India’s startup ecosystem should adapt to tight money conditions

Live MintIndia has emerged as the third largest startup ecosystem in the world, with 107 unicorns with a total valuation of $340.79 billion, as of 7 September 2022. The reason for such a ‘funding winter’ is to be traced to global macroeconomic developments, especially changing interest rate regimes between 2020 and 2022. The Fed also provided forward guidance on the future path of interest rates in successive Federal Open Market Committee statements throughout 2020, indicating that it would keep interest rates at near zero. With the US Fed having raised interest rates four times already in 2022 and also tapering its quantitative easing and other measures taken to cope with the pandemic, and the resultant squeeze on liquidity, one can expect a reversal from stocks back to bonds. The Reserve Bank of India too, in turn, has hiked interest rates thrice this year to cope with spiralling inflation, while also changing its monetary policy stance from ‘accommodative’ to a relatively hawkish policy stance.

History of this topic

Public procurements may come with startup quotas

Live Mint

India’s startup scene is picking up speed again

Hindustan Times

Indian Startups Secure Record Funding in October, But Funding Slumps

Deccan Chronicle

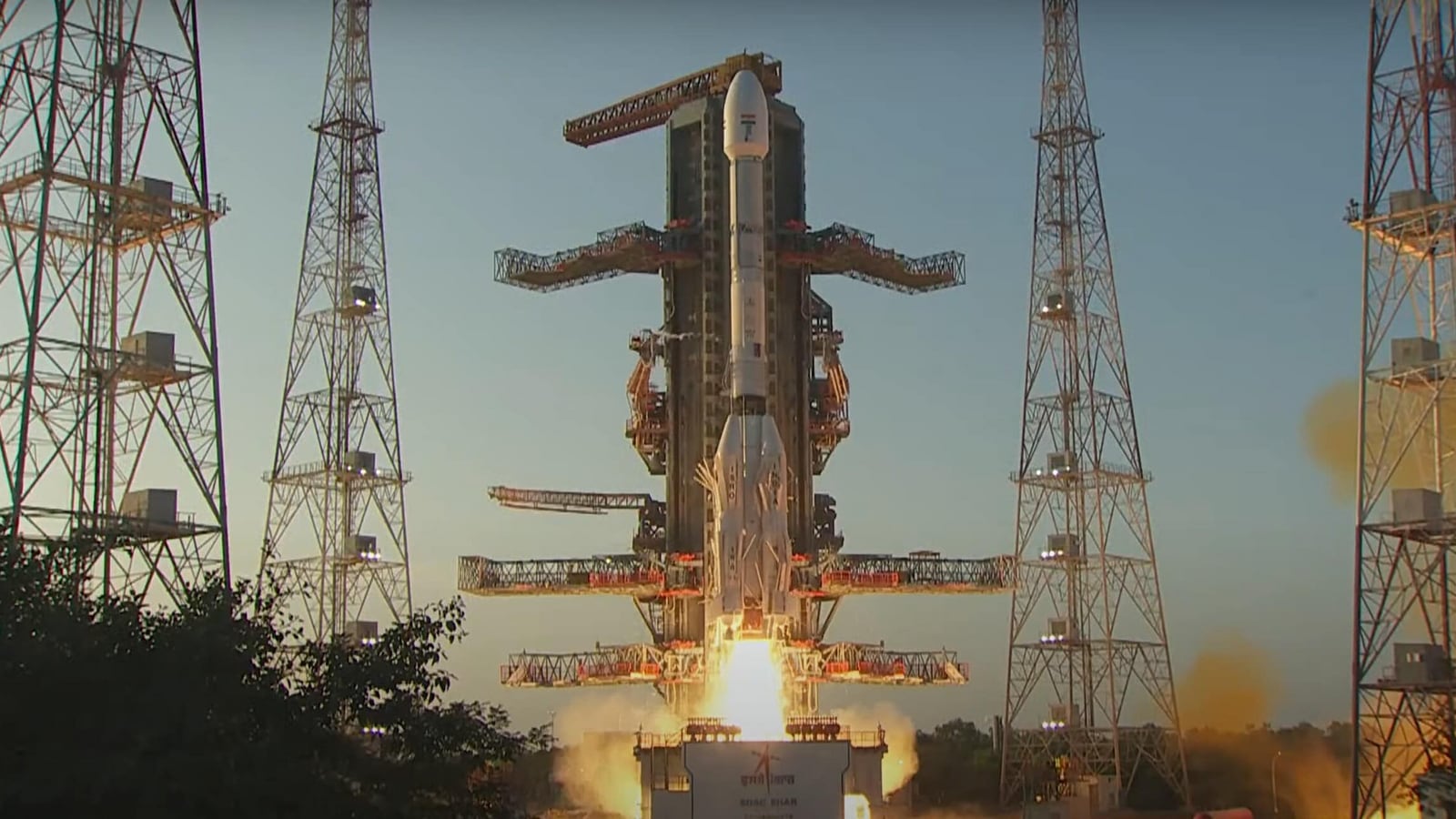

Budget 2024: Centre allocates ₹1000 cr venture fund to boost space economy ‘five-fold in next decade’

Hindustan Times

Indian Tech Startups Raise $4.1 Billion In First Half Of 2024, Secure 4th Place Globally: Study

ABP News

Kerala startup ecosystem registers 254 per cent growth: Study

New Indian Express

India’s startup growth to pave way to developed nation by 2047: PM Modi

Live Mint

Bank of America expects India fundraising to be busier than ever

Live Mint

National Startup Day: Visionaries speak on new ventures’ role in driving growth

Live Mint

Indian space industry's meteoric rise in 2023 sets stage for stellar 2024

India Today

Indian startups witness 65.8% drop in funding between Jan-Nov 2023: GlobalData

Live Mint

Indian startup funding shrinks by 73% in 2023. What model companies can adopt now?

Live Mint

Venture Capital funding in India plunges over by 67% during Jan-Oct this year

Live Mint

How Indian startups are contributing to India’s $5 trillion economy goal?

Live Mint

The Art Of A Good Unicorn| Unwrapping the prolonged funding winter

Hindustan Times

Indian startups set for more pain as funding crunch worsens

Live Mint

Startups in India see 75% drop in funding; check details

Live Mint)

No funding winter, funding always waiting to see more innovative startups: Nirmala Sitharaman to Network18

Firstpost)

Budget 2023 Expectations: Foster tie-ups between government and stakeholders to support startups

Firstpost)

Budget 2023 Expectations: Startups seek efforts to foster innovation and digitisation

Firstpost

US venture capitalists hope Budget 2023 supports growth, startup ecosystem

Business Standard

How Budget 2023 can help Indian Startups: Top 5 expectations

India TV News

Budget 2023: Industry Pins Hopes On Increased Govt Funding And Support For Online Initiatives

ABP News

Success rate of startups in India higher than in other countries: Piyush Goyal

The Hindu

Why are Indian start-ups facing such a severe funding winter?

Business Standard

India Inc's Overseas Direct Investment Drops 59% at $1.03 Billion in August: RBI Data

News 18

Is Rupee Fall Impacting Startups' Valuation, Funding? Know What Experts Say

News 18

Startup Funding Declines 33% Quarterly To $6.9 billion During April-June 2022

News 18

Startup Layoffs: Overall Funding Is No Less This Year, But Why Firms are Firing Employees

News 18

‘No easy money’: India’s startup boom is giving way to a painful slowdown

Live Mint

Budget 2022 is going to put India into a higher growth trajectory: Ranjit Jha

Deccan Chronicle)

Budget 2022: Incentivise tech adoption among small and medium businesses

Firstpost)

Union Budget 2022: What start-up companies and MSME sector are expecting this year

Firstpost

Global venture capital funds flock to India as China's appeal dims: Report

Hindustan Times

How India-China investment tension affects India's economy

China Daily)

Indian startups attracted $10.14 billion in funding in 2020 despite the COVID-19 pandemic

Firstpost)

Indian Startups Received $10.14 Billion in Funding in 2020; E-Commerce, Edtech Biggest Gainers: Report

News 18)

Indian Startups End 2020 on Strong Note Even as Chinese Investors Dry Up Cash Flow

News 18Discover Related