)

Refund Charges Collected Since Jan 1 on UPI, RuPay Transactions: Tax Dept to Banks

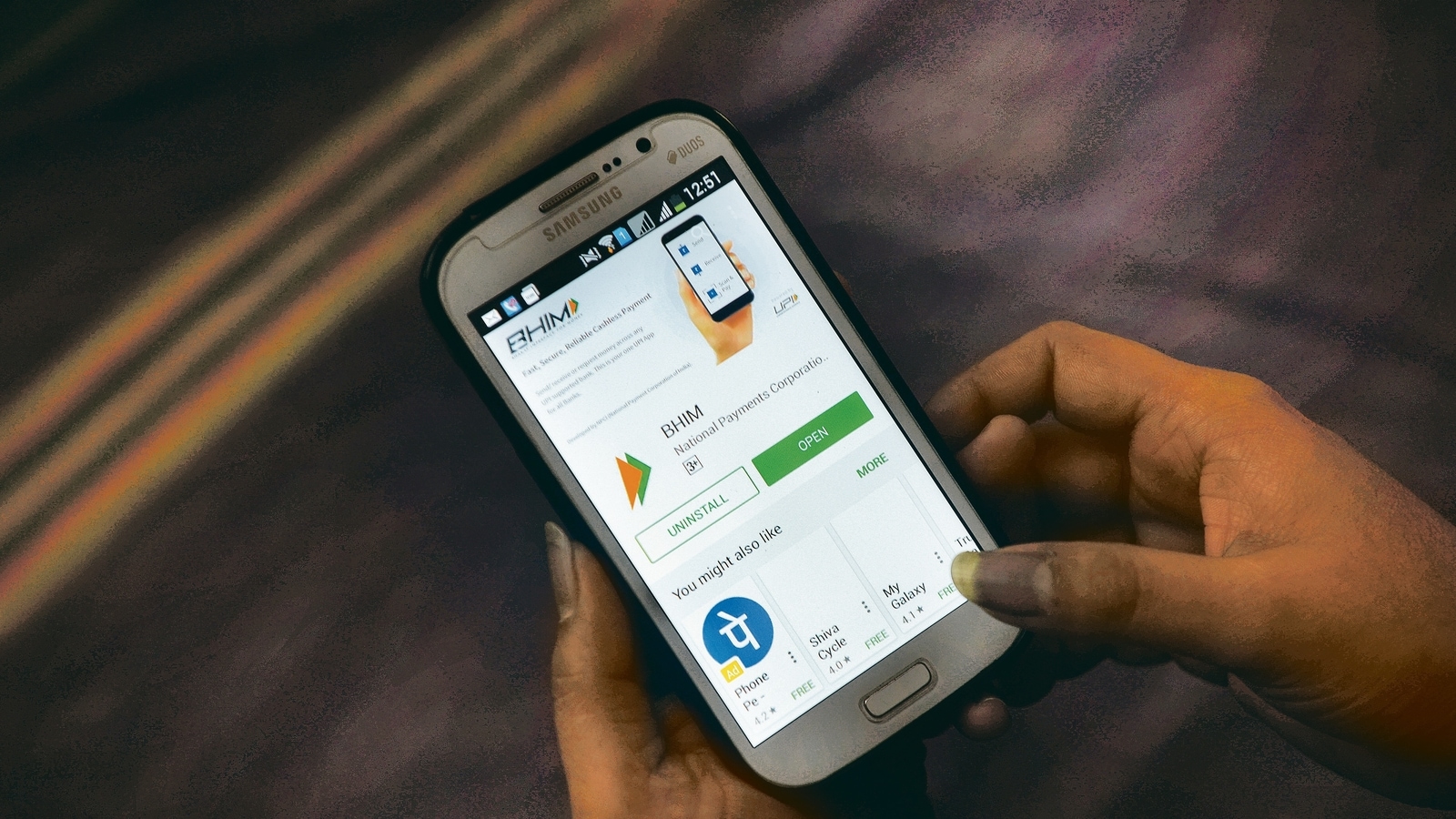

News 18The Income Tax department on Sunday asked banks to refund the charges collected on or after January 1, 2020, on transactions carried out through electronic modes like RuPay cards or BHIM-UPI. The Central Board of Direct Taxes, in a circular on 'imposition of charge on the prescribed electronic modes under section 269SU of I-T Act', also advised banks not to impose any charges on any future transactions carried out through these modes. "Banks are advised to immediately refund the charges collected, if any, on or after January 1, 2020, on transactions carried out using the electronic modes prescribed under section 269SU of the Income-tax Act,1961 and not to impose charges on any future transactions carried through the said prescribed modes," the CBDT circular said. Nangia Andersen LLP Partner Sandeep Jhunjhunwala said, "Processing of refund of charges collected from January 2020 till date and non-imposition on future transactions carried out using electronic modes prescribed under Section 269SU of the I-T Act could mean an added burden on the banking system handling transactions via RuPay or UPI right from initiation to settlement of such payments.

History of this topic

Explained | India’s UPI push

The Hindu

GST not payable on govt incentive to banks for promoting RuPay, BHIM-UPI: Centre

Hindustan Times

No charges on using RuPay credit card for UPI transactions less than ₹2,000

Hindustan Times

No Consideration to Levy Any Charges for UPI Services: Finance Ministry

News 18

No additional charges on UPI transaction, government rejects claims

Op IndiaDiscover Related

_1653629830547_1734242852120.jpg)