Committee: The repo rate was raised by 25 basis points by RBI to 6.5% Inflation is predicted to average 5.6% in the fourth quarter of 2023–2024 and to remain above the 4% target throughout this year Real GDP growth is anticipated to be 6.4% between 2023 and 2024, with Q1 growth estimated to be 7.8%, Q2 at 6.2%, Q3 at 5.8% Expected rate of inflation for the current fiscal year 2022–2023 is 6.5% Expected CPI inflation rate for 2023–2024 is 5.3%, assuming a typical monsoon season RBI’s MPC voted in a 4:2 decision to continue concentrating on the cancellation of the accommodating policy Government bond market hours have been reset to 9 am to 5 pm RBI advocated allowing all incoming visitors to use UPI payments for their in-country merchant purchases Read all the Latest Business News here

History of this topic

RBI monetary policy 2024: Soon, deposit cash through UPI in ATMs, says governor Shaktikanta Das

Hindustan Times

RBI@90, and what Prime Minister Modi had to say

Live Mint

Govt mindful of inflation situation, says RBI Governor Das

The HinduDiscover Related

_1653629830547_1734242852120.jpg)

)

)