)

Govt launches Rs 5,000-cr special credit facility for street vendors; here's all you need to know about Rs 10,000 loan scheme

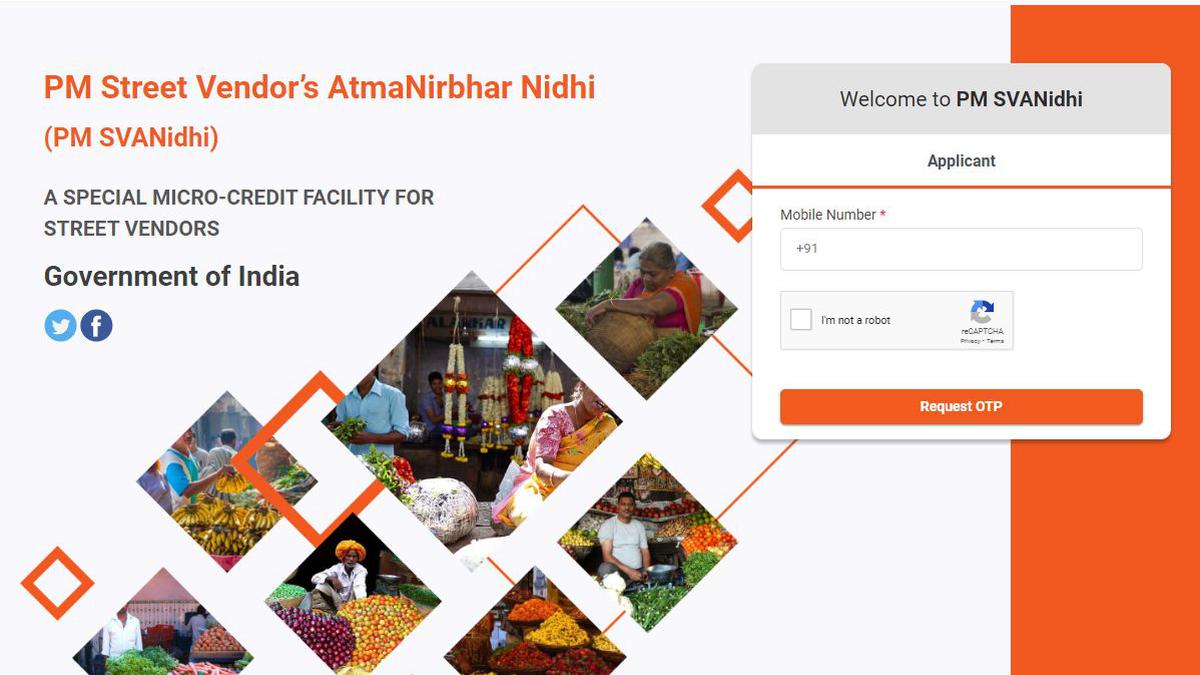

FirstpostIn order to revive businesses of street vendors that have taken a serious hit due to the COVID-19 lockdown, the Centre has launched a special micro-credit facility amounting to a total of Rs 5,000 crore that will provide them Rs 10,000 as initial working capital In order to revive businesses of street vendors that have taken a serious hit due to the COVID-19 lockdown, the Centre on Monday launched a special micro-credit facility amounting to a total of Rs 5,000 crore that will provide them Rs 10,000 as initial working capital. #CabinetDecisions | Rs 10,000 loan for street hawkers through PM SVANiDHI : @nitin_gadkari pic.twitter.com/j5xMiretQG — CNBC-TV18 June 1, 2020 The Ministry of Housing and Urban Affairs has launched a Special Micro-Credit Facility Scheme - PM SVANidhi - PM Street Vendor’s AtmaNirbharNidhi, for providing affordable loans to street vendors, the government release said. This scheme is special due to a number of reasons: 1- A historic first: This is for the first time in India’s history that street vendors from urban/ rural areas have become beneficiaries of an urban livelihood programme, the government release said. On timely/ early repayment of the loan, an interest subsidy @ 7% per annum will be credited to the bank accounts of beneficiaries through Direct Benefit Transfer on six monthly basis.

History of this topic

Rs 13.42 crore given to street vendors under PM SVANidhi scheme: All about it

India Today

MUDRA loan limit hike, credit guarantee scheme for MSMEs

New Indian Express

Female micro-entrepreneurs account for 43% of PM SVANidhi loan disbursement

Live Mint

Coimbatore Corporation holds special camp for street vendors for loans under PM SVANidhi

The Hindu

Tiruppur Corporation to cover 12,000 street vendors under Centrally-sponsored credit scheme

The Hindu

Reward Digital-Savvy Street Vendors, Find More Tech Aid: PM Advises Ministries on SVANidhi Scheme

News 18

Mobile app for loan application for street vendors under PM SVANidhi scheme

The HinduMore than 9,000 street food vendors on food delivery apps under Central scheme

The Hindu

52,000 hawkers sign up for PM Svanidhi loan scheme, 48,000 to go

Hindustan Times

Ahead of civic polls, BBMP wants to give micro loans to 1.8 lakh street vendors

The Hindu

12-13% NPAs in street vendors’ loan scheme, says Minister Hardeep Singh Puri

The Hindu

Top 5 government business loan schemes in India in 2022

India Today)

Nirmala Sitharaman announces new COVID-19 stimulus measures: From Rs 23,220 cr for public health to free 5 lakh tourist visas, key highlights

Firstpost

PM Modi to virtually distribute loans to 300,000 street vendors under PM SVANidhi Scheme today

Hindustan Times)

PM Modi to Interact with Beneficiaries of Scheme Launched to Help Street Vendors Hit by Covid-19

News 18

Swiggy to bring street food-vendors on its app, govt signs MoU

Op India

Only 7 pc of target street vendors get loan assistance

Deccan ChronicleGovernment loan scheme for street vendors gets Bollywood boost on social media

The Hindu

PM to interact with street vendor beneficiaries of govt scheme in Madhya Pradesh

Live Mint)

PM Modi to Interact with Street Vendor Beneficiaries of Govt Scheme in Madhya Pradesh

News 18

Kalyan-Dombivli civic body to provide hawkers with loans up to ₹10,000 to combat Covid lockdown losses

Hindustan Times)

Govt Receives Over 5 Lakh Loan Applications from Street Vendors Under PM SVANidhi Scheme

News 18

PM Modi Releases Rs 17,100 Cr Into Accounts of Over 8 Cr Farmers as 6th Installment of PM-KISAN Scheme

News 18)

PM SVANidhi: Centre Launches 'Letter of Recommendation' Module for Street Vendors Who Don't Have ID Cards

News 18

Create dedicated fund for street vendor loans: microlenders’ body

The Hindu

10 Key Takeaways | FM Nirmala Sitharaman Unveils First Part Of Rs 20 Lakh Cr Economic Stimulus

ABP News

Watch: Finance Minister Nirmala Sitharaman briefs media on economic package

Op India

Instamojo disburses ₹110 crore in small loans to MSMEs within a year

Live Mint

PNB sanctions debt worth ₹689 cr to 1,600 MSMEs via 59minute loan portal

Live MintDiscover Related