ETFs have bright future, say experts

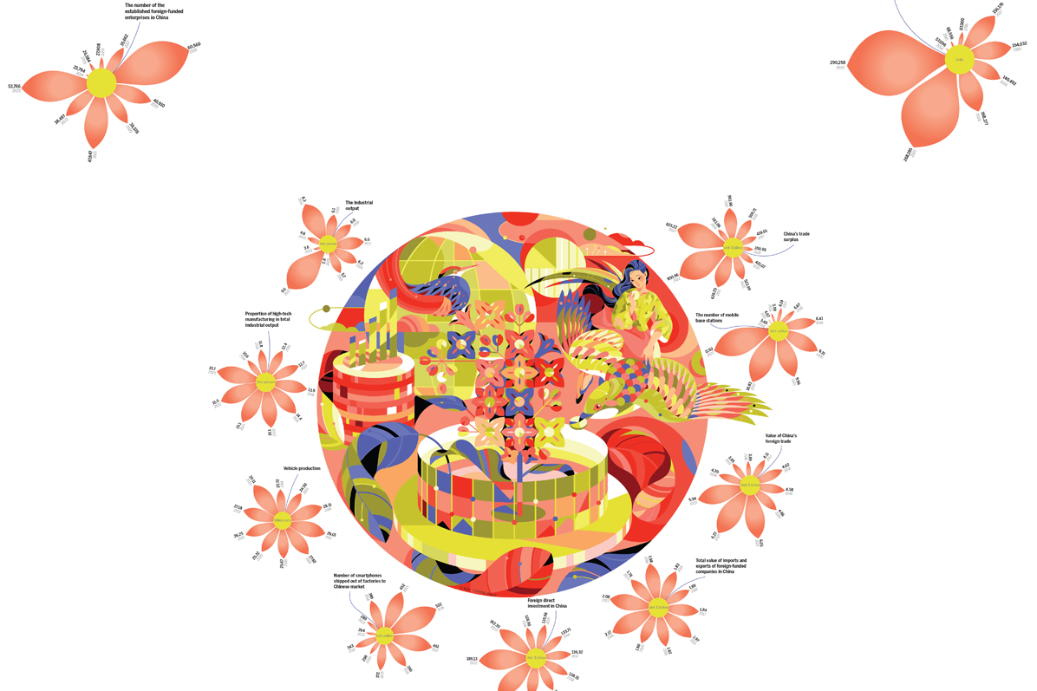

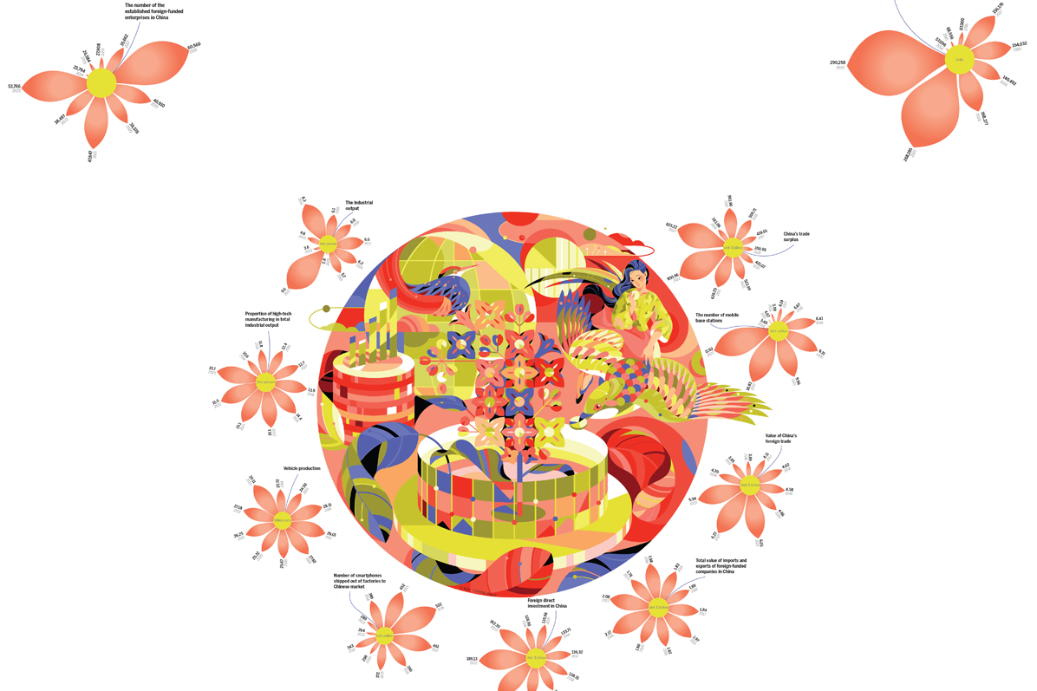

China DailyIndexing investment has much room for development thanks to recently-introduced government policies and the proliferation of long-term investment, experts from the Shanghai Stock Exchange, or SSE, have said. As of the end of May, the value of the Chinese onshore ETF market approached 2.45 trillion yuan, with 75 percent of that being ETF products listed at the Shanghai exchange. By the end of May, there were over 570 ETFs trading on the Shanghai exchange, with the total value amounting to 1.84 trillion yuan, up 19 percent from the beginning of the year and accounting for 75 percent of the total domestic ETF market size. Among these, the STAR 50 Index and STAR 100 Index, both of which are designed based on the STAR Market, saw their combined market value exceed 150 billion yuan. The onshore equity ETF only accounts for 2 percent of the A-share market value, and index funds only take up 11 percent of the total public fund size.

History of this topic

China ETF Market Booms, Attracting Global Investors

China Daily

ETFs have bright future, say experts

China Daily

ETF turnover tops ₹1 trillion for the second year in a row: Report

Live MintDiscover Related

)