Domestic abusers weaponising joint mortgages by refusing to pay their share

The IndependentGet the free Morning Headlines email for news from our reporters across the world Sign up to our free Morning Headlines email Please enter a valid email address Please enter a valid email address SIGN UP I would like to be emailed about offers, events and updates from The Independent. Please try again later {{ /verifyErrors }} Domestic abusers are pushing victims into spiralling debt and homelessness by weaponising joint mortgages against them - with 750,000 women in the UK estimated to be affected by mortgage abuse. Me and my children remain trapped in a mortgage prison with no way out.” Some 750,000 women in the UK are estimated to be affected by mortgage abuse Surviving Economic Abuse, whose report is funded by abrdn Financial Fairness Trust and the Joseph Rowntree Charitable Trust, is calling for the government to set up a cross-government taskforce on financial abuse to stop perpetrators from weaponising joint mortgages. Sam Smethers, interim chief executive of Surviving Economic Abuse, said: “Mortgage abuse is a hidden crime that’s destroying the lives of hundreds of thousands of survivors.” She warned abusers are wielding joint mortgages to unleash “economic devastation” - adding that being “forced to foot the full mortgage bill makes it near impossible for survivors to flee to safety”. But right now, banks are limited in what they can do to stop abusers from causing a lifetime of debt and homelessness for survivors.” Mortgage abuse is a hidden crime that’s destroying the lives of hundreds of thousands of survivors.” Sam Smethers She said banks could do a better job of helping victims under the current system but an urgent overhaul of the law is needed to “stop abusers from destroying lives”.

Discover Related

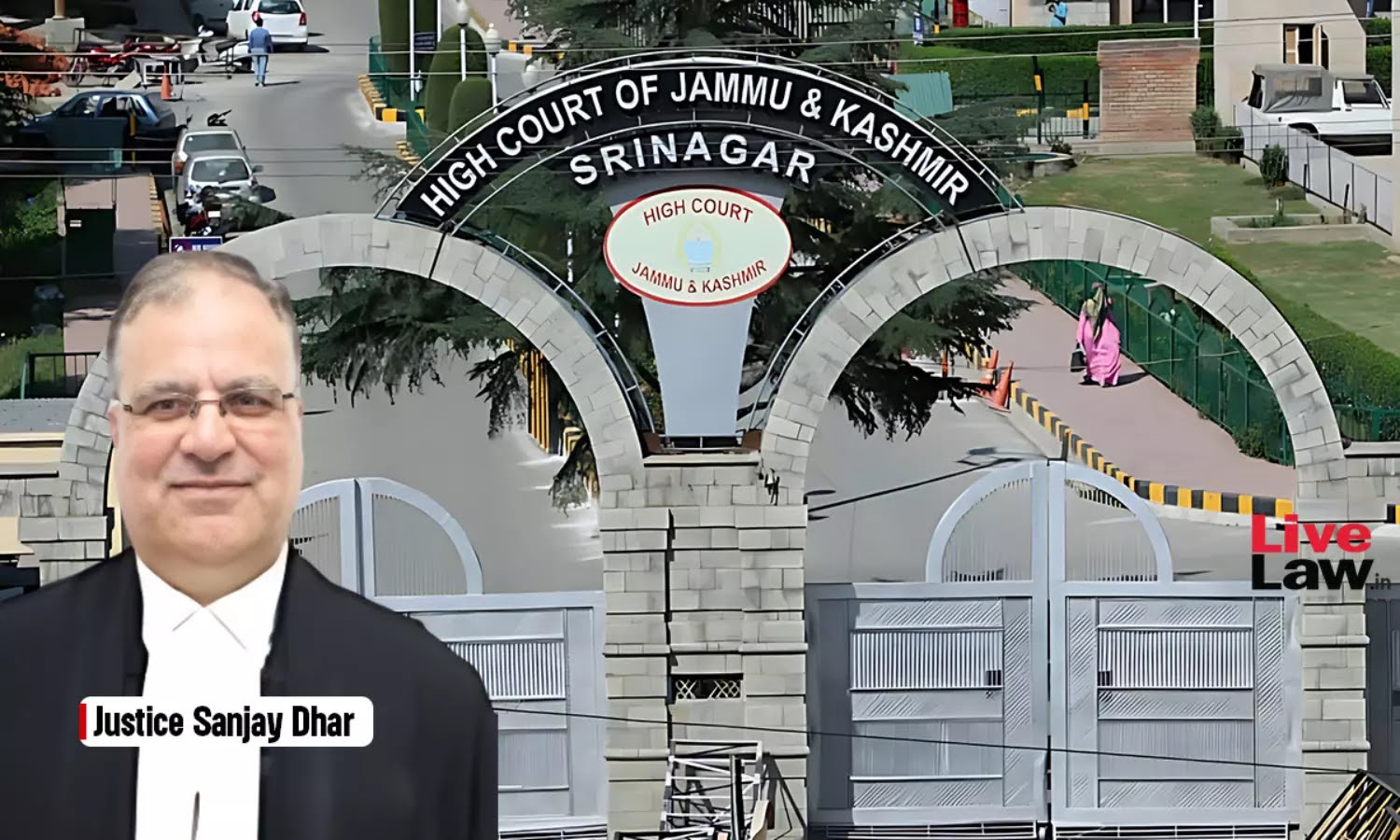

![[Domestic Violence Act] Court Can Order Husband To Pay Wife Monetary Expenses In Lieu Of Shared House: Karnataka High Court](https://www.livelaw.in/h-upload/2022/07/16/426148-karnataka-high-court-on-perjury-prosecution-pursuing-perjury-charges-when-a-prima-facie-deliberate-intention-is-disclosed.jpg)