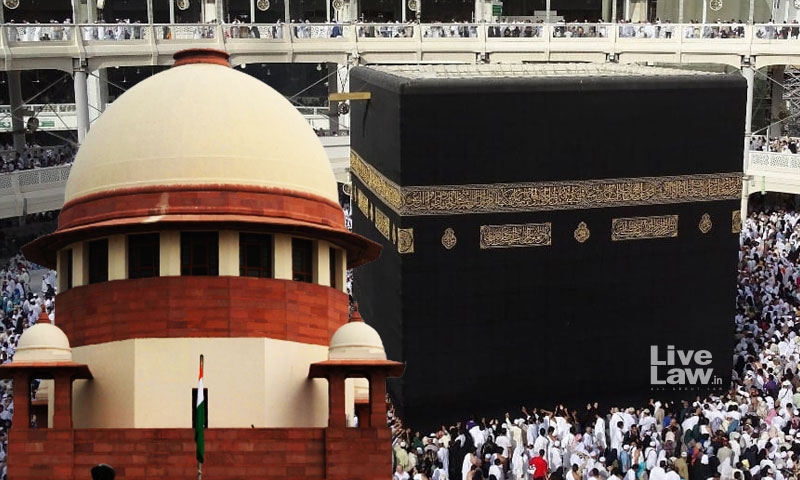

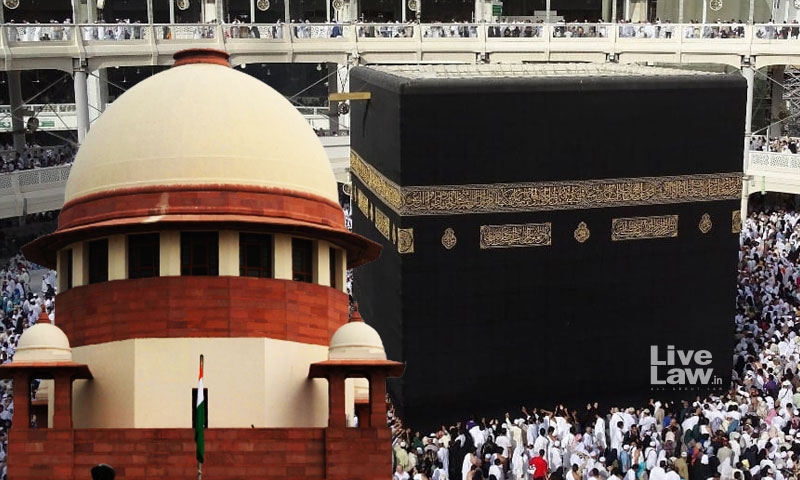

Articles for Haj, search results for gst

2 years, 4 months ago

2 years, 4 months ago

2 years, 8 months ago

3 years, 11 months ago