Reassessment Powers Could Not Be used For Reverification Or For A Rowing Inquiry: Gujarat High Court

Live LawThe Gujarat High Court has held that the reassessment powers could not be exercised either for the purpose of reverification or to have a merry sailing for a rowing inquiry.The division bench of Justice N.V. Anjaria and Justice Bhargav D. Karia has observed that the assessing officer wanted to undertake a fishing inquiry in relation to an issue about which he had already solicited information. The Gujarat High Court has held that the reassessment powers could not be exercised either for the purpose of reverification or to have a merry sailing for a rowing inquiry. The court found that the department's claim that the petitioner received the surrender value of the policy upon its premature redemption and that it was taxable under Section 80CCC of the Act was incorrect. The court quashed the notice issued by the Assessing Officer under Section 148 of the Income Tax Act, 1961, seeking to reopen the assessment in the case of the petitioner for the assessment year 2013–14.

History of this topic

Assessment Can Be Reopened Based On Audit Objections Under New Reassessment Regime: Kerala High Court

Live Law

Ahmedabad ITAT Quashes Reopening In Absence Of Tangible Material With AO To Form Reason To Believe Escaped Assessment

Live Law

Burden To Prove Escaped Assessment Lies On Assessing Authority: Allahabad High Court Quashes Reassessment Order Against Flipkart

Live Law

Reopening Initiated On Basis Of Wrong Reasons Renders Very Assessment As Invalid: Mumbai ITAT

Live Law

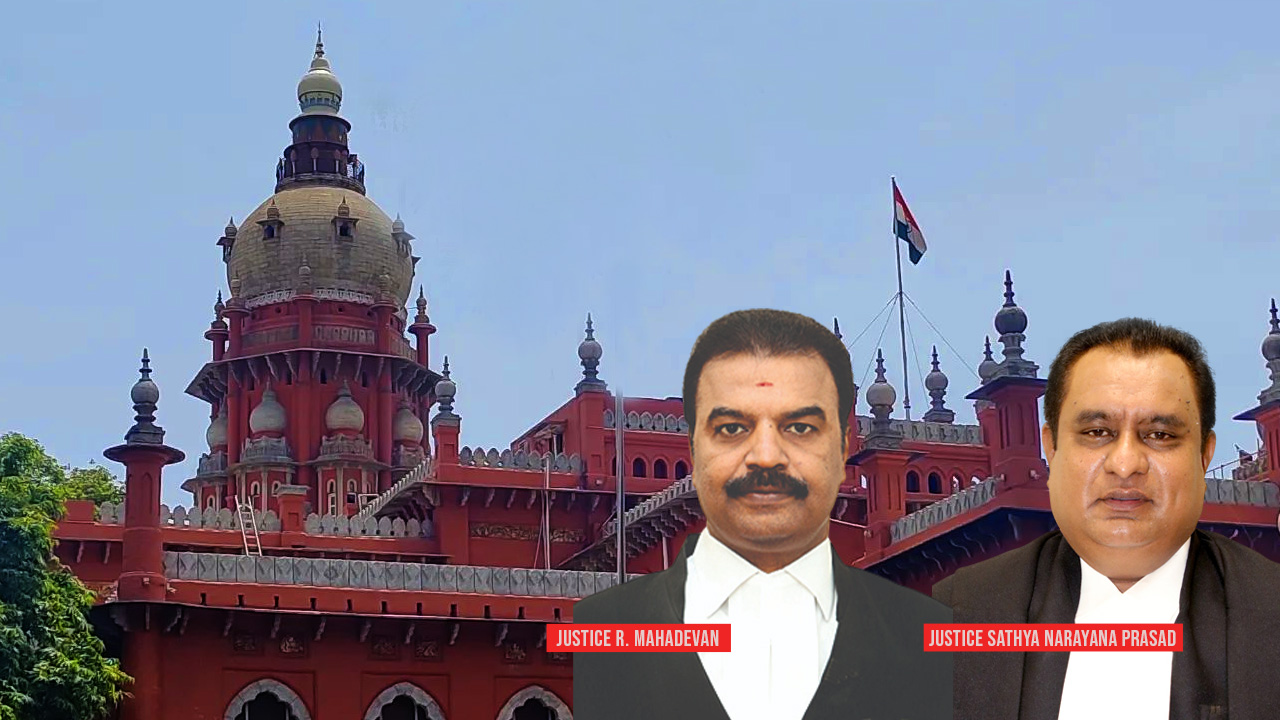

Reopening Of Assessment Inspired From 'Review' & 'Change Of Opinion' By Subsequent AO Is Deprecated: Madras HC

Live Law

Reassessment Proceedings Can't Be In The Nature Of Review: Karnataka High Court

Live Law

Reassessment Proceedings, Senior Officers Like ACIT, PCIT Expected To Apply Mind; Delhi High Court

Live Law

Dept.’s Personal Opinion Not Tangible Material For Reopening Assessment: Calcutta High Court Quashes Reassessment

Live Law

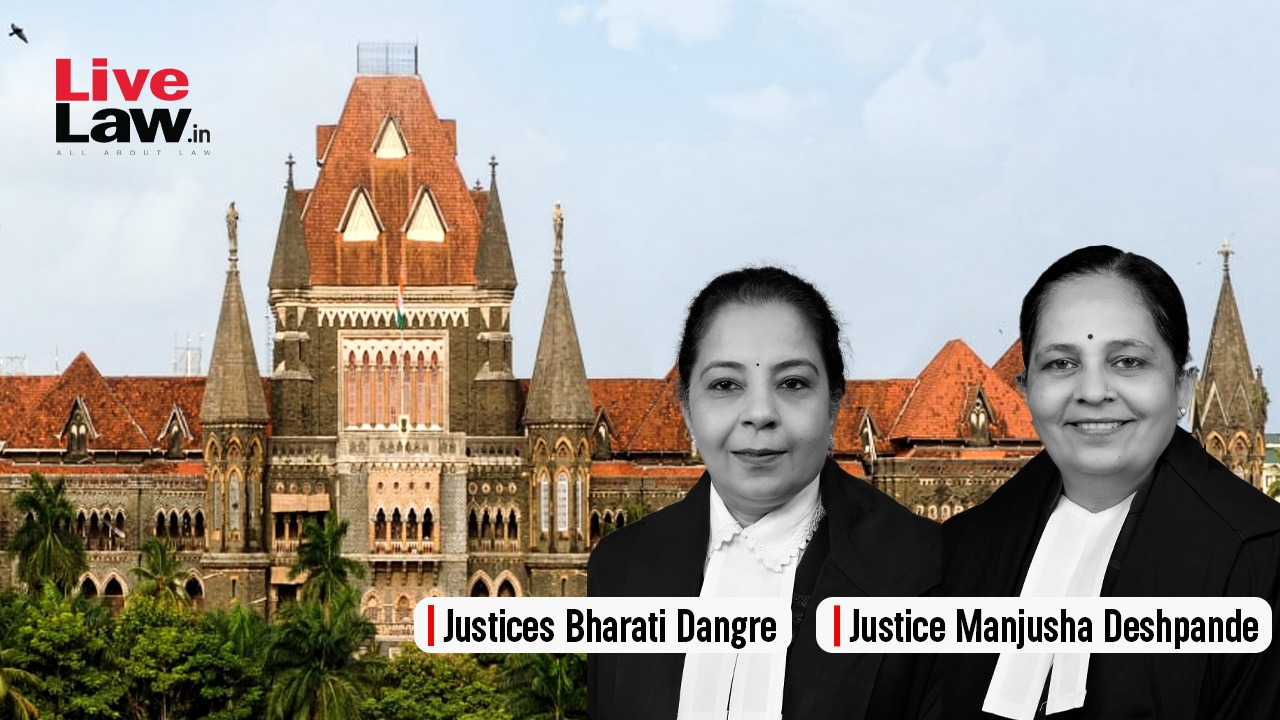

Re-Opening Is Not Permissible As It Falls Within The Purview Of A ‘Change Of Opinion’: Bombay High Court

Live Law

Income Tax Assessment Can’t Be Reopened Without Any Foundation: Gujarat High Court

Live Law

Absence Of Material: Bombay High Court Quashes Reassessment Proceedings

Live Law

Gujarat High Court Quashes Reassessment Order Citing Inability Of Assessee To Secure Relevant Documents Amid Covid-19 Lockdown

Live Law

Nothing New Happened Between The Date Of Reassessment Order And The Date Of Forming The Opinion By AO: Bombay High Court Quashes Reassessment Order

Live Law

In The Absence Of A Full And True Disclosure, Reassessment Is Not Barred By Limitation: Madras High Court

Live Law

Invalid Reassessment Notice, The Entire Proceedings have To Collapse: Calcutta High Court

Live Law

Reopening of IT Assessment By Officer Having No Jurisdiction: Madras High Court Invalidates Proceedings

Live Law

Reassessment Proceedings Can't Be Initiated On Same Set Of Facts Available: ITAT

Live LawDiscover Related

![[CLAT 2025] No 'Hands-Off' Approach If Answer Key Is Demonstrably Wrong, Injustice To Candidate Must Be Undone: Delhi HC](https://www.livelaw.in/h-upload/2023/06/15/476759-common-law-entrance-test-clat-bar-council-of-india-offers-to-hold-the-exam.jpg)

![[GST] Assesee Cannot File For Requisite Documents Once Plea Is Accepted And Notice Is Issued: Allahabad High Court](https://www.livelaw.in/h-upload/2022/04/30/416285-allahabad-hc-03.jpg)