Finance Bill 2023 was approved with amendments. Here are the highlights

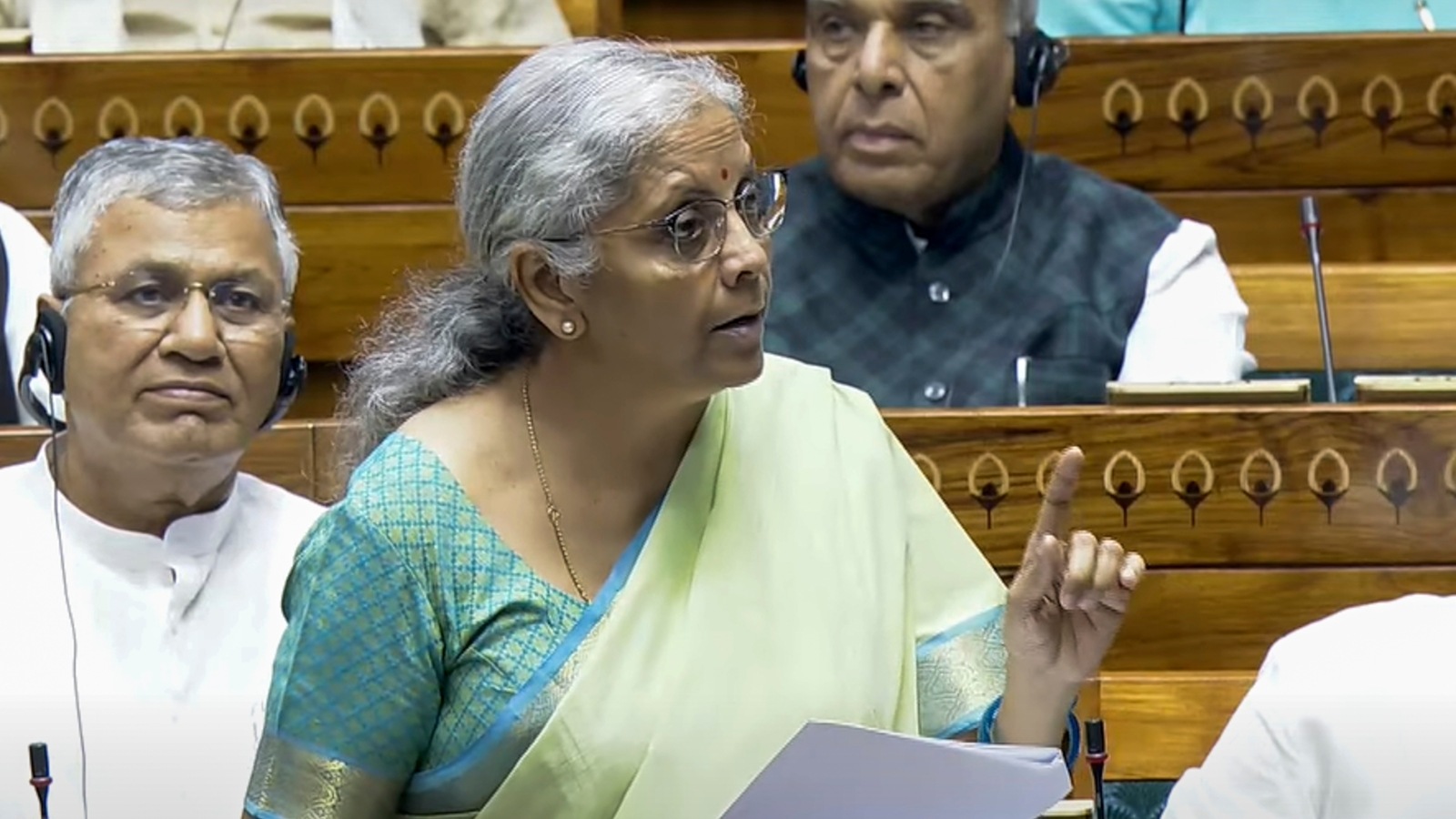

The HinduThe Finance Bill 2023 was been passed in Lok Sabha without a discussion and the House was adjourned to meet again on March 27. The Reserve Bank of India is being requested to look into this with a view to bring credit card payments for foreign tours within the ambit of LRS and tax collection at source thereon.” Withholding tax on royalties and technical services fee may increase cost of technology import The withholding tax rate on royalties and fee for technical services paid to non-residents has been raised from 10% to 20%. “This may increase the cost of import of technology in cases where Indian companies are grossing up withholding taxes and any bilateral tax treaty benefits are not available,” said Gouri Puri, partner at Shardul Amarchand Mangaldas & Co. GST Appellate Tribunals to be set up across country The Finance Bill has paved the way for setting up GST Appellate Tribunals across the country, with a principal bench in New Delhi and several State benches. Thus many taxpayers are able to reduce their tax liability through this arbitrage,” the Finance Ministry explained Tax on debt mutual funds Income from debt mutual funds that invest up to 35% in equity shares of domestic companies will be taxable at applicable rate since income from equities in such funds do not constitute interest income. Securities Transaction Tax raised on F&O contracts from April 1 The Government is raising the Securities Transaction Tax on futures and options contracts in the stock market from April 1, 2023, and changes to this effect were brought into the Finance Bill cleared by the Lok Sabha today.

History of this topic

Capital gains tax on real estate: Lok Sabha passes Finance Bill, amends LTCG tax provision on immovable properties

The Hindu

Lok Sabha passes Bill to allow government expenditure for FY 2024-25

The Hindu

Union Budget 2024: Overseas credit card spending above ₹7 lakh may be taxed 20%

Hindustan TimesNo Tax On Foreign Credit Card Spend Up To Rs 7 lakh

Deccan Chronicle

20% TCS on international credit card: Govt issues five-point clarification

Live MintLok Sabha passes Finance Bill 2023

Deccan Chronicle

Finance Bill 2023 passed in Lok Sabha with THESE major amendments. Details here

Live Mint

Lok Sabha passes Finance Bill

Deccan Chronicle

Lok Sabha Passes Finance Bill 2021

Live LawDiscover Related

)

)