Big Decision For Small Online Players: No Need For GST Registration If Sales Are Below Rs 20 Lakh

News 18In a move that will benefit persons in the unorganised sector, the GST Council on Wednesday decided to waive mandatory registration for small entities selling their products online. The Council has provided the “waiver of requirement of mandatory registration under section 24 of CGST Act for person supplying goods through ECOs, subject to certain conditions, such as – a) the aggregate turnover on all India basis does not exceed the turnover specified under sub-section of Section 22 of the CGST Act and notifications issued thereunder; b) the person is not making any inter-state taxable supply”, according to an official statement. With an estimated five crore MSMEs currently unable to sell online due to compulsory GST requirements, this game-changing measure can be an enabler for millions of small units, including artisans, boutiques and mom-and-pop stores. Providing a big relief to MSMEs, the Council has also extended the Rs 40-lakh threshold exemption for intra-state sales and the Rs 1.5-crore threshold under the composition scheme to online sellers.

History of this topic

Can unregistered small businesses receive GST notices?

India Today

55th GST Council Meeting: Raises tax on used car sales; postpones debates on insurance, 'sin' products

New Indian Express

Council may increase GST rate on all kinds of used cars to 18 per cent

New Indian Express

GST council approves key reforms, defers decision on insurance premium tax cuts

India TV News

Retailers urge FM and GST Council not to go for higher 35 pc tax rate

Live Mint

GST Council To Meet In Jaisalmer On Dec 21; Key Decisions On Insurance And Rate Cuts Likely

ABP News

A fresh start: On the Goods and Services Tax Council meet

The Hindu

DC Edit | GST breather for easier biz?

Deccan Chronicle

53rd GST Council meeting: Co-living firms welcome proposal to exempt GST on accommodation services

Hindustan Times

FM Proposes Minimum Threshold Monetary Limit For GSTAT, High Courts And Supreme Court: 53rd GST Council Meet

Live Law

53rd GST Council Meet Tomorrow: What's The Key Expectations?

Live Law

GST Council to meet on June 22, likely to review online gaming taxation

India TV News

GST Council may soon clarify tax exemption to RERA

Hindustan Times

Simplification in principal place of business norms mooted for MSMEs

Deccan Chronicle

52nd GST Council Meeting: What Lies Ahead For Online Gaming, SGST & Beyond?

News 18

Online gaming companies to collect 28% on full bet value, offshore platforms to be GST registered from October 1

The Hindu

Show cause notices to e-gaming cos as per legal provisions, GST demand based on data analysis: CBIC chief

The Hindu

Central GST (Amendment) Bill To Be Tabled To Include 28% GST On Online Gaming, Casinos, Horse Race Clubs

Live Law

Bengaluru-based MPL to lay off 350 employees

Hindustan Times

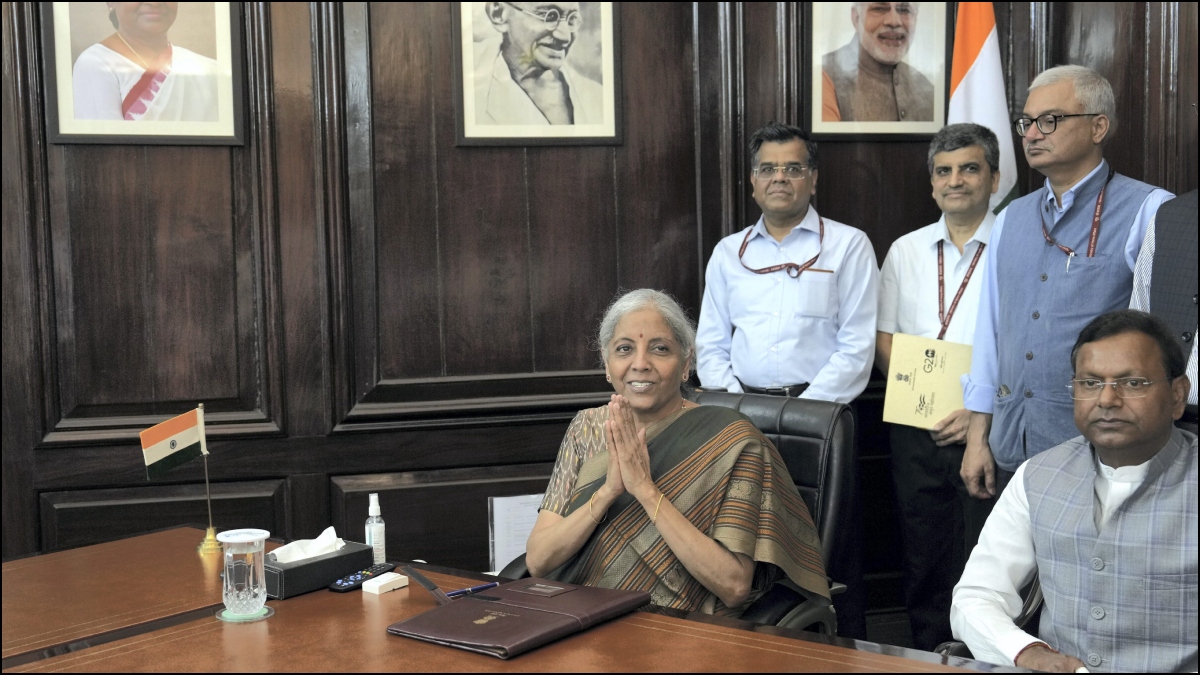

GST council meet: 28% tax on online gaming effective from Oct 1, announces FM

Hindustan Times

GST Council Keeps 28% Tax on Online Gaming, To Be Effective From Oct 1, Review After 6 Months

News 18

28 per cent tax on online gaming to be implemented from October 1: Nirmala Sitharaman

India TV News

GST Council to meet on August 2 to finalise 28% online gaming tax: Report

India Today

Maharashtra to raise traders' concern after Centre brings changes in GST rules

India Today

Online Gaming GST Tax Rajeev Chandrasekhar MeitY Approach Council Once Sustainable Framework Is Established

ABP News

T.N. underlines ban on online games in GST council meeting

The Hindu

GST Council to impose 28% tax on online gaming firms

The Hindu

GST Council Meeting highlights: 28% GST rate on full value of online gaming seen as setback for Indian players

Live Mint

GST Council Meeting highlights: 28% GST rate on full value of online gaming seen as setback for Indian players

Live Mint

50th GST council meeting: Setback for online gaming, horse racing, casinos; to attract 28% tax

India TV News

GST Council aims to close gold loophole

Live Mint

GST Council to weigh tax cuts on select items

Live Mint

Reform reluctance: On the 49th GST council meeting

The Hindu

49th GST Council Meet: Approves Report Of GoM On Capacity Based Taxation & Special Composition Scheme In Certain Sectors

Live Law

GST Council clears setting up tribunals, ad valorem cess on pan masala

Live Mint

GST Council Meeting Starts; Key Matters on Agenda

News 18

GST Council may take call on online game tax

Deccan Chronicle

Decision on GST hike taken after all States’ consent: Nirmala Sitharaman

The Hindu

GST Meet Highlights: GoM Suggestions on GST Exemptions, Correction of Inverted Duty Accepted, Says FM

News 18

GST Council bites the bullet

Hindustan Times

GST new rates: Check full list of goods, services that get costlier, cheaper

Live Mint

GST Council Meet: Pre-Packed Items Under GST; 28% Tax On Casino Deferred; Key Decisions

News 18

GST Council Defers 28% Tax On Casinos, Online Gaming; GoM To Submit Fresh Report Till July 15

News 18

GST Council Amends GSTR-3B, Extends GSTR-4 Deadline, Eases Compliance for Taxpayers

News 18

Govt may put online games in 28 per cent GST tax slab, council to discuss on June 28

India Today

GST Council meet today: From tax on online casinos to decision on taxing crypto

Live Mint

GST Council meet: States' compensation, easier e-comm suppliers' registration, tax tweaks on cards

India TV News

Strengthening the GST regime

Hindustan Times

GST Council may approve 28% rate on online games, casinos, race courses

Live MintDiscover Related

)

![Tax Weekly Round-Up [23rd December - 29th December 2024]](https://www.livelaw.in/h-upload/2024/12/02/574161-tax-weekly-round-up.jpg)

![Tax Weekly Round-Up [16th December - 22nd December 2024]](https://www.livelaw.in/h-upload/2024/12/02/574161-tax-weekly-round-up.jpg)