SFPs Classifiable As Parts Of Telecom Equipment: CESTAT Allows Customs Duty Exemption To Reliance Jio Infocomm

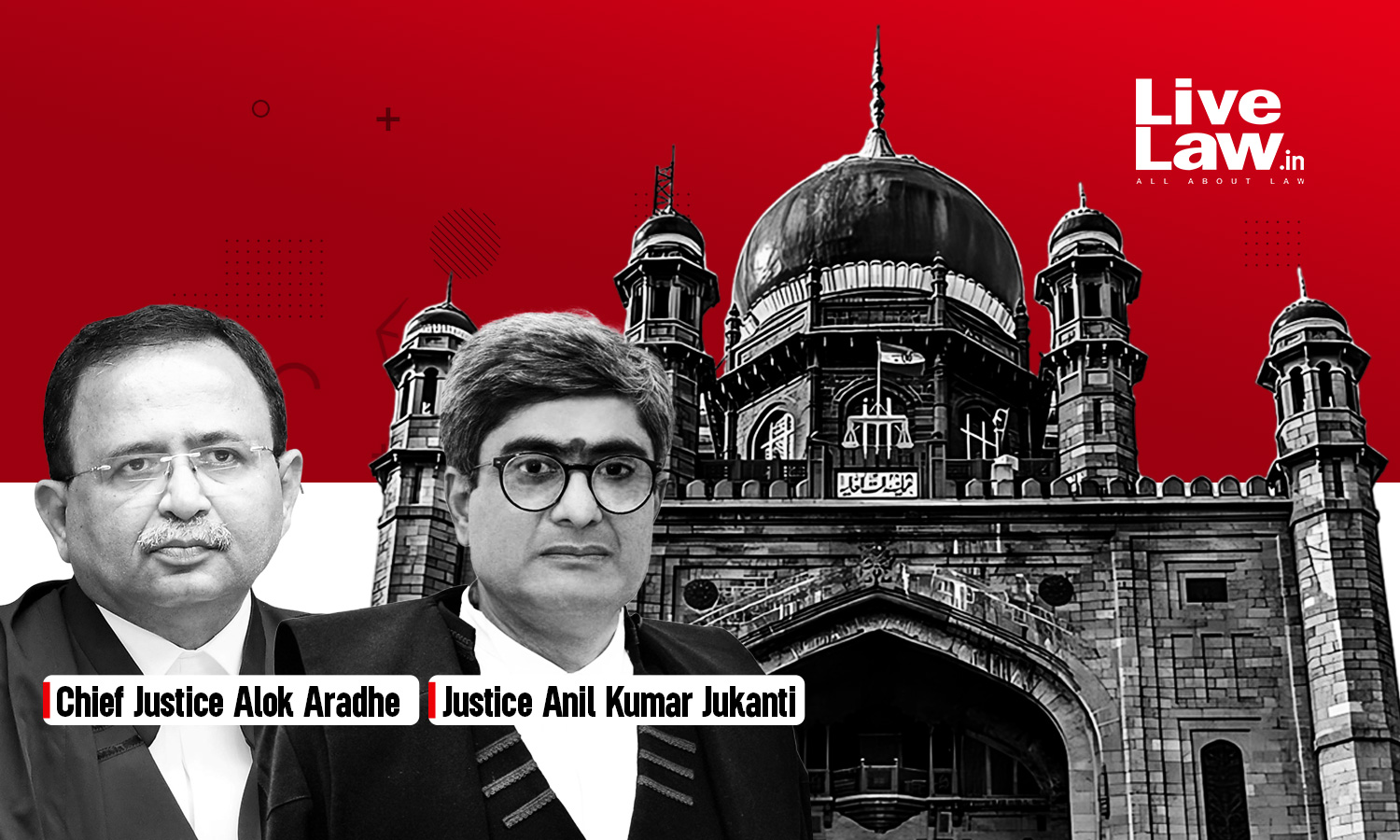

Live LawThe Mumbai Bench of the Customs, Excise and Service Tax Appellate Tribunal has granted the customs duty exemption to Reliance Jio Infocomm and held that Customs Excise and Service Tax Appellate Tribunal is classifiable as part of telecom equipment. The respondent stated that the common issue of classification of populated printed circuit boards for DWDM Equipment – Photonic Service Switch, common to all the appeals, was decided. The respondents submitted that SFPs are parts of various telecommunication equipment, viz., Alcatel-Lucent 1830 Photonic Service Switch, Ethernet Switch, and eNodeB; SFPs are fitted into the equipment and function as an integral part of such equipment. The department contended that the imported apparatus, being parts of the Photonic Service Switch, is to be classified under CTH 85176290, as per Explanation 'G' for Heading 8517.

History of this topic

Discover Related