Inflation, the key challenge

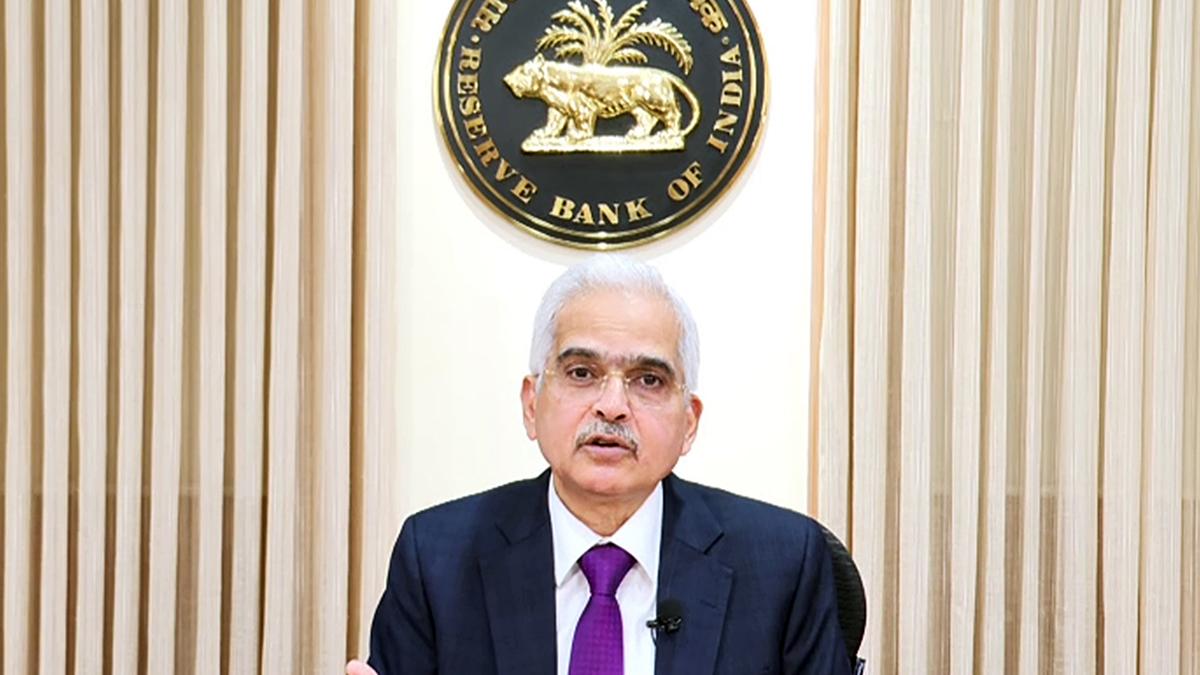

Hindustan TimesReserve Bank of India governor Shaktikanta Das surprised everyone when he said that the Monetary Policy Committee of the central bank convened an unscheduled meeting between May 2 and 4, and decided to hike the policy rate by 40 basis points and the Cash Reserve Ratio by 50 basis points. PREMIUM Reserve Bank of India Governor Shaktikanta Das digitally delivers a statement, May 4, 2022 While the MPC has kept the official stance of monetary policy as accommodative, it has reiterated that it is being “accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target”. Various factors such as the expectation of a sharp interest rate hike by the United States Federal Reserve — RBI’s announcement came hours before it — or a higher-than-expected inflation reading in April 2022 — the Consumer Price Index growth in March 2022 was 6.95% — could have played a role. However, what the MPC resolution says explicitly to justify its action is that there are “significant upside risks to the inflation trajectory set out in the April statement of the MPC”.

History of this topic

Growth to pick up in coming quarters on govt capex, says MPC member Nagesh Kumar

Live Mint

Price stability crucial for India’s economic growth, says RBI

Live Mint

Growth slowdown: Why lay a deeper economic malaise at RBI’s door?

Live Mint

DC Edit | FM, new RBI chief signal cut

Deccan Chronicle

Retail inflation eases to 5.48% in November from above 6% in October

India Today

Staying the course: On the RBI and inflation

The Hindu

DC Edit | RBI still cautious, but cuts CRR

Deccan Chronicle

Home loans may become more affordable and boost the real estate sector, experts say

Hindustan Times

RBI monetary policy: MPC projects FY25 inflation at 4.8%

Live Mint

Amid high inflation, RBI keeps repo rate unchanged at 6.5%

The Hindu

RBI to Announce Interest Rate Decision Amid High Inflation

Deccan Chronicle

RBI MPC verdict today: Repo rate to GDP, inflation forecasts— here are 5 key indicators to watch

Live Mint

RBI keeps key lending rate unchanged at 6.5%, focus remains on tackling inflation

India Today

RBI MPC Meeting: What happens if the central bank cuts interest rates tomorrow? D-Street experts weigh in

Live Mint

RBI MPC Meeting: When and where to watch Governor Shaktikanta Das’ policy announcement

Live Mint

RBI Policy: MPC meeting begins today; will the central bank cut the repo rate? Experts weigh in

Live Mint

RBI MPC meet: Growth needs a boost, but will inflation hold back rate cut?

India Today

RBI MPC to start today: Will there be a rate cut? 3 things to know

India Today

RBI MPC: FX, not inflation, curbing degrees of policy freedom

Live Mint

Is MPC doing enough on inflation? Consumers are divided

Live Mint

RBI committee meeting: A cut in cash reserve ratio likely, but not in repo rate

New Indian Express

MPC to keep rates unchanged amid slowing growth, rising inflation

Live Mint

Will RBI cut key interest rates on December 6? 3 things to know

India Today

Nirmala Sitharaman calls for 'affordable' interest rates after Piyush Goyal

India Today

October inflation wipes off rate cut hopes in Dec policy

Deccan Chronicle

Why October inflation numbers may delay RBI interest rate cut

India Today

RBI MPC 2024: RBI can’t ignore food inflation while framing monetary policy: RBI Governor Shaktikanta Das

The Hindu

RBI Governor warns against hasty rate cut

Deccan Chronicle

RBI MPC Meeting: Repo rate unchanged at 6.5% for 8th time in a row

The Hindu

RBI monetary policy: MPC keeps FY25 inflation forecast unchanged at 4.5%

Live Mint

Business News Highlights: Sensex Settles 1618 Points Up, Nifty Over 23,290 Amid RBI Keeping Repo Rate Unchanged At 6.5%

ABP News

RBI MPC Meet 2024 Highlights: Repo rate unchanged , Real GDP growth at 7.2%

Hindustan Times

RBI MPC meet: Central Bank may keep repo rate steady. Major reasons why

Hindustan Times

RBI MPC: Central Bank Unlikely To Cut Interest Rate On June 7 Amid Lok Sabha Election Results, Says Experts

ABP News

DC Edit | Cautious RBI targets inflation

Deccan Chronicle

Both dovish and hawkish

Hindustan Times

RBI MPC 2024: RBI Keeps Repo Rate Unchanged At 6.5%; Says GDP Growth Is Buoyant

News 18

RBI Monetary Policy | MPC holds rate at 6.5% to tame inflation, FY25 real GDP growth projected at 7%, CPI inflation at 4.5%

The Hindu

RBI MPC maintains repo rate at 6.5 per cent for the 7th consecutive time

India TV News

RBI Begins First MPC Of FY 24-25: High-level Discussions Starts Today, What To Expect?

News 18

RBI MPC Meeting April 2024: Check Date, Time & Other Key Details

News 18

Need to be vigilant on inflation front: MPC minutes

New Indian Express

Central bank work on lowering prices in delicate balance

New Indian Express

DC Edit | RBI is right to be cautious

Deccan Chronicle

RBI’s battles with inflation

Hindustan Times

RBI keeps repo rate unchanged at 6.5%

Deccan Chronicle

After many difficult quarters economic scenario turning more benign in terms of inflation, growth: MPC’s Varma

The Hindu

MPC minutes: Inflation outlook clouded by food prices, weather shocks, says RBI Guv

Hindustan Times

RBI’s MPC may rejig growth, inflation math

The Hindu

RBI Monetary Policy Meet underway: Key things to watch out for

Live MintDiscover Related

)

)